The office furniture market in North America. The United States, Canada, and Mexico

Office | July 2023

€2600

July 2023,

VII Ed. ,

129 pages

Price (single user license):

EUR 2600 / USD 2782

For multiple/corporate license prices please contact us

Language: English

Report code: S06

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The CSIL Market Research Report “The office furniture market in North America: the United States, Canada and Mexico” offers an overview of the office furniture sector in North America, with market evolution 2017-2022, market forecasts to 2024, figures by country, historical trends on production and consumption of office furniture, imports and exports data, market share of major office furniture companies operating in North America and distribution system analysis.

Country analysis. The USA, Canada, Mexico.

For each considered country this study provides:

- Market value to 2022 and market forecasts for 2023 and 2024.

- Analysis of the competitive system in terms of concentration, company dimension and manufacturing locations.

- Sales and estimates on market shares of the leading office furniture manufacturers, with short profiles of the top players.

- Distribution system description.

- International trade of office furniture by country and by geographical area of origin/destination (for seating and office furniture excluding seating).

- Demand determinants and economic indicators.

Focus on the United States.

Together with figures included for each considered country (see above), for the US this study provides:

- Office furniture market broken down by segment (office seating, operative desking, executive furniture, filing storage, furniture for communal areas, other products including walls and partitions).

- Breakdown by kind and by covering material for seating and by material for desking. Incidence of sit-stand/HAT.

- Company market shares at product level.

- Sales by State.

- Main distribution channels and a directory of some of the main dealerships in major metropolitan areas.

- Analysis of market potential focused on non-residential construction sector (office, lodging, healthcare, educational, etc.).

Over 100 addresses of key operators are included. The study has been carried out involving direct interviews with more than 100 sector firms, distributors and sector experts operating in North America.

Selected companies

9 to 5 Seating, Allseating Corporation, Arcadia+Encore, Artopex, Bestar Inc, Creaciones Industriales, Gebesa, Groupe Lacasse, Hat Collective, Haworth, HNI Corporation, Humanscale, Indiana Furniture, Inscape, Jasper Group JSI, Keilhauer, Kimball International, KI, MillerKnoll, Office Master, Productos Metalicos Steele, SitOnIt Seating, Steelcase, Teknion Group, Watson

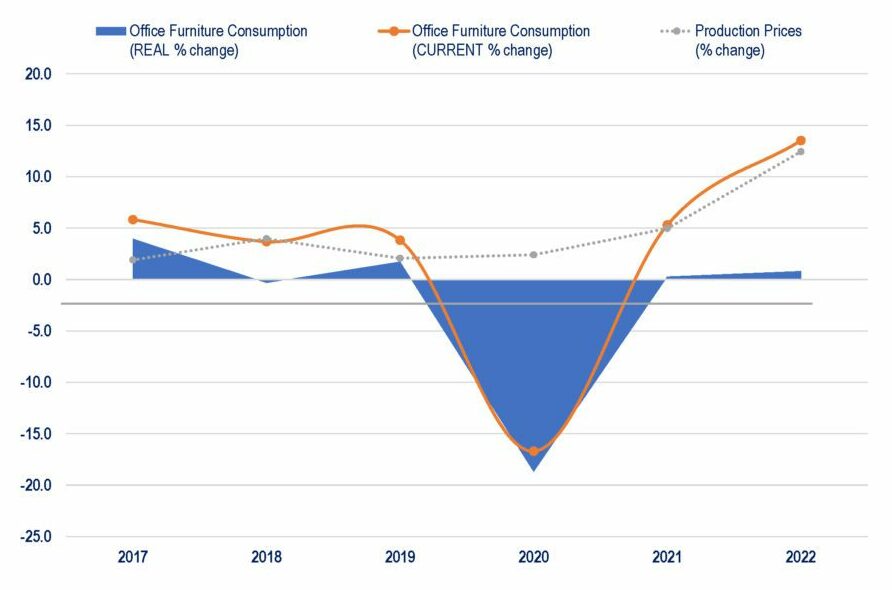

North America. Office furniture consumption and prices, 2017-2022. Percentage change

The North American office furniture market (including the United States, Canada and Mexico) accounts for over one third of the global office furniture demand. In 2022 consumption increased by 13% including a quite relevant inflation effect.

The United States is the largest importer worldwide with a total value of about US$ 3.0 billion. On the other hand, Canada and Mexico are net exporters with a positive trade balance which progressively improved over the last years. Both markets are strongly linked to the US as it represents 96% and almost 100% of exports destination respectively. Canada, in particular, is the second largest office furniture exporter in the world after China and represents more than half of the whole export values of North America. The competitive panorama is heavily concentrated in the hand on some large players as top 20 companies owns 3/4 of combined market share.

Abstract of Table of Contents

METHODOLOGY AND RESEARCH TOOLS

1 Scenario

1.1 Market scenario and figures by country: Trends, production, exports, imports and consumption

1.2 Leading companies in North America and their market shares

1.3 Foreign companies active in North America

1.4 Current trends and forecasts: Office furniture consumption, GDP and non-residential investments forecasts for 2023 and 2024

2 CANADA

2.1 The office furniture sector: production, exports, imports and consumption

2.2 Manufacturing presence

2.3 Competition

– Canada. Office furniture. Market shares estimate of the top 10 companies, 2022. Percentage shares

– Canada. Office furniture. Total sales in a sample of companies, 2022

2.4 Distribution channels

2.5 International trade. Exports, imports and trade balance, 2017-2022.

– Exports. Total office, office furniture, office seating by country and by geographical area

– Imports. Total office, office furniture, office seating by country and by geographical area

2.6 Demand determinants

– Economic indicators

– Construction

– Office space occupancy

3 MEXICO

3.1 The office furniture sector: production, exports, imports and consumption

3.2 Manufacturing presence

3.3 Competition

– Mexico. Office furniture. Market shares estimate of the top 10 companies, 2022. Percentage shares

– Mexico. Office furniture. Total sales in a sample of companies, 2022

3.4 Distribution channels

3.5 International trade

– Exports. Total office, office furniture, office seating by country and by geographical area

– Imports. Total office, office furniture, office seating by country and by geographical area

3.6 Demand determinants

– Economic indicators

– Construction

– Office space occupancy

4 THE UNITED STATES

4.1 The office furniture sector: production, exports, imports and consumption

4.2 Manufacturing presence

4.3 Product segments

– Office seating

– Office desking

– Height- Adjustable Tables (HAT)

4.4 Home Office

4.5 Competition

– The United States. Office furniture. Market shares estimate of the top 10 companies, 2022. Percentage shares

– United States. Office furniture. Total sales in a sample of companies, 2022

Estimated sales in a sample of companies for the following products:

– Seating

– Office desking

– Executive furniture

– Office filing and storage

– Furniture for communal areas

– Partitions, acoustic and other products

4.6 Sales of office furniture by state

4.7 Distribution channels

4.8 International trade

– Exports. Total office, office furniture, office seating by country and by geographical area

– Imports. Total office, office furniture, office seating by country and by geographical area

4.9 Demand determinants

– Economic indicators

– Construction

– Office space occupancy

Appendix 1: TRADE FAIRS, MAGAZINES AND ASSOCIATIONS

Appendix 2: List of Mentioned Companies

The CSIL Market Research Report “The office furniture market in North America: the United States, Canada and Mexico” offers an overview of the office furniture sector in North America, with market evolution 2017-2022, market forecasts to 2024, figures by country, historical trends on production and consumption of office furniture, imports and exports data, market share of major office furniture companies operating in North America and distribution system analysis.

Country analysis. The USA, Canada, Mexico.

For each considered country this study provides:

- Market value to 2022 and market forecasts for 2023 and 2024.

- Analysis of the competitive system in terms of concentration, company dimension and manufacturing locations.

- Sales and estimates on market shares of the leading office furniture manufacturers, with short profiles of the top players.

- Distribution system description.

- International trade of office furniture by country and by geographical area of origin/destination (for seating and office furniture excluding seating).

- Demand determinants and economic indicators.

Focus on the United States.

Together with figures included for each considered country (see above), for the US this study provides:

- Office furniture market broken down by segment (office seating, operative desking, executive furniture, filing storage, furniture for communal areas, other products including walls and partitions).

- Breakdown by kind and by covering material for seating and by material for desking. Incidence of sit-stand/HAT.

- Company market shares at product level.

- Sales by State.

- Main distribution channels and a directory of some of the main dealerships in major metropolitan areas.

- Analysis of market potential focused on non-residential construction sector (office, lodging, healthcare, educational, etc.).

Over 100 addresses of key operators are included. The study has been carried out involving direct interviews with more than 100 sector firms, distributors and sector experts operating in North America.

North America. Office furniture consumption and prices, 2017-2022. Percentage change

The North American office furniture market (including the United States, Canada and Mexico) accounts for over one third of the global office furniture demand. In 2022 consumption increased by 13% including a quite relevant inflation effect.

The United States is the largest importer worldwide with a total value of about US$ 3.0 billion. On the other hand, Canada and Mexico are net exporters with a positive trade balance which progressively improved over the last years. Both markets are strongly linked to the US as it represents 96% and almost 100% of exports destination respectively. Canada, in particular, is the second largest office furniture exporter in the world after China and represents more than half of the whole export values of North America. The competitive panorama is heavily concentrated in the hand on some large players as top 20 companies owns 3/4 of combined market share.

Abstract of Table of Contents

METHODOLOGY AND RESEARCH TOOLS

1 Scenario

1.1 Market scenario and figures by country: Trends, production, exports, imports and consumption

1.2 Leading companies in North America and their market shares

1.3 Foreign companies active in North America

1.4 Current trends and forecasts: Office furniture consumption, GDP and non-residential investments forecasts for 2023 and 2024

2 CANADA

2.1 The office furniture sector: production, exports, imports and consumption

2.2 Manufacturing presence

2.3 Competition

– Canada. Office furniture. Market shares estimate of the top 10 companies, 2022. Percentage shares

– Canada. Office furniture. Total sales in a sample of companies, 2022

2.4 Distribution channels

2.5 International trade. Exports, imports and trade balance, 2017-2022.

– Exports. Total office, office furniture, office seating by country and by geographical area

– Imports. Total office, office furniture, office seating by country and by geographical area

2.6 Demand determinants

– Economic indicators

– Construction

– Office space occupancy

3 MEXICO

3.1 The office furniture sector: production, exports, imports and consumption

3.2 Manufacturing presence

3.3 Competition

– Mexico. Office furniture. Market shares estimate of the top 10 companies, 2022. Percentage shares

– Mexico. Office furniture. Total sales in a sample of companies, 2022

3.4 Distribution channels

3.5 International trade

– Exports. Total office, office furniture, office seating by country and by geographical area

– Imports. Total office, office furniture, office seating by country and by geographical area

3.6 Demand determinants

– Economic indicators

– Construction

– Office space occupancy

4 THE UNITED STATES

4.1 The office furniture sector: production, exports, imports and consumption

4.2 Manufacturing presence

4.3 Product segments

– Office seating

– Office desking

– Height- Adjustable Tables (HAT)

4.4 Home Office

4.5 Competition

– The United States. Office furniture. Market shares estimate of the top 10 companies, 2022. Percentage shares

– United States. Office furniture. Total sales in a sample of companies, 2022

Estimated sales in a sample of companies for the following products:

– Seating

– Office desking

– Executive furniture

– Office filing and storage

– Furniture for communal areas

– Partitions, acoustic and other products

4.6 Sales of office furniture by state

4.7 Distribution channels

4.8 International trade

– Exports. Total office, office furniture, office seating by country and by geographical area

– Imports. Total office, office furniture, office seating by country and by geographical area

4.9 Demand determinants

– Economic indicators

– Construction

– Office space occupancy

Appendix 1: TRADE FAIRS, MAGAZINES AND ASSOCIATIONS

Appendix 2: List of Mentioned Companies

SEE ALSO

The world office furniture industry

December 2023, XII Ed. , 442 pages

A comprehensive picture of the global office furniture sector with production, consumption imports, and export data for the time series 2014-2023, international trade, market forecasts for the years 2024 and 2025, profiles of the leading office furniture manufacturers, and summary tables for 60 countries. Focus on the Top 20 office furniture countries.

The world market for Height Adjustable Tables

November 2023, I Ed. , 80 pages

A comprehensive analysis of the Height Adjustable Tables (HAT) market, delving into key players (manufacturers and suppliers), trends, and market forecasts by major world areas and relevant regions, focusing on product destinations.

The world market for office seating

November 2023, II Ed. , 162 pages

A comprehensive report analysing key statistics of the global office seating industry, including production, consumption, and international trade for the 2018-2023 time series, office seating market forecasts for 2024 and 2025, the leading companies, a range of products and their features, with a focus on three world regions (North America, Europe, and Asia-Pacific) and key countries.

The European market for office furniture

June 2023, XXXV Ed. , 281 pages

An extensive analysis of the office furniture sector in Europe, with historical data on key indicators, and demand prospects, delving into the performance of the leading manufacturers, the product categories, and the distribution.

Home office furniture market in Europe

September 2022, III Ed. , 115 pages

Trends in the home office furniture segment and hybrid working in Europe, demand drivers, market size and evolution, sales of home office furniture, distribution, manufacturers, retailers, and main results of the CSIL survey on a sample of end-users, aiming at analysing the home office environment, the furniture products, the purchasing process, the expected budgets and channels.