January 2016,

III Ed. ,

93 pages

Price (single user license):

EUR 1600 / USD 1728

For multiple/corporate license prices please contact us

Language: English

Report code: S.45

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The Report offers an overview of the lighting fixtures industry in Turkey, providing trends in lighting fixtures production and consumption, imports and exports, distribution and prices for residential, commercial, industrial and outdoor lighting.

A breakdown of lighting fixtures exports and imports is provided by country and by geographical area of destination/origin.

Data on consumer/residential lighting are broken down by style (classic, modern, design) and positioning of the lamp (floor, table, wall/ceiling, chandeliers/suspensions), while data on architectural/commercial lighting are broken down by product (downlights, fluorescence/track systems, low voltage spotlights and professional projectors, wall ceiling panels, high bays, decorative lighting for commercial use) and application (hospitality, office, retail/luxury shops, museums, schools and public infrastructures). Industrial lighting consists of lighting for industrial sites, emergency, hospital, explosion/weather proof and marine lighting. Outdoor lighting includes residential outdoor lighting, lighting for urban landscape, major roads, tunnels, sport plants and other large areas, Christmas/event lighting.

Lighting fixtures sales are broken down by light sources: incandescence, fluorescence, gas discharge, LED.

The analysis of lighting fixtures distribution in Turkey covers the following distribution channels: project dealers, lighting specialist stores, DIY and furniture chains, wholesalers and electrical stores, e-commerce.

Reference retail prices of lighting fixtures in Turkey are given in the two different segments (residential, technical) by category, application, light source, style and manufacturer/distributor.

An overview of the leading developers, architects, lighting designers and project dealers in Turkey is provided, as well as some information on the main magazines, associations and trade fairs.

Sales data and market shares are given for the major lighting companies present on the Turkish market for each segment (residential, commercial, industrial, outdoor lighting), as well as data on lighting fixtures exports for a sample of around 50 leading Turkish exporters. Short company profiles for the main players are also included.

Macroeconomic indicators with information on Turkish economy, population, real growth of GDP and data on construction activity are also provided.

A list of around 120 addresses of lighting fixtures companies present on the Turkish market is also available.

Selected companies

ACK Ultralight, AFC Lighting, Alkan Kardesler, Arlight, Assan Elektronik, Avolux – Murat, Avonni Üstün Avize, Aygün Alüminyum, Bahar, Bas – Total Lighting, Burc, Buse, Cemdag, CHRA Lighting, Çözüm LED, Damla Elektrik, DMB Elektronik – ProNeo, EAE Aydinlatma, EEC Electronics, Eglo, Elit Elektronik, Fersa, FSL Lighting, Gecem, Gestas, Glopsan – Veraluce, Goya Lighting, Gül Elektrik – Jupiter, Heper Moonlight, Ikizler, Lamp 83, Led & Light, Lider, Litpa, LSP Aydınlatma, Metsan, NVC Lighting, Osram, Ozcan, Özlem – Polight, Pamir Elektrik, Pedas Elektrik, Pelsan, Philips Lighting, Prolux, PSL Elektronik – Fiberli, Schréder, Sevinc, Sezay, Stilas, TLT Panel, Toros, Trilux, Ugur – Greengo, Veksan, Vestel, Vito – Raina, Zumtobel

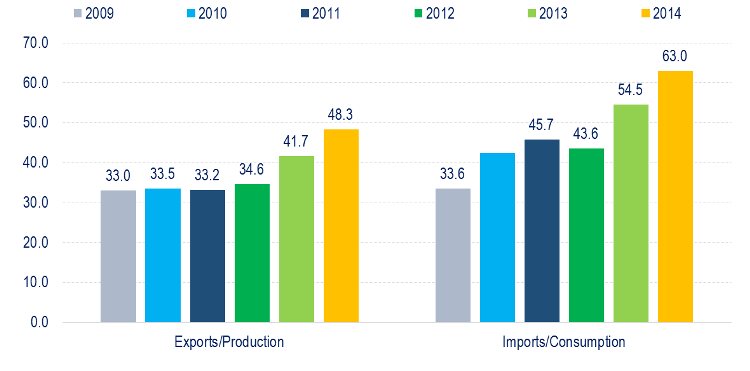

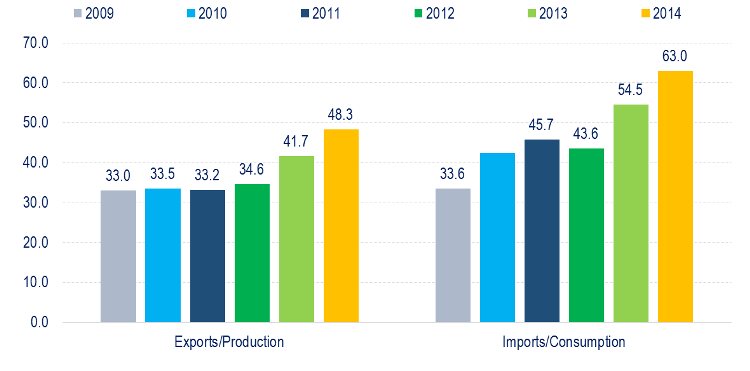

Turkey. Lighting fixtures. The openness of the market, 2009-2014.Percentage share

Lighting fixtures production in Turkey can be estimated worth EUR 490 million in 2014, decreasing by 8% compared to 2013 and by 3% on average over the period 2009/2014. However, due to the exchange rate effect the performance in local currency unit (LCU) was positive: +5.5% in 2014 and +9% on average since 2009. Market openness increased enormously over the last years. Pushed by favorable exchange rate, exports (EUR 237 million) accounted for 48% of local output (35% in 2012) and increased by 6.4% in 2014 (+22% in LCU). Imports reached EUR 431 million in the year showing double digit growth in EUR (+33% in LCU). On the consumption side, Turkish market continues to expand and absorbed EUR 684 million for the year 2014, recording an average yearly growth by 10% during the last five years (+17% in LCU). LED based products are expected to continue its expansion over the next years. According to CSIL forecasts the incidence of LED will reach 38% of the market by the end of 2018.

Research field and methodology

Working tools ; Terminology

1. Market size and segmentation

Basic data and activity trend

– Lighting fixtures production, international trade and consumption, 2009-2014. EUR and TYR million

– Lighting fixtures production, largest manufacturers worldwide

– Lighting fixtures. The openness of the market, 2009-2014

Forecasts up to 2018

– Lighting fixtures consumption, 2009-2015. Annual % change in USD and in local currency (TYR)

– Consumption of total and LED based lighting fixtures and real growth of GDP, 2014-2018. USD and TYR million and annual % change

Segments: Residential, Commercial, Industrial and Outdoor lighting

– Lighting fixtures production, international trade and consumption by segment, 2009-2014

Leading producers

– Lighting fixtures. Turnover and number of employees in a sample of companies

2. International trade

Exports and Imports

– Exports and imports of lighting fixtures by country and by geographical area, 2009-2014

– Exports and imports of lighting fixtures and components

– Exports and imports of lamps

3. Supply structure

Kind of lighting companies

– Classification of lighting company and their characteristics

Productivity and employment

– Lighting fixtures. Number of employees and average turnover per employee in a sample of companies

Product breakdown

– Residential lighting: Sales breakdown by style and by positioning of the lamp. 2008, 2012, 2014. % share

– Commercial lighting. Sales breakdown by product and by destination in a sample of companies

– Industrial lighting. Sales breakdown by product in a sample of companies

– Outdoor lighting. Sales breakdown by product in a sample of companies

LED and other light sources

– Lighting fixtures. Sales breakdown by light source, 2008, 2012, 2014. % share

– LED based lighting fixtures sales, 2011-2014 estimated data and 2015-2018 forecasts. EUR and TYR million

– Lighting fixtures. Sales breakdown by light source in a sample of companies

– Turkish government’s policy and action for adopting LED lighting

4. Distribution

Distribution channels

– Lighting fixtures. Distribution channels, by residential and technical application

– Lighting fixtures. Sales breakdown by distribution channels in a sample of companies

Reference prices

– Residential and Technical Lighting. Reference retail prices in a sample of stores

Developers, Architects and lighting designers

– Leading developers, Architects, Lighting Designers/Consultants, Project Dealers in Turkey

5. Magazines, associations and trade fairs

6. The competitive system

Top players

– Lighting fixtures turnover and market shares for a sample of 50 leading Turkish manufacturers

– Lighting fixtures turnover breakdown by segment for a sample of 50 leading 50 Turkish manufacturers

Residential, Commercial, Industrial, Outdoor lighting

– Lighting fixtures turnover and market shares of the top Turkish manufacturers by segment

Exporters

– Lighting fixtures exports for a sample of 45 leading Turkish exporters. Total and breakdown by geographical area

Lighting fixtures Sales in the domestic market: total, residential, commercial, industrial and outdoor lighting

– Lighting fixtures sales in Turkey and market shares for a sample of 50 leading companies. Total and by segment

7. Demand drivers

The economy

– Real growth of GDP, 2012-2019

– Economic indicators

– Population growth rate (%), 1993-2023

– Number of enterprises by region

Construction activity

– Total construction permits. Number of Buildings and floor area in square metres 2006-2014

– Total construction permits. Breakdown by kind of building

– Construction permits (new buildings and additions) 2006-2014. Number of buildings and floor area (thousand sqm)

– Building Permits Statistics and Percentage Changes, 2002-2014

Foreign direct investments

– Foreign Direct Investments, 2006-2014. US$ billion

Appendix: directory of companies active in the Turkish lighting market

The Report offers an overview of the lighting fixtures industry in Turkey, providing trends in lighting fixtures production and consumption, imports and exports, distribution and prices for residential, commercial, industrial and outdoor lighting.

A breakdown of lighting fixtures exports and imports is provided by country and by geographical area of destination/origin.

Data on consumer/residential lighting are broken down by style (classic, modern, design) and positioning of the lamp (floor, table, wall/ceiling, chandeliers/suspensions), while data on architectural/commercial lighting are broken down by product (downlights, fluorescence/track systems, low voltage spotlights and professional projectors, wall ceiling panels, high bays, decorative lighting for commercial use) and application (hospitality, office, retail/luxury shops, museums, schools and public infrastructures). Industrial lighting consists of lighting for industrial sites, emergency, hospital, explosion/weather proof and marine lighting. Outdoor lighting includes residential outdoor lighting, lighting for urban landscape, major roads, tunnels, sport plants and other large areas, Christmas/event lighting.

Lighting fixtures sales are broken down by light sources: incandescence, fluorescence, gas discharge, LED.

The analysis of lighting fixtures distribution in Turkey covers the following distribution channels: project dealers, lighting specialist stores, DIY and furniture chains, wholesalers and electrical stores, e-commerce.

Reference retail prices of lighting fixtures in Turkey are given in the two different segments (residential, technical) by category, application, light source, style and manufacturer/distributor.

An overview of the leading developers, architects, lighting designers and project dealers in Turkey is provided, as well as some information on the main magazines, associations and trade fairs.

Sales data and market shares are given for the major lighting companies present on the Turkish market for each segment (residential, commercial, industrial, outdoor lighting), as well as data on lighting fixtures exports for a sample of around 50 leading Turkish exporters. Short company profiles for the main players are also included.

Macroeconomic indicators with information on Turkish economy, population, real growth of GDP and data on construction activity are also provided.

A list of around 120 addresses of lighting fixtures companies present on the Turkish market is also available.

Turkey. Lighting fixtures. The openness of the market, 2009-2014.Percentage share

Lighting fixtures production in Turkey can be estimated worth EUR 490 million in 2014, decreasing by 8% compared to 2013 and by 3% on average over the period 2009/2014. However, due to the exchange rate effect the performance in local currency unit (LCU) was positive: +5.5% in 2014 and +9% on average since 2009. Market openness increased enormously over the last years. Pushed by favorable exchange rate, exports (EUR 237 million) accounted for 48% of local output (35% in 2012) and increased by 6.4% in 2014 (+22% in LCU). Imports reached EUR 431 million in the year showing double digit growth in EUR (+33% in LCU). On the consumption side, Turkish market continues to expand and absorbed EUR 684 million for the year 2014, recording an average yearly growth by 10% during the last five years (+17% in LCU). LED based products are expected to continue its expansion over the next years. According to CSIL forecasts the incidence of LED will reach 38% of the market by the end of 2018.

Research field and methodology

Working tools ; Terminology

1. Market size and segmentation

Basic data and activity trend

– Lighting fixtures production, international trade and consumption, 2009-2014. EUR and TYR million

– Lighting fixtures production, largest manufacturers worldwide

– Lighting fixtures. The openness of the market, 2009-2014

Forecasts up to 2018

– Lighting fixtures consumption, 2009-2015. Annual % change in USD and in local currency (TYR)

– Consumption of total and LED based lighting fixtures and real growth of GDP, 2014-2018. USD and TYR million and annual % change

Segments: Residential, Commercial, Industrial and Outdoor lighting

– Lighting fixtures production, international trade and consumption by segment, 2009-2014

Leading producers

– Lighting fixtures. Turnover and number of employees in a sample of companies

2. International trade

Exports and Imports

– Exports and imports of lighting fixtures by country and by geographical area, 2009-2014

– Exports and imports of lighting fixtures and components

– Exports and imports of lamps

3. Supply structure

Kind of lighting companies

– Classification of lighting company and their characteristics

Productivity and employment

– Lighting fixtures. Number of employees and average turnover per employee in a sample of companies

Product breakdown

– Residential lighting: Sales breakdown by style and by positioning of the lamp. 2008, 2012, 2014. % share

– Commercial lighting. Sales breakdown by product and by destination in a sample of companies

– Industrial lighting. Sales breakdown by product in a sample of companies

– Outdoor lighting. Sales breakdown by product in a sample of companies

LED and other light sources

– Lighting fixtures. Sales breakdown by light source, 2008, 2012, 2014. % share

– LED based lighting fixtures sales, 2011-2014 estimated data and 2015-2018 forecasts. EUR and TYR million

– Lighting fixtures. Sales breakdown by light source in a sample of companies

– Turkish government’s policy and action for adopting LED lighting

4. Distribution

Distribution channels

– Lighting fixtures. Distribution channels, by residential and technical application

– Lighting fixtures. Sales breakdown by distribution channels in a sample of companies

Reference prices

– Residential and Technical Lighting. Reference retail prices in a sample of stores

Developers, Architects and lighting designers

– Leading developers, Architects, Lighting Designers/Consultants, Project Dealers in Turkey

5. Magazines, associations and trade fairs

6. The competitive system

Top players

– Lighting fixtures turnover and market shares for a sample of 50 leading Turkish manufacturers

– Lighting fixtures turnover breakdown by segment for a sample of 50 leading 50 Turkish manufacturers

Residential, Commercial, Industrial, Outdoor lighting

– Lighting fixtures turnover and market shares of the top Turkish manufacturers by segment

Exporters

– Lighting fixtures exports for a sample of 45 leading Turkish exporters. Total and breakdown by geographical area

Lighting fixtures Sales in the domestic market: total, residential, commercial, industrial and outdoor lighting

– Lighting fixtures sales in Turkey and market shares for a sample of 50 leading companies. Total and by segment

7. Demand drivers

The economy

– Real growth of GDP, 2012-2019

– Economic indicators

– Population growth rate (%), 1993-2023

– Number of enterprises by region

Construction activity

– Total construction permits. Number of Buildings and floor area in square metres 2006-2014

– Total construction permits. Breakdown by kind of building

– Construction permits (new buildings and additions) 2006-2014. Number of buildings and floor area (thousand sqm)

– Building Permits Statistics and Percentage Changes, 2002-2014

Foreign direct investments

– Foreign Direct Investments, 2006-2014. US$ billion

Appendix: directory of companies active in the Turkish lighting market

SEE ALSO

The worldwide market for connected lighting

February 2024, I Ed. , 88 pages

This report analyses the global lighting market focusing on LED and connected lighting trends. It provides market forecasts emphasizing the impact of green transition and digital transformation. The study also includes a section on industry competition, estimating sales, and market shares for leading manufacturers.

Lighting: World Market Outlook

November 2023, XXVI Ed. , 123 pages

The world market for lighting fixtures reached a value of USD 97 billion in 2023. After some fluctuating performance in the post-pandemic period, it is expected to remain stable in 2024, followed by moderate growth in 2025 and 2026. The major consuming countries are the US, China, Japan, India and Germany. The twenty-six edition of CSIL research “Lighting: World market outlook” analyzes, through tables and graphs, data on lighting fixtures production, consumption and international trade at worldwide level as a whole and for 70 considered countries, for the years 2013-2022 and 2023 preliminary. lighting fixtures market forecasts for the next three years (2024-2026) are also provided

The lighting fixtures market in China

September 2023, XVI Ed. , 205 pages

The 16th edition of The Lighting Fixtures market in China offers an accurate and in-deep analysis of the lighting fixtures industry in China, providing data and trends for the period 2017-2022 and forecasts up to 2025. From one hand, the report analyses the main trends affecting the market over the last five years, considering the production, consumption, imports and exports of lighting fixtures in the country. On the other hand, it offers an analysis of the supply structure and the competitive system, an overview on smart connected lighting trend, the distribution system and the main players operating in the market

The lighting fixtures market in the United States

June 2023, XVII Ed. , 256 pages

The total US lighting market is estimated to be worth around USD 26 billion in 2022. This value includes lighting fixtures and lamps. The US lighting market during 2022 registers a 6.5% growth in nominal terms as for lighting fixtures (consumer, professional, outdoor), up to 23.2 billion USD. The lamps market registers a decrease (about -2.9%). The residential segment has grown well above the market average (+5.9% on average over the last five years). In 2022, the weight of Office and Entertainment on the overall commercial lighting market has declined, while Hospitality and Public premises grew. In 2022, the value of completed construction grew by more than 10 percent to nearly USD 1.8 billion

The European market for lighting fixtures

May 2023, XXXII Ed. , 392 pages

In 2022, consumption of lighting fixtures in the EU30 countries registered a 8.3% increase, reaching a value of EUR 19.9 billion. Better results for commercial lighting (versus residential, industrial and outdoor), big players (with a 12% Ebitda), design oriented, area lighting, hospitality, contract (versus retail), linear lighting, emergency. More IP patents and acquisitions. Top 10 players hold a 30% market share.