January 2024,

X Ed. ,

517 pages

Price (single user license):

EUR 3500 / USD 3780

For multiple/corporate license prices please contact us

Language: English

Report code: W0102

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

Download

Abstract

Part of CSIL’s Country Furniture Outlook Series covering 100 countries at present, ‘The furniture industry in Europe’ contains all the main statistics and indicators useful to analyze the furniture sector in Europe and in 30 European countries: Austria, Belgium-Lux, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, the UK.

EUROPEAN FURNITURE MARKET OUTLOOK

The first part of this study goes in-depth into challenges affecting the furniture industry, the future perspectives for the European furniture sector, and a hot topic for the European furniture industry, which is the green and digital transitions.

The role of Europe in the global furniture context is analysed with historical series of basic data (furniture production, consumption, and trade 2018-2023), the European furniture production performance and future perspectives, the main factors affecting the competitiveness of manufacturers (labor cost, availability of raw materials and components, investments in technology and machinery, innovations, recycling, sustainability, and circularity), imports penetration, exports orientation, description of the main furniture manufacturing countries.

The European furniture market potential and development insights: future perspectives of the furniture sector in Europe, furniture market forecasts up to 2025.

The Furniture manufacturing system and trends in the development of furniture production by segment, with trends in furniture sub-segments (available data up to 2022).

The competitive system in Europe, with the recent European furniture manufacturers’ strategies, mergers, and acquisitions.

The Top furniture manufacturers in Europe: the competitive system analysis includes figures for the leading 50 European furniture companies (company name, country, website, activity, furniture specialization, total turnover, and the number of employees, share of furniture on total sales) ranked by their turnover.

This part also comments on the most recent challenges affecting the furniture industry, like the impact of the energy crisis, the geopolitical issues, the strategies implemented by the leading furniture manufacturers and suppliers, the supply chain disruptions, and the price increase.

COUNTRY ANALYSIS: 30 COUNTRY REPORTS

For each considered country (Austria, Belgium-Lux, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, the United Kingdom):

- Market outline and macroeconomic trends

- Production, consumption, imports, and exports of furniture for the time series 2018-2023

- Comparison with the European furniture sector: country rankings on production, consumption, imports, and exports

- Furniture market forecasts for 2024 and 2025

- Trading partners: the origin of furniture imports and furniture export destination

- Value of furniture consumption and production by segment (upholstered furniture, office furniture, kitchen furniture, Furniture for bedroom, dining-living room* and other furniture)

- Manufacturing system: number of furniture firms, and size

- Short profiles of leading furniture manufacturers

Over 2000 short profiles of furniture manufacturers are also provided, with information on their activity, product portfolio, turnover range, employees range, general email address -when available- and website.

Types of furniture covered: Office furniture, Upholstered furniture, Non-upholstered seats, Kitchen furniture, Bedroom furniture, Dining and living room furniture, and Other Furniture.

* For Bulgaria, Croatia, Latvia, Lithuania, Malta, Slovenia, and Switzerland, the furniture consumption and production breakdown by segment is available only by upholstered furniture, office furniture, kitchen furniture, and other furniture.

Selected companies

Among the leading furniture manufacturers mentioned in this study: Aquinos, BRW Black Red White, Cotta Collection, Design Holding, Ekornes, Friul Intagli, Howden Joinery, IKEA, Lifestyle Design, Natuzzi, Nobilia, Nowy Styl, Polipol, Schmidt Groupe, Schüller, Société Fournier, Steelcase, Welle Holding.

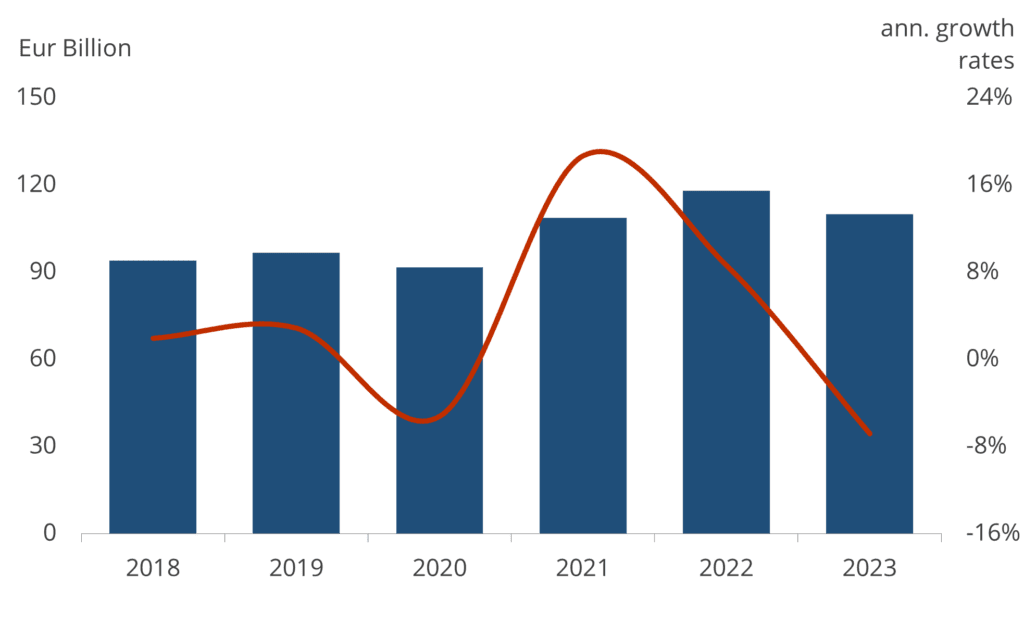

Europe. Total furniture consumption, 2018-2023. Eur billion and %

Europe continues to hold a crucial position in the global furniture industry, acting as a pivotal hub for production, market size and world trade.

With a value in the range of EUR 110 billion, the European market accounts for more than one-quarter of the global world furniture market. The largest markets are Germany, the UK, France, and Italy, which also rank among the top 10 furniture markets worldwide.

A significant proportion of the current demand in Europe is fulfilled by EU production, making up 80% of the total furniture consumption, while the remaining portion is sourced through imports from other countries.

After two years (2021 and 2022) of exceptional market growth, European furniture demand in 2023 contracted. CSIL estimates that furniture demand is forecasted to experience a slight decrease in real terms in 2024 and progressively slightly improve in the medium term (demand should return to more physiological growth in 2025).

The European furniture industry is predominantly comprised of Small and Medium-sized Enterprises (SMEs), supporting a substantial workforce, with over 1 million employees distributed over 135,000 manufacturing companies.

While remaining an SME-based industry, both industry and retail are progressively concentrating.

EU furniture manufacturers play a pivotal role in setting global trends, particularly in the high-end furniture market. In this segment, the EU stands out as a world leader, with nearly two-thirds of high-end furniture products sold globally originating from within the EU.

Abstract of Table of Contents

EXECUTIVE SUMMARY

Challenges affecting the furniture industry

- – The future perspectives for the European furniture sector

- – Green and digital transitions: a hot topic for the European furniture industry

THE EUROPEAN FURNITURE SECTOR

The role of Europe in the global furniture context

- – Europe and the rest of the world. Furniture production, consumption, exports, imports

The integration process within Europe - – International furniture trade, furniture exports by destination and origin of furniture imports

The future perspectives for the EU furniture sector - – The global macroeconomic context and furniture market forecasts in Europe

The European furniture production performance - – Description of the main furniture manufacturing countries (Italy, Germany, Poland, The United Kingdom, France)

Factors affecting the competitiveness of EU furniture producers

The furniture competitive system in Europe

- – Recent European furniture manufacturers’ strategies, M&A

- – The TOP 50 European manufacturers. Ranking by total turnover

European furniture market performance

Market sources

- National production, EU market integration and import flows

Trade balance

The growing degree of market openness

- – The export orientation

European furniture production by segment

Trends in furniture sub-segments

- – Hybrid solutions and flat-pack furniture

COUNTRY ANALYSIS | Market outline and macroeconomic trends, Production, consumption, imports, and exports of furniture, Country rankings, Furniture market forecasts, Trading partners, Furniture consumption and production by segment, Manufacturing system and Short profiles of leading furniture manufacturers for:

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom

SHORT PROFILES OF OVER 2000 EUROPEAN FURNITURE COMPANIES:

- activity

- product portfolio

- turnover range

- employees range

- email address

- website

METHODOLOGICAL NOTES

Part of CSIL’s Country Furniture Outlook Series covering 100 countries at present, ‘The furniture industry in Europe’ contains all the main statistics and indicators useful to analyze the furniture sector in Europe and in 30 European countries: Austria, Belgium-Lux, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, the UK.

EUROPEAN FURNITURE MARKET OUTLOOK

The first part of this study goes in-depth into challenges affecting the furniture industry, the future perspectives for the European furniture sector, and a hot topic for the European furniture industry, which is the green and digital transitions.

The role of Europe in the global furniture context is analysed with historical series of basic data (furniture production, consumption, and trade 2018-2023), the European furniture production performance and future perspectives, the main factors affecting the competitiveness of manufacturers (labor cost, availability of raw materials and components, investments in technology and machinery, innovations, recycling, sustainability, and circularity), imports penetration, exports orientation, description of the main furniture manufacturing countries.

The European furniture market potential and development insights: future perspectives of the furniture sector in Europe, furniture market forecasts up to 2025.

The Furniture manufacturing system and trends in the development of furniture production by segment, with trends in furniture sub-segments (available data up to 2022).

The competitive system in Europe, with the recent European furniture manufacturers’ strategies, mergers, and acquisitions.

The Top furniture manufacturers in Europe: the competitive system analysis includes figures for the leading 50 European furniture companies (company name, country, website, activity, furniture specialization, total turnover, and the number of employees, share of furniture on total sales) ranked by their turnover.

This part also comments on the most recent challenges affecting the furniture industry, like the impact of the energy crisis, the geopolitical issues, the strategies implemented by the leading furniture manufacturers and suppliers, the supply chain disruptions, and the price increase.

COUNTRY ANALYSIS: 30 COUNTRY REPORTS

For each considered country (Austria, Belgium-Lux, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, the United Kingdom):

- Market outline and macroeconomic trends

- Production, consumption, imports, and exports of furniture for the time series 2018-2023

- Comparison with the European furniture sector: country rankings on production, consumption, imports, and exports

- Furniture market forecasts for 2024 and 2025

- Trading partners: the origin of furniture imports and furniture export destination

- Value of furniture consumption and production by segment (upholstered furniture, office furniture, kitchen furniture, Furniture for bedroom, dining-living room* and other furniture)

- Manufacturing system: number of furniture firms, and size

- Short profiles of leading furniture manufacturers

Over 2000 short profiles of furniture manufacturers are also provided, with information on their activity, product portfolio, turnover range, employees range, general email address -when available- and website.

Types of furniture covered: Office furniture, Upholstered furniture, Non-upholstered seats, Kitchen furniture, Bedroom furniture, Dining and living room furniture, and Other Furniture.

* For Bulgaria, Croatia, Latvia, Lithuania, Malta, Slovenia, and Switzerland, the furniture consumption and production breakdown by segment is available only by upholstered furniture, office furniture, kitchen furniture, and other furniture.

Europe. Total furniture consumption, 2018-2023. Eur billion and %

Europe continues to hold a crucial position in the global furniture industry, acting as a pivotal hub for production, market size and world trade.

With a value in the range of EUR 110 billion, the European market accounts for more than one-quarter of the global world furniture market. The largest markets are Germany, the UK, France, and Italy, which also rank among the top 10 furniture markets worldwide.

A significant proportion of the current demand in Europe is fulfilled by EU production, making up 80% of the total furniture consumption, while the remaining portion is sourced through imports from other countries.

After two years (2021 and 2022) of exceptional market growth, European furniture demand in 2023 contracted. CSIL estimates that furniture demand is forecasted to experience a slight decrease in real terms in 2024 and progressively slightly improve in the medium term (demand should return to more physiological growth in 2025).

The European furniture industry is predominantly comprised of Small and Medium-sized Enterprises (SMEs), supporting a substantial workforce, with over 1 million employees distributed over 135,000 manufacturing companies.

While remaining an SME-based industry, both industry and retail are progressively concentrating.

EU furniture manufacturers play a pivotal role in setting global trends, particularly in the high-end furniture market. In this segment, the EU stands out as a world leader, with nearly two-thirds of high-end furniture products sold globally originating from within the EU.

Abstract of Table of Contents

EXECUTIVE SUMMARY

Challenges affecting the furniture industry

- – The future perspectives for the European furniture sector

- – Green and digital transitions: a hot topic for the European furniture industry

THE EUROPEAN FURNITURE SECTOR

The role of Europe in the global furniture context

- – Europe and the rest of the world. Furniture production, consumption, exports, imports

The integration process within Europe - – International furniture trade, furniture exports by destination and origin of furniture imports

The future perspectives for the EU furniture sector - – The global macroeconomic context and furniture market forecasts in Europe

The European furniture production performance - – Description of the main furniture manufacturing countries (Italy, Germany, Poland, The United Kingdom, France)

Factors affecting the competitiveness of EU furniture producers

The furniture competitive system in Europe

- – Recent European furniture manufacturers’ strategies, M&A

- – The TOP 50 European manufacturers. Ranking by total turnover

European furniture market performance

Market sources

- National production, EU market integration and import flows

Trade balance

The growing degree of market openness

- – The export orientation

European furniture production by segment

Trends in furniture sub-segments

- – Hybrid solutions and flat-pack furniture

COUNTRY ANALYSIS | Market outline and macroeconomic trends, Production, consumption, imports, and exports of furniture, Country rankings, Furniture market forecasts, Trading partners, Furniture consumption and production by segment, Manufacturing system and Short profiles of leading furniture manufacturers for:

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom

SHORT PROFILES OF OVER 2000 EUROPEAN FURNITURE COMPANIES:

- activity

- product portfolio

- turnover range

- employees range

- email address

- website

METHODOLOGICAL NOTES

SEE ALSO

The furniture industry in India

April 2024, IX Ed. , 81 pages

Comprehensive analysis of the furniture sector in India, delving into the country’s productive system, the furniture demand and trade (time series 2013-2023), the furniture market development (forecasts up to 2025) with CSIL’s assessment of market potential and competitive landscape covering the leading Indian manufacturers of furniture, their performance and profiles.

United Kingdom Furniture Outlook

January 2024, XXVIII Ed. , 23 pages

Analysis of the furniture market in the United Kingdom, with value and trends of furniture production and consumption, furniture imports, and exports. Top furniture companies in the UK. Demand determinants, market potential and future prospect for the Furniture market.

Germany Furniture Outlook

January 2024, XXVIII Ed. , 23 pages

This market research analyses the furniture market in Germany providing value and trends of furniture production and consumption, furniture imports and exports. Top furniture companies in Germany with short profiles. Demand determinants, market potential and future prospect for the Furniture market.

Poland Furniture Outlook

January 2024, XXII Ed. , 25 pages

Market research analyses the furniture industry in Poland: furniture market size and forecasts, trends in furniture production, consumption, imports and exports, list of top furniture companies. Demand determinants, market potential and future prospect for the Polish furniture market.

France Furniture Outlook

January 2024, XXVIII Ed. , 20 pages

This market research analyses the furniture market in France providing value and trends of furniture production and consumption, furniture imports and exports. Top furniture companies. Demand determinants, market potential and future prospect for the Furniture market.