July 2022,

V Ed. ,

201 pages

Price (single user license):

EUR 1600 / USD 1712

For multiple/corporate license prices please contact us

Language: English

Report code: S.72

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The report, now at its fifth edition, analyses the Lighting fixtures market in 7 Asian Pacific countries (Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, Vietnam), a market with an estimated consumption (at factory prices) that, in 2021, amounts to USD 6.3 billion.

The Study provides data and trend (2016-2021) on the production, the international trade and the market size of the lighting fixtures industry, broken down by consumer/residential and technical/professional lighting (divided in architectural/commercial, industrial, and outdoor). An overview of the top players in the lamps lighting market is also provided. Forecasts up to 2025 for the lighting fixtures market and selected economic indicators are included for each considered countries.

The first chapter offers an overview of the lighting industry in Asia Pacific (7 country) as a whole, ranking the top companies as total lighting sales (including: Lighting fixtures, LED and Conventional lamps), as lighting fixtures sales by segment (consumer/professional, indoor/outdoor), specific products and applications (downlights, projectors, high bays, etc.; hospitality, retail, healthcare, street lighting, etc.), light sources (LED share), distribution channels.

After a first glance of the Asian Pacific lighting market as a whole, the report is structured as follows, for each country:

- Paragraph I Market size, activity trend and forecast offers an overview of the lighting fixtures industry with data on production, consumption and international trade for the period 2016-2021 and forecast up to 2025.

- Paragraph II International trade provides detailed tables on lighting fixtures exports and imports, by country and by geographical area of destination/origin, highlighting the main destination for lighting fixtures exports and the top lighting fixtures importers, and data on international trade of lamps, pointing out the percentage share of LED based lamps on total exported and imported lamps.

- Paragraph III Competitive system offers an insight into the leading local and foreign players present in each market via detailed tables showing sales data and market shares and short company profiles.

- Paragraph IV Light sources provides an estimated breakdown of lighting fixtures sales by light sources (penetration rate of the LED lighting segment versus conventional lighting sources).

- Paragraph V Distribution channels gives an overview of the main distribution channels. A selection of architectural companies involved in the lighting business, a selection of the main associations and trade fairs, a focus on the most relevant cities for each country are also included.

- Paragraph VI Economic indicators provides data and forecasts for selected macroeconomic indicators, population and social trends, and building activity.

Selected companies

Alto Lighting, Aplico, Artemide, Artolite, AZ E-Lite, Azcor Lighting, Boonthavorn Lighting, CARA Lighting, Changi Light, Chor Rungsang Lighting, Chunil, Davico, Dien Quang Lamp, Dongmyung Lighting – Raat, Duc Hau Long, Eglo, ELM Lighting, Erco, EVE Lighting, Fagerhult, Fluxlite, Focus Vina, Fokus Indo Lighting, Fosera Lighting, FSL Lighting, Fumaco, Goodlite, Hannochs, Hanssem, Hapulico Lighting, Hikari, Honyar, Hori Lighting, Kangsan Lighting, Krisbow, Kum Kang Electric, L&E Lighting and Equipment, Lamptan, Leedarson, LeKise, Ligman, Lumens, Maltani Lighting, MLS – Ledvance, Neo-Neon, NVC, Opple, PAK Lighting, Rang Dong, RZB, Saka Lighting, Signify, Solarens Ledindo, Sunil Elecomm, Tan Phat, Ushio Lighting, Wooree Lighting, XaLoTho, Yankon, Zumtobel

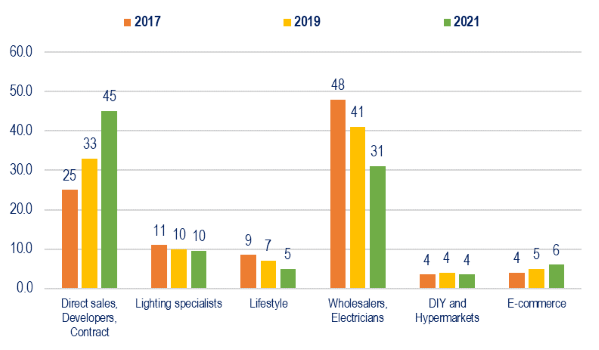

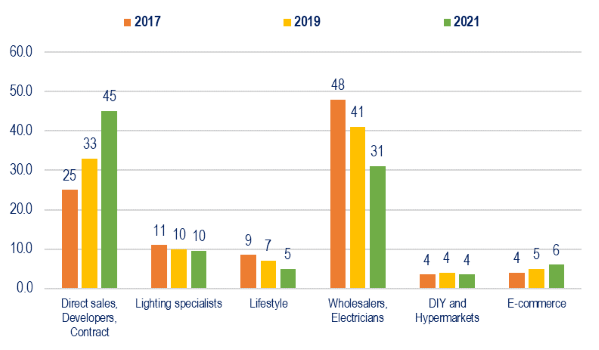

Breakdown of lighting fixtures sales in Asia Pacific by distribution channels. Sector estimate, 2017, 2019 and 2021. Percentage share in value

The lighting fixtures market in Asia Pacific (7 countries considered, in alphabetical order: Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, Vietnam) was estimated to worth US$ 6,264 million at factory prices, for the year 2021.

The above mentioned value does not include lamps (Conventional and LED lamps), which are estimated to worth an additional US$ 1,533 million, while the overall lighting turnover (fixtures + lamps) is around US$ 7.8 billion.

Over 60% the share of LED based lighting fixtures.

Around 3% of these luminaires and lamps are today connected, but this share could easily to reach somewhat 10% in a 3-4 year span.

Top 50 players hold almost 40% of the lighting fixtures market in Asia Pacific.

Among the major players: Eve, Hannochs, Hansol, Ledvance, L&E, Maltani, Panasonic, Rang Dong, Signify, Tan Phat, Tospo. These players register an average 6% sales growth during 2021.

South Korea is by far the main market in the region (US$ 2.3 billion), followed by Vietnam and Thailand.

Vietnam is the country with an higher share of trade (both exports and imports). An increasing share of the Asian Pacific market for lighting fixtures is handled on a Project basis.

Lighting market in Asia Pacific (7 Countries) – Lighting industry at a glance: Lighting fixtures production, international trade and consumption; trade and consumption of Lamps, estimates of total lighting market.

Lighting market forecasts up to 2025, by country and for Asia Pacific as a whole

Competitive system: the top players. Estimated sales data and market shares of the leading companies for: Total Lighting, Lamps, Lighting fixtures, Residential/ Consumer, Commercial/ Architectural, Industrial and Outdoor Lighting markets, LED-based lighting. Short company profiles.

Breakdown of lighting fixtures sales by style, products type, applications, distribution channels for a sample of companies and sector estimates.

Lighting demand in a selected sample of Asian-Pacific cities

COUNTRY ANALYSIS: Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, Vietnam

For each country considered:

Market size, activity trend and forecast: lighting fixtures time series on production, consumption and international trade. Forecast on the trend of the lighting market and selected economic indicators.

International trade: export and import flows of lighting fixtures by country and by geographical area of destination/origin, and data on international trade of lamps.

Competitive system: estimated lighting sales data and market shares among the major local and international players present in each market, as well as short company profiles

Light sources: LED lighting segment versus conventional lighting sources

Distribution: overview of the main distribution channels and selection of architectural companies involved in the lighting business and lighting design studios. Lighting demand in selected cities

Economic indicators: data and forecasts for selected economic indicators

The report, now at its fifth edition, analyses the Lighting fixtures market in 7 Asian Pacific countries (Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, Vietnam), a market with an estimated consumption (at factory prices) that, in 2021, amounts to USD 6.3 billion.

The Study provides data and trend (2016-2021) on the production, the international trade and the market size of the lighting fixtures industry, broken down by consumer/residential and technical/professional lighting (divided in architectural/commercial, industrial, and outdoor). An overview of the top players in the lamps lighting market is also provided. Forecasts up to 2025 for the lighting fixtures market and selected economic indicators are included for each considered countries.

The first chapter offers an overview of the lighting industry in Asia Pacific (7 country) as a whole, ranking the top companies as total lighting sales (including: Lighting fixtures, LED and Conventional lamps), as lighting fixtures sales by segment (consumer/professional, indoor/outdoor), specific products and applications (downlights, projectors, high bays, etc.; hospitality, retail, healthcare, street lighting, etc.), light sources (LED share), distribution channels.

After a first glance of the Asian Pacific lighting market as a whole, the report is structured as follows, for each country:

- Paragraph I Market size, activity trend and forecast offers an overview of the lighting fixtures industry with data on production, consumption and international trade for the period 2016-2021 and forecast up to 2025.

- Paragraph II International trade provides detailed tables on lighting fixtures exports and imports, by country and by geographical area of destination/origin, highlighting the main destination for lighting fixtures exports and the top lighting fixtures importers, and data on international trade of lamps, pointing out the percentage share of LED based lamps on total exported and imported lamps.

- Paragraph III Competitive system offers an insight into the leading local and foreign players present in each market via detailed tables showing sales data and market shares and short company profiles.

- Paragraph IV Light sources provides an estimated breakdown of lighting fixtures sales by light sources (penetration rate of the LED lighting segment versus conventional lighting sources).

- Paragraph V Distribution channels gives an overview of the main distribution channels. A selection of architectural companies involved in the lighting business, a selection of the main associations and trade fairs, a focus on the most relevant cities for each country are also included.

- Paragraph VI Economic indicators provides data and forecasts for selected macroeconomic indicators, population and social trends, and building activity.

Breakdown of lighting fixtures sales in Asia Pacific by distribution channels. Sector estimate, 2017, 2019 and 2021. Percentage share in value

The lighting fixtures market in Asia Pacific (7 countries considered, in alphabetical order: Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, Vietnam) was estimated to worth US$ 6,264 million at factory prices, for the year 2021.

The above mentioned value does not include lamps (Conventional and LED lamps), which are estimated to worth an additional US$ 1,533 million, while the overall lighting turnover (fixtures + lamps) is around US$ 7.8 billion.

Over 60% the share of LED based lighting fixtures.

Around 3% of these luminaires and lamps are today connected, but this share could easily to reach somewhat 10% in a 3-4 year span.

Top 50 players hold almost 40% of the lighting fixtures market in Asia Pacific.

Among the major players: Eve, Hannochs, Hansol, Ledvance, L&E, Maltani, Panasonic, Rang Dong, Signify, Tan Phat, Tospo. These players register an average 6% sales growth during 2021.

South Korea is by far the main market in the region (US$ 2.3 billion), followed by Vietnam and Thailand.

Vietnam is the country with an higher share of trade (both exports and imports). An increasing share of the Asian Pacific market for lighting fixtures is handled on a Project basis.

Lighting market in Asia Pacific (7 Countries) – Lighting industry at a glance: Lighting fixtures production, international trade and consumption; trade and consumption of Lamps, estimates of total lighting market.

Lighting market forecasts up to 2025, by country and for Asia Pacific as a whole

Competitive system: the top players. Estimated sales data and market shares of the leading companies for: Total Lighting, Lamps, Lighting fixtures, Residential/ Consumer, Commercial/ Architectural, Industrial and Outdoor Lighting markets, LED-based lighting. Short company profiles.

Breakdown of lighting fixtures sales by style, products type, applications, distribution channels for a sample of companies and sector estimates.

Lighting demand in a selected sample of Asian-Pacific cities

COUNTRY ANALYSIS: Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, Vietnam

For each country considered:

Market size, activity trend and forecast: lighting fixtures time series on production, consumption and international trade. Forecast on the trend of the lighting market and selected economic indicators.

International trade: export and import flows of lighting fixtures by country and by geographical area of destination/origin, and data on international trade of lamps.

Competitive system: estimated lighting sales data and market shares among the major local and international players present in each market, as well as short company profiles

Light sources: LED lighting segment versus conventional lighting sources

Distribution: overview of the main distribution channels and selection of architectural companies involved in the lighting business and lighting design studios. Lighting demand in selected cities

Economic indicators: data and forecasts for selected economic indicators

SEE ALSO

The worldwide market for connected lighting

February 2024, I Ed. , 88 pages

This report analyses the global lighting market focusing on LED and connected lighting trends. It provides market forecasts emphasizing the impact of green transition and digital transformation. The study also includes a section on industry competition, estimating sales, and market shares for leading manufacturers.

Lighting: World Market Outlook

November 2023, XXVI Ed. , 123 pages

The world market for lighting fixtures reached a value of USD 97 billion in 2023. After some fluctuating performance in the post-pandemic period, it is expected to remain stable in 2024, followed by moderate growth in 2025 and 2026. The major consuming countries are the US, China, Japan, India and Germany. The twenty-six edition of CSIL research “Lighting: World market outlook” analyzes, through tables and graphs, data on lighting fixtures production, consumption and international trade at worldwide level as a whole and for 70 considered countries, for the years 2013-2022 and 2023 preliminary. lighting fixtures market forecasts for the next three years (2024-2026) are also provided

The lighting fixtures market in China

September 2023, XVI Ed. , 205 pages

The 16th edition of The Lighting Fixtures market in China offers an accurate and in-deep analysis of the lighting fixtures industry in China, providing data and trends for the period 2017-2022 and forecasts up to 2025. From one hand, the report analyses the main trends affecting the market over the last five years, considering the production, consumption, imports and exports of lighting fixtures in the country. On the other hand, it offers an analysis of the supply structure and the competitive system, an overview on smart connected lighting trend, the distribution system and the main players operating in the market

The lighting fixtures market in the United States

June 2023, XVII Ed. , 256 pages

The total US lighting market is estimated to be worth around USD 26 billion in 2022. This value includes lighting fixtures and lamps. The US lighting market during 2022 registers a 6.5% growth in nominal terms as for lighting fixtures (consumer, professional, outdoor), up to 23.2 billion USD. The lamps market registers a decrease (about -2.9%). The residential segment has grown well above the market average (+5.9% on average over the last five years). In 2022, the weight of Office and Entertainment on the overall commercial lighting market has declined, while Hospitality and Public premises grew. In 2022, the value of completed construction grew by more than 10 percent to nearly USD 1.8 billion

The European market for lighting fixtures

May 2023, XXXII Ed. , 392 pages

In 2022, consumption of lighting fixtures in the EU30 countries registered a 8.3% increase, reaching a value of EUR 19.9 billion. Better results for commercial lighting (versus residential, industrial and outdoor), big players (with a 12% Ebitda), design oriented, area lighting, hospitality, contract (versus retail), linear lighting, emergency. More IP patents and acquisitions. Top 10 players hold a 30% market share.