Insights from the world mattress industry in 2023

According to CSIL, the world mattress market is valued at US$ 30 billion and has experienced stable growth over the past decade.

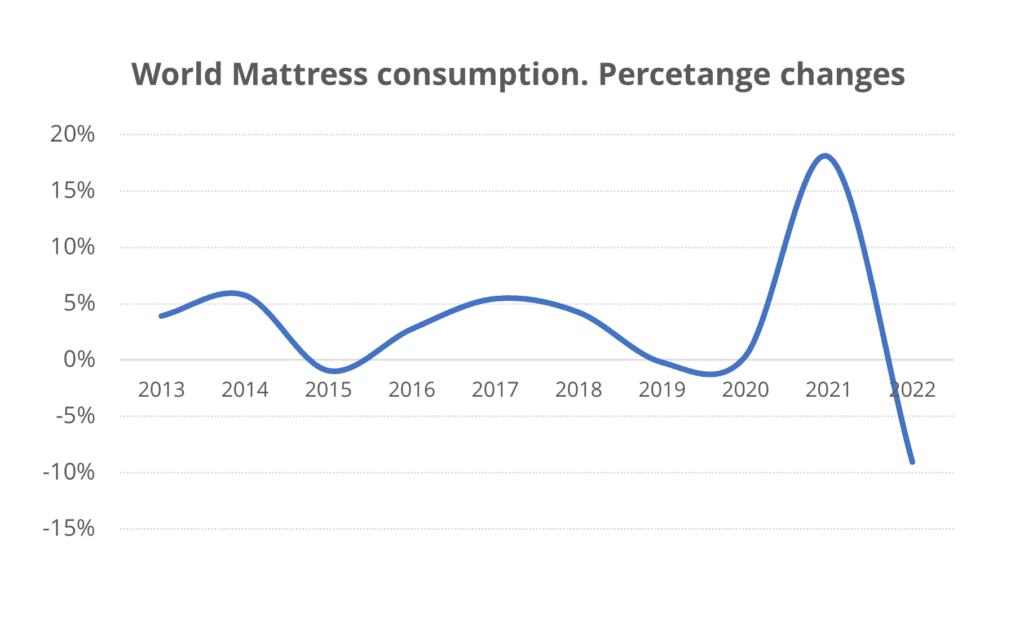

In the short term, however, the market can be described as a two-tier system, characterized by a gap between demand and supply in 2021, followed by retailers’ overstock of mattresses due to decreasing demand at the end of 2022 and early 2023.

During the pandemic, the mattress sector experienced remarkable growth within the furniture industry. With consumers forced to stay at home, there was a significant surge in demand for home renovations, leading to an early replacement of beds and mattresses. This trend resulted in substantial double-digit growth in the global market, prompting retailers to increase their inventories to meet the escalating demand.

However, the industry also faced challenges related to disruptions in the supply chains, primarily due to the limited availability of raw materials and components for production (e.g., PU foam). This scarcity hindered manufacturers from meeting the sudden surge in mattress consumption, leading to a noticeable gap between demand and supply. As a result, delays in product deliveries occurred, and this scarcity-driven dynamic in the market triggered notable price increases.

In 2021, supply chain issues began to resolve, and world mattress production increased consistently, resulting in retailers receiving fully ordered products and warehouses quickly becoming overloaded.

When pandemic restrictions eased in 2022, consumer spending started to shift away from home-related products. Additionally, high inflationary pressures have further undermined consumers’ purchasing power, and consequently demand for mattresses contracted, particularly during the second half of the year. As a result, retailers, having enough products (and at higher prices than those on the market) still crammed in their warehouses, reduced orders to manufacturers even below the pre-pandemic levels. Consequently, according to CSIL, the world mattress industry contracted in 2022 over 2021. Source: CSIL. The world mattress industry (July, 2023).

Source: CSIL. The world mattress industry (July, 2023).

Looking ahead to 2023, there are plausible downside risks stemming from consequences of financial sector turmoil and continuing inflation.

CSIL estimates a contraction of the world mattress market in real terms, which is expected to rebound in 2024. This rebound will be driven by positive trends indicating potential growth in the coming years, such as increasing consumer awareness of the health benefits of better sleep, surging demand for roll-packed/compressed mattresses in both online and traditional sales channels and the resume of the contract segment.

CSIL’s comprehensive analysis of the world mattress industry is available in “The World Mattress Industry” Report (July 2023).

Major topics covered by the analysis:

- Trends of mattress production, consumption, import and export at world, regional and country levels (50 countries). This information can provide valuable insights into the overall and comparative performance and dynamics of the mattress market worldwide.

- Mattress supply in terms of filling materials for most important producing countries

- Competitive system analysis of the leading 20 producing countries. Within each country, the report identifies the top mattress manufacturers based on mattress turnover, which can offer a comprehensive overview of the key players in the market.

- Most promising mattress markets indicating potential growth opportunities in specific regions or countries, providing consumption forecasts for 2023 and 2024.