March 2020,

IX Ed. ,

66 pages

Price (single user license):

EUR 1600 / USD 1696

For multiple/corporate license prices please contact us

Language: English

Report code: S25RU

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

CSIL Market Research Report The kitchen furniture market in Russia analyses production, distribution, consumption, trade and competition for one of the most challenging markets for this sector, providing kitchen furniture production and consumption statistics and trends, as well as import and export data by country and by geographical area of origin/destination.

The survey involved collecting information from approximately 100 sector companies either through active participation (direct interviews or completion of a questionnaire) or from company balance sheets, figures and estimates.

Historical data are examined, especially as regards five-year and one-year market comparisons.

The report covers both kitchen furniture and the built-in appliances sold through this channel.

Information on the competitive system include sales data and market shares for 50 of the top kitchen furniture manufacturers in this area (players from Russia, Germany and Italy), as well as short company profiles.

Highlights of distribution channels are given, along with a list of 100 among the most important retailers selling kitchen furniture and furniture trade centres in Russia, from low to luxury price ranges and by Federal District.

The kitchen furniture market in Russia is broken down by kitchen style, cabinet door material, worktop material. Most of data and figures are available either in value than in quantity.

The Report also gives a wide range of macro-economic indicators (country indicators, real growth of GDP and inflation up to 2022, population indicators, data on building activity).

An address list of the major players in the kitchen furniture industry in Russia is also provided.

Selected companies

Aran, Bravo Design, Decorum, DMI, Driada, Dvor, Europrestige, Front Décor, Giulia Novars, Hoff, Ikea, Kuchenberg, Marya, Leroy Merlin, Mebelny Biznes, Metro, Nobilia, Nolte, Riviera Kazan, Scavolini, Snaidero, Sputnik Style, Stilnie Kuchni, Trio Interier, Vardek, Veneta.

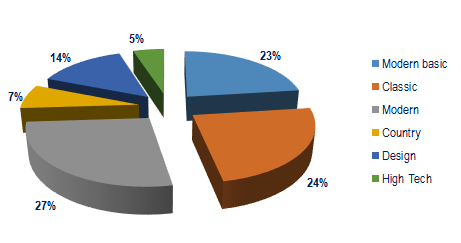

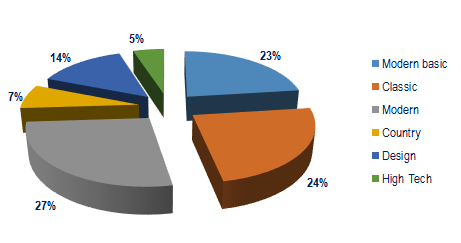

RUSSIA. Breakdown of kitchen furniture sales by kitchen style, 2019. % share

CSIL estimates the Russian kitchen furniture market for the year 2019 in around 1.2 billion Eur, with an increase in comparison with 2018 by 0.9% in quantity, by 6.5% in value. Italian and German companies are the main exporters of kitchen furniture to Russia.

BSH is market leader in a built-in appliances market worth around 3 million units. To be noticed a growth of the middle end of the market and the contract market. Top 45 companies hold around the 78% of the market. Among the top players: Marya, Ikea, Stilnie Kuhni, Nobilia, Leroy Merlin, Veneta, Hoff

Abstract of Table of Contents

Introduction: Scope of the research and methodology

Macroeconomic indicators

Country indicators, Real growth of GDP and inflation up to 2024, Population indicators, Data on building activity

Kitchen furniture market: size of the market and activity trend

Basic data: Kitchens sold in the Russian market by price range. Thousand units, average price and EUR million

Activity trend: Kitchen furniture production, consumption, imports and exports, in value and volume. Data 2013-2019

International trade

Exports and Imports of kitchen furniture by country and by geographical area, 2013-2018. Data in EUR and RUB

Trade of major appliances

Size of the built-in appliances market

Distribution of built-in appliances

Market structure

Employment and supply structure

- List of major kitchen furniture manufacturers by town and year of establishment

- Breakdown of major kitchen operators by products and number of employees

Regional sales breakdown

- Breakdown of kitchen furniture sales by Federal Distric

Tabletops

- Breakdown of kitchen furniture sales by worktop material

Cabinet door material and kitchen styles

- Breakdown of kitchen furniture sales by cabinet door material and by kitchen style

Kitchen door colour and lacquered type

- Breakdown of kitchen furniture sales by colour and laquered type

Distribution channels

Breakdown of kitchen furniture sales by distribution channel

Average sales price of a kitchen in a sample of companies

Focus on the Italian kitchen furniture import

The leading kitchen furniture companies

Overall competition

- Sales of kitchen furniture by price range in a sample of 45 leading companies

Low end, low and middle-low segments

- Sales of kitchen furniture for a sample of companies in the low end (first price), low and middle-low price range

Middle end middle-upper segments

- Sales of kitchen furniture for a sample of companies in the middle and middle-upper price range

Upper and luxury segments

- Sales of kitchen furniture for a sample of companies in the upper and luxury price range

Ukraine. A snapshot on the Ukrainian kitchen furniture market

Annex I: Directory of magazines active in the Russian furniture market

Annex II: Directory of companies active in the Russian kitchen furniture market

CSIL Market Research Report The kitchen furniture market in Russia analyses production, distribution, consumption, trade and competition for one of the most challenging markets for this sector, providing kitchen furniture production and consumption statistics and trends, as well as import and export data by country and by geographical area of origin/destination.

The survey involved collecting information from approximately 100 sector companies either through active participation (direct interviews or completion of a questionnaire) or from company balance sheets, figures and estimates.

Historical data are examined, especially as regards five-year and one-year market comparisons.

The report covers both kitchen furniture and the built-in appliances sold through this channel.

Information on the competitive system include sales data and market shares for 50 of the top kitchen furniture manufacturers in this area (players from Russia, Germany and Italy), as well as short company profiles.

Highlights of distribution channels are given, along with a list of 100 among the most important retailers selling kitchen furniture and furniture trade centres in Russia, from low to luxury price ranges and by Federal District.

The kitchen furniture market in Russia is broken down by kitchen style, cabinet door material, worktop material. Most of data and figures are available either in value than in quantity.

The Report also gives a wide range of macro-economic indicators (country indicators, real growth of GDP and inflation up to 2022, population indicators, data on building activity).

An address list of the major players in the kitchen furniture industry in Russia is also provided.

RUSSIA. Breakdown of kitchen furniture sales by kitchen style, 2019. % share

CSIL estimates the Russian kitchen furniture market for the year 2019 in around 1.2 billion Eur, with an increase in comparison with 2018 by 0.9% in quantity, by 6.5% in value. Italian and German companies are the main exporters of kitchen furniture to Russia.

BSH is market leader in a built-in appliances market worth around 3 million units. To be noticed a growth of the middle end of the market and the contract market. Top 45 companies hold around the 78% of the market. Among the top players: Marya, Ikea, Stilnie Kuhni, Nobilia, Leroy Merlin, Veneta, Hoff

Abstract of Table of Contents

Introduction: Scope of the research and methodology

Macroeconomic indicators

Country indicators, Real growth of GDP and inflation up to 2024, Population indicators, Data on building activity

Kitchen furniture market: size of the market and activity trend

Basic data: Kitchens sold in the Russian market by price range. Thousand units, average price and EUR million

Activity trend: Kitchen furniture production, consumption, imports and exports, in value and volume. Data 2013-2019

International trade

Exports and Imports of kitchen furniture by country and by geographical area, 2013-2018. Data in EUR and RUB

Trade of major appliances

Size of the built-in appliances market

Distribution of built-in appliances

Market structure

Employment and supply structure

- List of major kitchen furniture manufacturers by town and year of establishment

- Breakdown of major kitchen operators by products and number of employees

Regional sales breakdown

- Breakdown of kitchen furniture sales by Federal Distric

Tabletops

- Breakdown of kitchen furniture sales by worktop material

Cabinet door material and kitchen styles

- Breakdown of kitchen furniture sales by cabinet door material and by kitchen style

Kitchen door colour and lacquered type

- Breakdown of kitchen furniture sales by colour and laquered type

Distribution channels

Breakdown of kitchen furniture sales by distribution channel

Average sales price of a kitchen in a sample of companies

Focus on the Italian kitchen furniture import

The leading kitchen furniture companies

Overall competition

- Sales of kitchen furniture by price range in a sample of 45 leading companies

Low end, low and middle-low segments

- Sales of kitchen furniture for a sample of companies in the low end (first price), low and middle-low price range

Middle end middle-upper segments

- Sales of kitchen furniture for a sample of companies in the middle and middle-upper price range

Upper and luxury segments

- Sales of kitchen furniture for a sample of companies in the upper and luxury price range

Ukraine. A snapshot on the Ukrainian kitchen furniture market

Annex I: Directory of magazines active in the Russian furniture market

Annex II: Directory of companies active in the Russian kitchen furniture market

SEE ALSO

Il mercato italiano dei mobili per cucina (Italian)

April 2024, XLII Ed. , 95 pages

This study offers a comprehensive analysis of the kitchen furniture industry in Italy through production and consumption data, trade interchange, market shares of the major players in the industry by price range, sales location, distribution channels, profitability, types of integrated appliances sold, types and materials of cabinet doors and countertops, market trends and prospects.

Kitchen furniture: World market outlook

December 2023, XVIII Ed. , 185 pages

CSIL analyses 60 kitchen furniture markets with a rich collection of key country data, production and consumption both in value and units. Company profiles for 35 among the main kitchen furniture manufacturers worldwide

The European market for kitchen furniture

May 2023, XXXIII Ed. , 305 pages

In 2022, the European production (30 EU countries) of kitchen furniture amounts to around 7 million units manufactured, including around one million units of upper end kitchens.

The kitchen furniture market in the United States

March 2023, VIII Ed. , 112 pages

In-deep analysis of the kitchen furniture sector in the US, with trends and forecasts of production, consumption, imports and exports, leading players by geographical areas and price ranges (clustered in six price groups), marketing policies and distribution channels

The kitchen furniture market in China

March 2022, IX Ed. , 160 pages

The Report, now at its IX edition, offers an in-depth investigation of the kitchen market in China, with size and trends of production, consumption, international trade, as well as analysis of demand determinants and competitive system