December 2021,

V Ed. ,

219 pages

Price (single user license):

EUR 2000 / USD 2120

For multiple/corporate license prices please contact us

Language: English

Report code: W.19

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

CSIL report The world market for outdoor lighting offers a full analysis of the outdoor lighting fixtures market worldwide. This study provides outdoor lighting industry statistics (consumption data), sales data and market shares of the top manufacturers.

‘World‘ is considered such as the aggregate of 70 monitored countries, selected by CSIL on the basis of the size of their economy, the importance of their lighting fixtures sector and their contribution to the world trade of lighting fixtures, plus an estimation of the market value in the Rest of the World, given by the value of Chinese exports worldwide minus the value of Chinese exports in the other 69 considered countries:

The geographical classification of the 70 monitored countries is as follows:

- North America: Canada, Mexico and the United States;

- Central and South America: Argentina, Brazil, Chile, Colombia, Venezuela;

- European Union (27) + United Kingdom, Norway and Switzerland: Austria, Belgium (including Luxembourg), Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom;

- Russia, Serbia, Turkey and CIS Countries: Belarus, Kazakhstan, Russia, Serbia, Turkey, Ukraine;

- China;

- India;

- Japan;

- Asia Pacific; Indonesia, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, Vietnam;

- Oceania: Australia, New Zealand

- Middle East and Africa: Algeria, Bahrain, Egypt, Israel, Jordan, Kuwait, Lebanon, Morocco, Oman, Qatar, Saudi Arabia, South Africa, Tunisia, United Arab Emirates.

For each Regional cluster, market size, activity trend and market shares are provided.

Outdoor lighting is analyzed according to the following segments:

- Residential/Consumer lighting (home gardens lighting and architectural lighting for common spaces in residential buildings).

- Urban landscape lighting (architectural lighting for city centers, ‘city beautification’).

- Christmas and Event lighting

- Streets and major roads lighting

- Lighting for tunnels and galleries

- Campus/area lighting (sporting plants, open air parking, petrol stations, airports).

For each market segment, market size, activity trend and market shares are provided.

The Report includes profiles of 85 cities worldwide with a selection of economic and demographic indicators and hard facts on the potential market for outdoor lighting fixtures.

Selected companies

Acuity Brands, AEC Illuminazione, Alto Lighting, Amerlux, Aurora, Bajaj, Beacon Lighting, Bega, Blachere,Boos Lighting, CG Crompton, Cree Lighting, Daiko, Debbas, Delta Light, Disano, Dien Quang, Ecosense, Eglo, Endo, Erco, Everlight, Experience Brands, Fagerhult, Finelite, Flos, Focal Point, FSL Lighting, GE Current, Glamox, Hannochs, Hess, Home Depot, Hubbell, Hunter Industries, iGuzzini, Ikea, Intense, Intral, Intra Lighting, Iris Oyhama, Iwasaki, Jiawei Renewable, Klite, Koizumi, Koito, Ledvance, L&E, Ligman, LSI, Lumenpulse, Lumens, Lianovation, Lumicenter, Musco Sports, Nixan, Nikkon, Nouran, NVC, Ocean’s King, Opple, Orient Electric, Osram Digital Solutions, Pak Lighting, Panasonic Life Solutions, Platek, Racer, Ragni, RangDong, RZB, Schreder, Siteco, Signify, SLV, Syska, Tospo, Trilux, Unilumin, Yankon, We-Ef, Wooree Lighting, Xindeco, Zubair Electric, Zumtobel

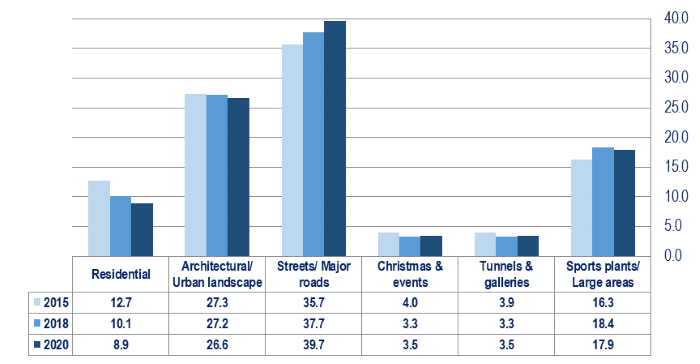

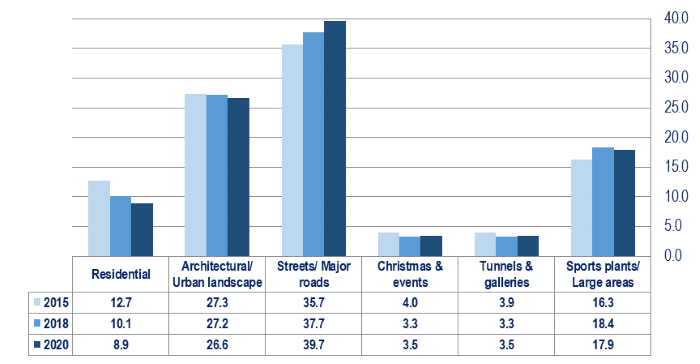

Total World. Estimated breakdown of outdoor lighting fixtures market by product, 2015-2018-2020. Percentage share in value

Leaders of outdoor lighting include Signify worldwide, with a market share of 7%-8%, Acuity Brands in America, Schréder in Europe, Middle East and Latin America, Panasonic Life Solutions and Tospo in Asia. Among the following major players: Cree Lighting (United States and Europe), Fagerhult and Zumtobel (Europe and Australia). On a growing trend GE Current (with the acquisition of Hubbell), Lianovation, Honyar, Megaphoton, NVC in Asia, Schréder in Australia.

Top 60 analyzed companies hold a worldwide market share estimated in the region of 40%-45%.

High profitability rates in the sector are disclosed, among others, by Acuity Brands, MLS-Ledvance, Endo, Ocean’s King, Flos, Thorpe, Disano, Jiawei, Huati, Delta Light.

15%-30% of outdoor lighting is already connected in the most recent projects in the wealthiest markets.

Sales of outdoor lighting fixtures through direct channels (ESCOs, Municipalities, direct Contract deals) are estimated in around 41% of the market value (some more among top players, outdoor and street lighting specialists). It is an increasing share in comparison with a previous estimate (37.5% in 2015).

CSIL estimates in around 137 million of units the number of outdoor lighting fixtures installed in the last year worldwide, including 3.5-4.0 million of connected outdoor items.

1 BASIC DATA, ACTIVITY TREND AND SHORT-TERM FORECASTS

Market size, trend and forecasts

Estimated market of outdoor lighting fixtures by product and by price range. Values and quantities

Estimated market of outdoor lighting fixtures by country, 2011-2015-2018-2020

Product breakdown:

Estimated breakdown of outdoor lighting fixtures market by product and by country/geographic area

United States, Europe, Russia, China, India, Japan, Asia Pacific: Estimated breakdown of outdoor lighting fixtures market by application in a sample of local companies

Smart management of urban and street lighting

Population, area, road network and number of light points by country

2 MARKET DRIVERS: TOP 100 WORLD MUNICIPALITIES

North and South America; Europe; Russia, Ukraine, Turkey; China; India; Japan; Asia Pacific; Middle East and Africa: profiles of 85 cities worldwide with a selection of economic and demographic indicators and hard facts on the potential market for outdoor lighting fixtures

3 OUTDOOR LED LIGHTING, CONNECTED LUMINAIRES AND SERVICEABILITY

Estimated consumption of outdoor LED-based lighting fixtures, 2014-2020 estimated data and 2021-2024 forecasts

Connected luminaires and Serviceability

4 DISTRIBUTION

Estimated breakdown of outdoor lighting sales by distribution channel, 2015, 2018, 2020 and for a sample of companies

5 WORLDWIDE COMPETITION BY KIND OF PRODUCT

Consumer outdoor lighting; Architectural outdoor lighting, façade, city beautification; Street lighting, highway lighting; Christmas and Events lighting; Tunnels and galleries lighting; Area lighting (parking, gas stations, airports, sporting plants)

For each of the above-mentioned market segment: sales data, market shares and short profiles for a sample of leading companies

Profitability

Profitability indicators (ROE, ROCE, ROA, EBIT, EBITDA) in a sample of 100 lighting manufacturers

6 WORLDWIDE COMPETITION BY COUNTRY

North America (focus on the United States); Central-South America (focus on Brazil); Europe (focus on Nordic Countries, Benelux, United Kingdom, France, DACH, Italy, Spain, Central-Eastern Europe); Turkey, Russia, Ukraine, CIS Countries (focus on Russia); China; Japan; Asia Pacific; Oceania; India; Middle East and Africa.

For each Regional cluster: market size, sales data, market shares and short profiles for a sample of leading companies

ANNEX: A SELECTION OF IP PATENTS IN THE OUTDOOR LIGHTING FIELD

CSIL report The world market for outdoor lighting offers a full analysis of the outdoor lighting fixtures market worldwide. This study provides outdoor lighting industry statistics (consumption data), sales data and market shares of the top manufacturers.

‘World‘ is considered such as the aggregate of 70 monitored countries, selected by CSIL on the basis of the size of their economy, the importance of their lighting fixtures sector and their contribution to the world trade of lighting fixtures, plus an estimation of the market value in the Rest of the World, given by the value of Chinese exports worldwide minus the value of Chinese exports in the other 69 considered countries:

The geographical classification of the 70 monitored countries is as follows:

- North America: Canada, Mexico and the United States;

- Central and South America: Argentina, Brazil, Chile, Colombia, Venezuela;

- European Union (27) + United Kingdom, Norway and Switzerland: Austria, Belgium (including Luxembourg), Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom;

- Russia, Serbia, Turkey and CIS Countries: Belarus, Kazakhstan, Russia, Serbia, Turkey, Ukraine;

- China;

- India;

- Japan;

- Asia Pacific; Indonesia, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, Vietnam;

- Oceania: Australia, New Zealand

- Middle East and Africa: Algeria, Bahrain, Egypt, Israel, Jordan, Kuwait, Lebanon, Morocco, Oman, Qatar, Saudi Arabia, South Africa, Tunisia, United Arab Emirates.

For each Regional cluster, market size, activity trend and market shares are provided.

Outdoor lighting is analyzed according to the following segments:

- Residential/Consumer lighting (home gardens lighting and architectural lighting for common spaces in residential buildings).

- Urban landscape lighting (architectural lighting for city centers, ‘city beautification’).

- Christmas and Event lighting

- Streets and major roads lighting

- Lighting for tunnels and galleries

- Campus/area lighting (sporting plants, open air parking, petrol stations, airports).

For each market segment, market size, activity trend and market shares are provided.

The Report includes profiles of 85 cities worldwide with a selection of economic and demographic indicators and hard facts on the potential market for outdoor lighting fixtures.

Total World. Estimated breakdown of outdoor lighting fixtures market by product, 2015-2018-2020. Percentage share in value

Leaders of outdoor lighting include Signify worldwide, with a market share of 7%-8%, Acuity Brands in America, Schréder in Europe, Middle East and Latin America, Panasonic Life Solutions and Tospo in Asia. Among the following major players: Cree Lighting (United States and Europe), Fagerhult and Zumtobel (Europe and Australia). On a growing trend GE Current (with the acquisition of Hubbell), Lianovation, Honyar, Megaphoton, NVC in Asia, Schréder in Australia.

Top 60 analyzed companies hold a worldwide market share estimated in the region of 40%-45%.

High profitability rates in the sector are disclosed, among others, by Acuity Brands, MLS-Ledvance, Endo, Ocean’s King, Flos, Thorpe, Disano, Jiawei, Huati, Delta Light.

15%-30% of outdoor lighting is already connected in the most recent projects in the wealthiest markets.

Sales of outdoor lighting fixtures through direct channels (ESCOs, Municipalities, direct Contract deals) are estimated in around 41% of the market value (some more among top players, outdoor and street lighting specialists). It is an increasing share in comparison with a previous estimate (37.5% in 2015).

CSIL estimates in around 137 million of units the number of outdoor lighting fixtures installed in the last year worldwide, including 3.5-4.0 million of connected outdoor items.

1 BASIC DATA, ACTIVITY TREND AND SHORT-TERM FORECASTS

Market size, trend and forecasts

Estimated market of outdoor lighting fixtures by product and by price range. Values and quantities

Estimated market of outdoor lighting fixtures by country, 2011-2015-2018-2020

Product breakdown:

Estimated breakdown of outdoor lighting fixtures market by product and by country/geographic area

United States, Europe, Russia, China, India, Japan, Asia Pacific: Estimated breakdown of outdoor lighting fixtures market by application in a sample of local companies

Smart management of urban and street lighting

Population, area, road network and number of light points by country

2 MARKET DRIVERS: TOP 100 WORLD MUNICIPALITIES

North and South America; Europe; Russia, Ukraine, Turkey; China; India; Japan; Asia Pacific; Middle East and Africa: profiles of 85 cities worldwide with a selection of economic and demographic indicators and hard facts on the potential market for outdoor lighting fixtures

3 OUTDOOR LED LIGHTING, CONNECTED LUMINAIRES AND SERVICEABILITY

Estimated consumption of outdoor LED-based lighting fixtures, 2014-2020 estimated data and 2021-2024 forecasts

Connected luminaires and Serviceability

4 DISTRIBUTION

Estimated breakdown of outdoor lighting sales by distribution channel, 2015, 2018, 2020 and for a sample of companies

5 WORLDWIDE COMPETITION BY KIND OF PRODUCT

Consumer outdoor lighting; Architectural outdoor lighting, façade, city beautification; Street lighting, highway lighting; Christmas and Events lighting; Tunnels and galleries lighting; Area lighting (parking, gas stations, airports, sporting plants)

For each of the above-mentioned market segment: sales data, market shares and short profiles for a sample of leading companies

Profitability

Profitability indicators (ROE, ROCE, ROA, EBIT, EBITDA) in a sample of 100 lighting manufacturers

6 WORLDWIDE COMPETITION BY COUNTRY

North America (focus on the United States); Central-South America (focus on Brazil); Europe (focus on Nordic Countries, Benelux, United Kingdom, France, DACH, Italy, Spain, Central-Eastern Europe); Turkey, Russia, Ukraine, CIS Countries (focus on Russia); China; Japan; Asia Pacific; Oceania; India; Middle East and Africa.

For each Regional cluster: market size, sales data, market shares and short profiles for a sample of leading companies

ANNEX: A SELECTION OF IP PATENTS IN THE OUTDOOR LIGHTING FIELD

SEE ALSO

The worldwide market for connected lighting

February 2024, I Ed. , 88 pages

This report analyses the global lighting market focusing on LED and connected lighting trends. It provides market forecasts emphasizing the impact of green transition and digital transformation. The study also includes a section on industry competition, estimating sales, and market shares for leading manufacturers.

Lighting: World Market Outlook

November 2023, XXVI Ed. , 123 pages

The world market for lighting fixtures reached a value of USD 97 billion in 2023. After some fluctuating performance in the post-pandemic period, it is expected to remain stable in 2024, followed by moderate growth in 2025 and 2026. The major consuming countries are the US, China, Japan, India and Germany. The twenty-six edition of CSIL research “Lighting: World market outlook” analyzes, through tables and graphs, data on lighting fixtures production, consumption and international trade at worldwide level as a whole and for 70 considered countries, for the years 2013-2022 and 2023 preliminary. lighting fixtures market forecasts for the next three years (2024-2026) are also provided

The lighting fixtures market in China

September 2023, XVI Ed. , 205 pages

The 16th edition of The Lighting Fixtures market in China offers an accurate and in-deep analysis of the lighting fixtures industry in China, providing data and trends for the period 2017-2022 and forecasts up to 2025. From one hand, the report analyses the main trends affecting the market over the last five years, considering the production, consumption, imports and exports of lighting fixtures in the country. On the other hand, it offers an analysis of the supply structure and the competitive system, an overview on smart connected lighting trend, the distribution system and the main players operating in the market

The lighting fixtures market in the United States

June 2023, XVII Ed. , 256 pages

The total US lighting market is estimated to be worth around USD 26 billion in 2022. This value includes lighting fixtures and lamps. The US lighting market during 2022 registers a 6.5% growth in nominal terms as for lighting fixtures (consumer, professional, outdoor), up to 23.2 billion USD. The lamps market registers a decrease (about -2.9%). The residential segment has grown well above the market average (+5.9% on average over the last five years). In 2022, the weight of Office and Entertainment on the overall commercial lighting market has declined, while Hospitality and Public premises grew. In 2022, the value of completed construction grew by more than 10 percent to nearly USD 1.8 billion

The European market for lighting fixtures

May 2023, XXXII Ed. , 392 pages

In 2022, consumption of lighting fixtures in the EU30 countries registered a 8.3% increase, reaching a value of EUR 19.9 billion. Better results for commercial lighting (versus residential, industrial and outdoor), big players (with a 12% Ebitda), design oriented, area lighting, hospitality, contract (versus retail), linear lighting, emergency. More IP patents and acquisitions. Top 10 players hold a 30% market share.