May 2021,

I Ed. ,

31 pages

Price (single user license):

EUR 2000 / USD 2160

For multiple/corporate license prices please contact us

Language: English

Report code: EU06BE

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The Report provides data on production, consumption and international trade of lighting fixtures for the years 2010-2020, together with the main macroeconomic indicators needed to analyze the performance of the sector, and forecasts for the next four years.

Lighting fixtures exports and imports are given by country and by geographical area of destination/origin.

Market structure offers an analysis of the lighting fixtures market by segment (Residential-consumer, architectural-commercial, industrial, outdoor lighting), and by types of products and applications.

Overview of the main distribution channels active on the Belgian lighting fixtures market, for both Residential-consumer and Professional segments: direct sales and contract, specialist lighting stores, furniture/lifestyle stores and chains, wholesalers, DIY and Hyper stores, e-commerce.

Competitive system offers an insight into the leading local and International companies present on the Belgian lighting fixtures market. Market shares and short profiles are also included.

This Report is the result of:

- information collected from approximately 200 European companies active in the lighting business. The information was gathered either through active participation (direct replies to an interview or completion of a questionnaire) or through company balance sheets, figures and estimations;

- analysis of CSIL databases for lighting fixtures in Europe and worldwide;

- web scraping (localization of lighting retailers and other relevant trade outlets);

- general documentation related to the lighting industry;

- official figures for foreign trade provided by Eurostat.

Selected companies

3F Filippi, Alcon, Aleco, Alelek Groep, Artemide, Bega, Briloner Leuchten, Dark At Night, Delta Light, Disano Illuminazione, DM Lights, Dräger, Eglo, Eltra, Erco, Etap, Fagerhult, Flos, Glamox, Hortilux, Hubo, Ikea, Inotec, Kreon, LEDS-C4, Ledvance, Leedarson Lighting, Light & Living – Lightmakers, Linea Verdace, Louis Poulsen, Multiline, Nordeon, Occhio, Orbit, Performance in Lighting, Schréder, Signify, SLV, Trilux, Vlux, V-Tac, XAL, Yankon, Zumtobel

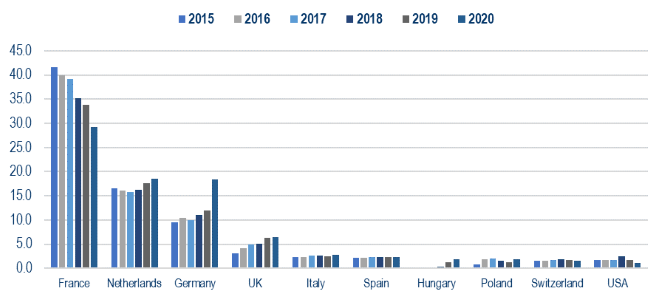

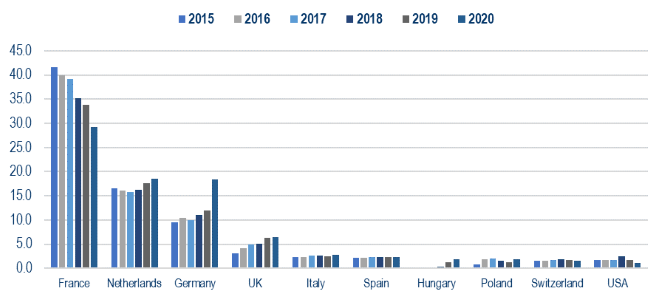

Top ten destination countries for Belgian exports of lighting fixtures, 2015-2020. Percentage share in value

Lighting fixtures sales in Belgium (including Luxembourg) have moderately increased during the last decennium, from around 432 million Eur in 2010 to 477 million Eur in 2020 (with a peak of over 500 million Eur in 2019.

Production side, Belgium today produces around 40% less in comparison with 2010, respectively around 250 million Eur of lighting fixtures in 2020 and 410 million Eur in 2010.

Today, Belgium (with Luxembourg) is a net importer of lighting fixtures for around 230 million Eur.

GDP is expected to contract by 6.2% in 2020. After a steep decline in the first two quarters and a stronger-than-expected rebound in the 3Q, renewed restrictions linked to a second wave of infections brought the recovery to a halt in the 4Q. The current level of restrictions is set to remain in place in early 2021

All in all, annual GDP growth is forecast to reach 3.9% in 2021 and 3.1% in 2022. GDP is set to return to its pre-crisis level by 2022.

ACTIVITY TREND AND FORECAST

Trend 2010-2020 and forecasts 2021-2024: Production, consumption, international trade of lighting fixtures and comparison with selected country indicators. Focus: the impact of COVID-19, pandemic variables tracked.

INTERNATIONAL TRADE

Top ten destination countries for Belgian exports of lighting fixtures and top ten origin countries for Belgian imports, 2015-2020. Exports and Imports of lighting fixtures by geographical area of destination/origin.

MARKET STRUCTURE

Lighting fixtures market in Belgium by segment (Residential-consumer, architectural-commercial, industrial, outdoor lighting), and by types of products and applications.

Belgium. Installed stock of LED luminaires (% share) by destination segment, 2010-2019.

DISTRIBUTION CHANNELS

Overview of the main distribution channels active on the Belgian lighting fixtures market: direct sales and contract, specialist lighting stores, furniture/lifestyle stores and chains, wholesalers, DIY and Hyper stores, e-commerce. Selection of the main stores that sell lighting fixtures around Belgium. Estimated breakdown of lighting fixtures sales in Belgium by distribution channel in a sample of companies.

COMPETITIVE SYSTEM

Lighting fixtures sales data and market shares for a sample of 50 among the leading companies and short profiles: Total lighting fixtures market; Residential/consumer lighting fixtures market; Architectural/Commercial lighting fixtures market; Industrial, Healthcare and Emergency lighting fixtures market; Outdoor lighting fixtures market.

The Report provides data on production, consumption and international trade of lighting fixtures for the years 2010-2020, together with the main macroeconomic indicators needed to analyze the performance of the sector, and forecasts for the next four years.

Lighting fixtures exports and imports are given by country and by geographical area of destination/origin.

Market structure offers an analysis of the lighting fixtures market by segment (Residential-consumer, architectural-commercial, industrial, outdoor lighting), and by types of products and applications.

Overview of the main distribution channels active on the Belgian lighting fixtures market, for both Residential-consumer and Professional segments: direct sales and contract, specialist lighting stores, furniture/lifestyle stores and chains, wholesalers, DIY and Hyper stores, e-commerce.

Competitive system offers an insight into the leading local and International companies present on the Belgian lighting fixtures market. Market shares and short profiles are also included.

This Report is the result of:

- information collected from approximately 200 European companies active in the lighting business. The information was gathered either through active participation (direct replies to an interview or completion of a questionnaire) or through company balance sheets, figures and estimations;

- analysis of CSIL databases for lighting fixtures in Europe and worldwide;

- web scraping (localization of lighting retailers and other relevant trade outlets);

- general documentation related to the lighting industry;

- official figures for foreign trade provided by Eurostat.

Top ten destination countries for Belgian exports of lighting fixtures, 2015-2020. Percentage share in value

Lighting fixtures sales in Belgium (including Luxembourg) have moderately increased during the last decennium, from around 432 million Eur in 2010 to 477 million Eur in 2020 (with a peak of over 500 million Eur in 2019.

Production side, Belgium today produces around 40% less in comparison with 2010, respectively around 250 million Eur of lighting fixtures in 2020 and 410 million Eur in 2010.

Today, Belgium (with Luxembourg) is a net importer of lighting fixtures for around 230 million Eur.

GDP is expected to contract by 6.2% in 2020. After a steep decline in the first two quarters and a stronger-than-expected rebound in the 3Q, renewed restrictions linked to a second wave of infections brought the recovery to a halt in the 4Q. The current level of restrictions is set to remain in place in early 2021

All in all, annual GDP growth is forecast to reach 3.9% in 2021 and 3.1% in 2022. GDP is set to return to its pre-crisis level by 2022.

ACTIVITY TREND AND FORECAST

Trend 2010-2020 and forecasts 2021-2024: Production, consumption, international trade of lighting fixtures and comparison with selected country indicators. Focus: the impact of COVID-19, pandemic variables tracked.

INTERNATIONAL TRADE

Top ten destination countries for Belgian exports of lighting fixtures and top ten origin countries for Belgian imports, 2015-2020. Exports and Imports of lighting fixtures by geographical area of destination/origin.

MARKET STRUCTURE

Lighting fixtures market in Belgium by segment (Residential-consumer, architectural-commercial, industrial, outdoor lighting), and by types of products and applications.

Belgium. Installed stock of LED luminaires (% share) by destination segment, 2010-2019.

DISTRIBUTION CHANNELS

Overview of the main distribution channels active on the Belgian lighting fixtures market: direct sales and contract, specialist lighting stores, furniture/lifestyle stores and chains, wholesalers, DIY and Hyper stores, e-commerce. Selection of the main stores that sell lighting fixtures around Belgium. Estimated breakdown of lighting fixtures sales in Belgium by distribution channel in a sample of companies.

COMPETITIVE SYSTEM

Lighting fixtures sales data and market shares for a sample of 50 among the leading companies and short profiles: Total lighting fixtures market; Residential/consumer lighting fixtures market; Architectural/Commercial lighting fixtures market; Industrial, Healthcare and Emergency lighting fixtures market; Outdoor lighting fixtures market.

SEE ALSO

The worldwide market for connected lighting

February 2024, I Ed. , 88 pages

This report analyses the global lighting market focusing on LED and connected lighting trends. It provides market forecasts emphasizing the impact of green transition and digital transformation. The study also includes a section on industry competition, estimating sales, and market shares for leading manufacturers.

Lighting: World Market Outlook

November 2023, XXVI Ed. , 123 pages

The world market for lighting fixtures reached a value of USD 97 billion in 2023. After some fluctuating performance in the post-pandemic period, it is expected to remain stable in 2024, followed by moderate growth in 2025 and 2026. The major consuming countries are the US, China, Japan, India and Germany. The twenty-six edition of CSIL research “Lighting: World market outlook” analyzes, through tables and graphs, data on lighting fixtures production, consumption and international trade at worldwide level as a whole and for 70 considered countries, for the years 2013-2022 and 2023 preliminary. lighting fixtures market forecasts for the next three years (2024-2026) are also provided

The lighting fixtures market in China

September 2023, XVI Ed. , 205 pages

The 16th edition of The Lighting Fixtures market in China offers an accurate and in-deep analysis of the lighting fixtures industry in China, providing data and trends for the period 2017-2022 and forecasts up to 2025. From one hand, the report analyses the main trends affecting the market over the last five years, considering the production, consumption, imports and exports of lighting fixtures in the country. On the other hand, it offers an analysis of the supply structure and the competitive system, an overview on smart connected lighting trend, the distribution system and the main players operating in the market

The lighting fixtures market in the United States

June 2023, XVII Ed. , 256 pages

The total US lighting market is estimated to be worth around USD 26 billion in 2022. This value includes lighting fixtures and lamps. The US lighting market during 2022 registers a 6.5% growth in nominal terms as for lighting fixtures (consumer, professional, outdoor), up to 23.2 billion USD. The lamps market registers a decrease (about -2.9%). The residential segment has grown well above the market average (+5.9% on average over the last five years). In 2022, the weight of Office and Entertainment on the overall commercial lighting market has declined, while Hospitality and Public premises grew. In 2022, the value of completed construction grew by more than 10 percent to nearly USD 1.8 billion

The European market for lighting fixtures

May 2023, XXXII Ed. , 392 pages

In 2022, consumption of lighting fixtures in the EU30 countries registered a 8.3% increase, reaching a value of EUR 19.9 billion. Better results for commercial lighting (versus residential, industrial and outdoor), big players (with a 12% Ebitda), design oriented, area lighting, hospitality, contract (versus retail), linear lighting, emergency. More IP patents and acquisitions. Top 10 players hold a 30% market share.