February 2017,

II Ed. ,

87 pages

Price (single user license):

EUR 1280 / USD 1382.4

For multiple/corporate license prices please contact us

Language: English

Report code: EU.26

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

This Report aims to provide figures and trends for the European market for lighting controls, analysing the sector performance, the competitive system, market drivers and major market players.

The study has been produced on the basis of around 20 direct interviews and overall documentation relating to the lighting industry available both online and offline + CSIL’s database of roughly 1,000 worldwide manufacturers operating in the lighting industry.

Product segmentation included: residential, commercial, industrial and outdoor lighting controls applications. Subcategories of the mentioned segments have also been investigated (offices, hotels, private homes, shops, industrial plants, hospitals, urban landscape and streets…).

The following technologies have been investigated: user interfaces (including sliders, dimmers, touch panels, remote controls, timers and standard control panels), sensors (including presence, occupancy, movement and light sensors) and control modules (including relay panels, group controllers, scene controllers and DMX controllers).

Fixture mounted (including all devices mounted on the fixtures or luminaries), wall mounted (including ceiling mounted) and integrated building automation system (BAS) are some of the product sectors examined in this research.

Further analysis on protocols used (DALI, DMX, etc.) is also included.

Geographical coverage: in-deep analysis for 16 West European countries (around 85% of the market value), overview on Central-East Europe, Russia, Middle East and North Africa (15%).

Lighting control systems are used for working places, aesthetic, and security illumination for interior, exterior and landscape lighting, and theatre stage lighting productions.

They are often part of sustainable architecture and lighting design for integrated green building energy conservation programs.

A major advantage of a lighting control system over conventional individual switching is the ability to control any light, group of lights, or all lights in a building from a single user interface device. Any light or device can be controlled from any location.

This ability to control multiple light sources from a user device allows complex “light scenes” to be created. A room may have multiple scenes available, each one created for different activities in the room. A lighting scene can create dramatic changes in atmosphere, for a residence or the stage, by a simple button press.

In landscape design, in addition to landscape lighting, fountain pumps, water spa heating, swimming pool covers, motorized gates, and outdoor fireplace ignition; it can be remotely or automatically controlled.

Other benefits include reduced energy consumption and power costs through more efficient usage, longer bulb life from dimming, and reduced carbon emission.

Newer, wireless lighting control systems provide additional benefits including reduced installation costs and increased flexibility in where switches and sensors can be placed

Selected companies

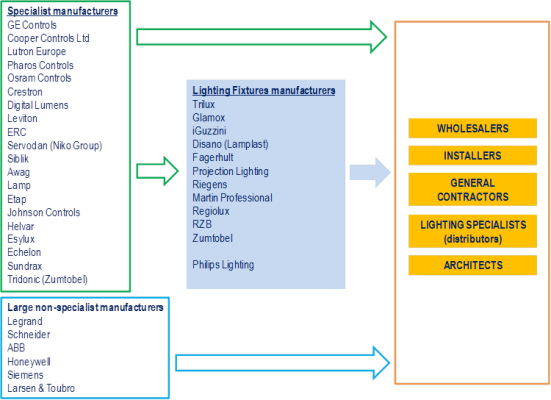

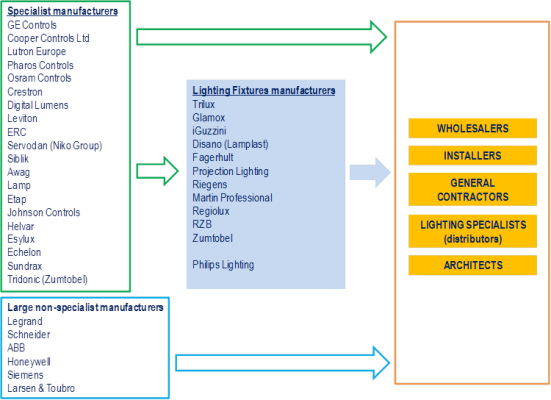

Lighting control solutions companies can be divided in:

• Specialist lighting controls manufacturers (Lutron, Tridonic, Pharos, Servodan, Helvar)

• Large-non specialists manufacturers (Schneider Electric, Legrand, ABB, Siemens)

• Lighting fixtures manufacturers (Philips, Fagerhult, Projection Lighting, Trilux)

• Start ups (Gooee, Casambi).

Some of the mentioned companies: ABB, Aurora Lighting, Echelon, Fagerhult, Harvard Technology, Helvar, Legrand, Leviton, Lucibel, Lutron, Mackwell, Mean Well, Nicolaudie, Osram, Pharos, Philips, RZB, Servodan, Tridonic, Xicato.

Lighting controls market in Europe. Relevant players by kind.

The European market for lighting controls, according to CSIL estimates, registered an average 10%-12% yearly growth from 2012 (referring to the first edition of this Report) to 2016.

Fifty players hold over 80% of this market.

The market is very concentrated in the commercial applications, which together with the industrial segment account for the 70% of the market.

The residential and outdoor segments are almost equally divided in the remaining 30%.

Lighting controls installed in office buildings represent the largest part (24%), followed by warehouses/industrial plants, Hospitality and Outdoor.

Lighting controls weight around 3% on the lighting fixtures market in Europe.

German speaking countries absorbs the largest part, followed by the United Kingdom and Ireland, where several European headquarters of North American manufacturers are located..

TERMINOLOGY

Field of interest ; Lighting controls systems ; Internet of Things (IoT) ; IoT and Lighting ; Power over Ethernet ; Bluetooth and Beacons ; Li-Fi Technology

BASIC DATA

Lighting controls market in Europe. Relevant players by kind

ACTIVITY TREND

From lighting controls to light-based IoT

Total number of connections to the Internet, 1996-2020

Market drivers: energy saving

SUPPLY STRUCTURE

Kind of protocols

Wireless Controls

Basic and Intelligent solutions

Frameworks and connectivity

LED modules

LED drivers

MARKET BREAWDOWN: END USER SECTORS

Overview

Europe. Sales of lighting controls by segment

Europe. Sales of lighting controls. Total. Top 50 players. Million Euro and % market shares

Residential solutions: Sales of lighting controls. Top 20 players

Office solutions: Sales of lighting controls. Top 20 players

Retail solutions: Sales of lighting controls. Top 20 players

Hospitality solutions: Sales of lighting controls. Top 20 players

Healthcare solutions: Sales of lighting controls.. Top 20 players

Industrial solutions: Sales of lighting controls. Top 20 players

Outdoor solutions: Sales of lighting controls. Top 20 players ; Smart management of urban and street lighting ; Multilevel use of lighting poles

MARKET BREAKDOWN: MAIN COUNTRIES

Overview

Europe. Sales of lighting controls by country/region

Nordic countries: Sales of lighting controls. Top 20 players

Germany, Austria and Switzerland: Sales of lighting controls. Top 30 players

United Kingdom, Ireland and Netherlands: Sales of lighting controls. Top 30 players

France and Belgium: Sales of lighting controls. Top 20 players

Italy, Spain, Portugal and Greece: Sales of lighting controls. Top 20 players.

East Europe, Russia and MENA countries: Sales of lighting controls. Top 20 players

APPENDIX: LIST OF MENTIONED COMPANIES

This Report aims to provide figures and trends for the European market for lighting controls, analysing the sector performance, the competitive system, market drivers and major market players.

The study has been produced on the basis of around 20 direct interviews and overall documentation relating to the lighting industry available both online and offline + CSIL’s database of roughly 1,000 worldwide manufacturers operating in the lighting industry.

Product segmentation included: residential, commercial, industrial and outdoor lighting controls applications. Subcategories of the mentioned segments have also been investigated (offices, hotels, private homes, shops, industrial plants, hospitals, urban landscape and streets…).

The following technologies have been investigated: user interfaces (including sliders, dimmers, touch panels, remote controls, timers and standard control panels), sensors (including presence, occupancy, movement and light sensors) and control modules (including relay panels, group controllers, scene controllers and DMX controllers).

Fixture mounted (including all devices mounted on the fixtures or luminaries), wall mounted (including ceiling mounted) and integrated building automation system (BAS) are some of the product sectors examined in this research.

Further analysis on protocols used (DALI, DMX, etc.) is also included.

Geographical coverage: in-deep analysis for 16 West European countries (around 85% of the market value), overview on Central-East Europe, Russia, Middle East and North Africa (15%).

Lighting control systems are used for working places, aesthetic, and security illumination for interior, exterior and landscape lighting, and theatre stage lighting productions.

They are often part of sustainable architecture and lighting design for integrated green building energy conservation programs.

A major advantage of a lighting control system over conventional individual switching is the ability to control any light, group of lights, or all lights in a building from a single user interface device. Any light or device can be controlled from any location.

This ability to control multiple light sources from a user device allows complex “light scenes” to be created. A room may have multiple scenes available, each one created for different activities in the room. A lighting scene can create dramatic changes in atmosphere, for a residence or the stage, by a simple button press.

In landscape design, in addition to landscape lighting, fountain pumps, water spa heating, swimming pool covers, motorized gates, and outdoor fireplace ignition; it can be remotely or automatically controlled.

Other benefits include reduced energy consumption and power costs through more efficient usage, longer bulb life from dimming, and reduced carbon emission.

Newer, wireless lighting control systems provide additional benefits including reduced installation costs and increased flexibility in where switches and sensors can be placed

Lighting controls market in Europe. Relevant players by kind.

The European market for lighting controls, according to CSIL estimates, registered an average 10%-12% yearly growth from 2012 (referring to the first edition of this Report) to 2016.

Fifty players hold over 80% of this market.

The market is very concentrated in the commercial applications, which together with the industrial segment account for the 70% of the market.

The residential and outdoor segments are almost equally divided in the remaining 30%.

Lighting controls installed in office buildings represent the largest part (24%), followed by warehouses/industrial plants, Hospitality and Outdoor.

Lighting controls weight around 3% on the lighting fixtures market in Europe.

German speaking countries absorbs the largest part, followed by the United Kingdom and Ireland, where several European headquarters of North American manufacturers are located..

TERMINOLOGY

Field of interest ; Lighting controls systems ; Internet of Things (IoT) ; IoT and Lighting ; Power over Ethernet ; Bluetooth and Beacons ; Li-Fi Technology

BASIC DATA

Lighting controls market in Europe. Relevant players by kind

ACTIVITY TREND

From lighting controls to light-based IoT

Total number of connections to the Internet, 1996-2020

Market drivers: energy saving

SUPPLY STRUCTURE

Kind of protocols

Wireless Controls

Basic and Intelligent solutions

Frameworks and connectivity

LED modules

LED drivers

MARKET BREAWDOWN: END USER SECTORS

Overview

Europe. Sales of lighting controls by segment

Europe. Sales of lighting controls. Total. Top 50 players. Million Euro and % market shares

Residential solutions: Sales of lighting controls. Top 20 players

Office solutions: Sales of lighting controls. Top 20 players

Retail solutions: Sales of lighting controls. Top 20 players

Hospitality solutions: Sales of lighting controls. Top 20 players

Healthcare solutions: Sales of lighting controls.. Top 20 players

Industrial solutions: Sales of lighting controls. Top 20 players

Outdoor solutions: Sales of lighting controls. Top 20 players ; Smart management of urban and street lighting ; Multilevel use of lighting poles

MARKET BREAKDOWN: MAIN COUNTRIES

Overview

Europe. Sales of lighting controls by country/region

Nordic countries: Sales of lighting controls. Top 20 players

Germany, Austria and Switzerland: Sales of lighting controls. Top 30 players

United Kingdom, Ireland and Netherlands: Sales of lighting controls. Top 30 players

France and Belgium: Sales of lighting controls. Top 20 players

Italy, Spain, Portugal and Greece: Sales of lighting controls. Top 20 players.

East Europe, Russia and MENA countries: Sales of lighting controls. Top 20 players

APPENDIX: LIST OF MENTIONED COMPANIES

SEE ALSO

The worldwide market for connected lighting

February 2024, I Ed. , 88 pages

This report analyses the global lighting market focusing on LED and connected lighting trends. It provides market forecasts emphasizing the impact of green transition and digital transformation. The study also includes a section on industry competition, estimating sales, and market shares for leading manufacturers.

Lighting: World Market Outlook

November 2023, XXVI Ed. , 123 pages

The world market for lighting fixtures reached a value of USD 97 billion in 2023. After some fluctuating performance in the post-pandemic period, it is expected to remain stable in 2024, followed by moderate growth in 2025 and 2026. The major consuming countries are the US, China, Japan, India and Germany. The twenty-six edition of CSIL research “Lighting: World market outlook” analyzes, through tables and graphs, data on lighting fixtures production, consumption and international trade at worldwide level as a whole and for 70 considered countries, for the years 2013-2022 and 2023 preliminary. lighting fixtures market forecasts for the next three years (2024-2026) are also provided

The lighting fixtures market in China

September 2023, XVI Ed. , 205 pages

The 16th edition of The Lighting Fixtures market in China offers an accurate and in-deep analysis of the lighting fixtures industry in China, providing data and trends for the period 2017-2022 and forecasts up to 2025. From one hand, the report analyses the main trends affecting the market over the last five years, considering the production, consumption, imports and exports of lighting fixtures in the country. On the other hand, it offers an analysis of the supply structure and the competitive system, an overview on smart connected lighting trend, the distribution system and the main players operating in the market

The lighting fixtures market in the United States

June 2023, XVII Ed. , 256 pages

The total US lighting market is estimated to be worth around USD 26 billion in 2022. This value includes lighting fixtures and lamps. The US lighting market during 2022 registers a 6.5% growth in nominal terms as for lighting fixtures (consumer, professional, outdoor), up to 23.2 billion USD. The lamps market registers a decrease (about -2.9%). The residential segment has grown well above the market average (+5.9% on average over the last five years). In 2022, the weight of Office and Entertainment on the overall commercial lighting market has declined, while Hospitality and Public premises grew. In 2022, the value of completed construction grew by more than 10 percent to nearly USD 1.8 billion

The European market for lighting fixtures

May 2023, XXXII Ed. , 392 pages

In 2022, consumption of lighting fixtures in the EU30 countries registered a 8.3% increase, reaching a value of EUR 19.9 billion. Better results for commercial lighting (versus residential, industrial and outdoor), big players (with a 12% Ebitda), design oriented, area lighting, hospitality, contract (versus retail), linear lighting, emergency. More IP patents and acquisitions. Top 10 players hold a 30% market share.