November 2022,

IX Ed. ,

118 pages

Price (single user license):

EUR 1600 / USD 1712

For multiple/corporate license prices please contact us

Language: English

Report code: M02

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

This report analyses e-commerce for the furniture industry on a global level and it is mainly divided into two parts:

PART I. E-COMMERCE FOR THE FURNITURE INDUSTRY deals with the features and the incidence of the online channel in the furniture market with a focus on key geographical areas (Europe, North America, Asia Pacific) and key countries, and analyses the different e-commerce business models and the performance of the leading players.

An overview of the world furniture industry, with current furniture consumption in large markets, introduces this part.

Trends in furniture e-commerce sales, 2022 (preliminary estimates) compared to 2019, are provided by segment (upholstered furniture, outdoor furniture, office furniture, kitchen furniture, other furniture), by geographical area and by kind of distributor (E-tailers, Furniture specialists, Non-specialists/Lifestyle/DIY and Furniture manufacturers selling online)

The different E-commerce business models (Furniture manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains, Open Platforms) and their evolution and organization (the omnichannel approach, the ‘dynamic shopping’ through a mixture of live-streaming and online shopping, and strategies and investments toward sustainable and responsible growth) are discussed in light of companies’ experience.

ANALYSIS BY GEOGRAPHICAL AREAS: The furniture e-commerce business in Europe, North America, and Asia Pacific:for each considered region, the report analyses demand drivers, the online furniture market performance and sales of the leading furniture e-commerce players. E-commerce furniture sales are also provided for the most relevant markets (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, United Kingdom – the United States, Canada, Mexico – Australia, China, India, Japan, South Korea).

Online sales are presented for around 190 leading players based in North America, Europe, and Asia Pacific, with profiles highlighting their e-commerce policies. Profiles of the major companies are also provided. E-commerce furniture sales are provided both for European and North American companies.

PART II. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS provides results of a CSIL survey conducted in the period October-November 2022 to a sample of around 150 furniture manufacturers from all over the world, aiming at understanding their approach to the web channel, their strategies, their future expectations, and the most-demanded products in the web channel.

This survey mainly focused on:

- Companies revenues and performance

- The use of e-commerce/ Intentions to invest in e-commerce

- Features of the companies’ e-commerce channels

- Products sold online, strategies and promotion tools

Selected companies

Amazon, Ambientedirect, Anthropologie, Bygghemma Group, C Discount, Coupang, Crate and Barrel, Dunhelm, Hayneedle, Harvey Norman, Home Depot, Home 24, Ikea, Jingdong, John Lewis, Lowe’s, Otto, Overstock, Pepperfry, Restoration Hardware, Suning, Tmall, Wal-Mart, Wayfair, Westwing, Williams-Sonoma.

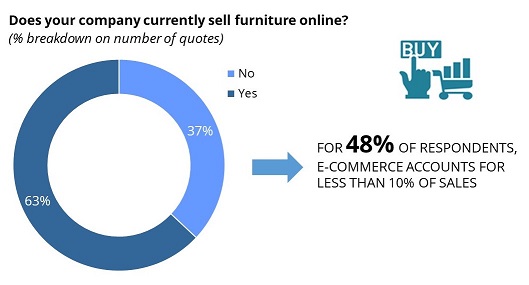

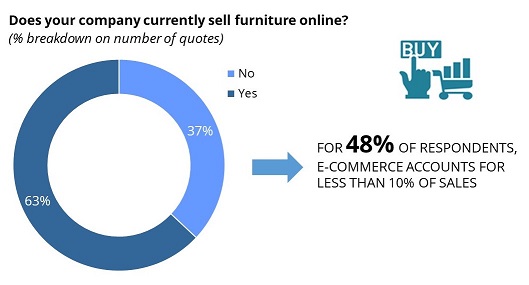

Use of e-commerce and incidence of total furniture sales, 2022. Percentage shares on the total sample of respondents to the CSIL survey

With a yearly growth of 18% during the period 2019-2022, the e-commerce furniture market has evolved rapidly in recent years, growing faster than the whole furniture market. The United States is the largest e-commerce marketplace globally, with the highest penetration rate, followed by China.

The swiftly changing worldwide scenario strongly continues to influence the evolution of the e-commerce channel. Following the booming performance during the pandemic, the market has been impacted by the consequences of the war in Ukraine, energy and food shortages, and strong inflationary pressures.

Also, the e-commerce competitive arena is showing some turbulence. Online sales of furniture are falling giving an advantage to the omnichannel retailers (brick & click) which are showing resilience to the weak market conditions, maximising physical stores’ potential in combination with the virtual experience.

INTRODUCTION: Research Tools, Sample of companies, Terminology and methodological notes

EXECUTIVE SUMMARY: E-commerce for the furniture sector at a glance

1. E-COMMERCE FOR THE FURNITURE INDUSTRY

1.1. An overview of the furniture market: Consumption and Imports

1.2. E-commerce for the furniture industry: basic data

- -incidence of e-commerce on total furniture consumption

- -furniture consumption and e-commerce sales by geographical region

- -furniture consumption and e-commerce sales by product segment (Upholstered furniture, Outdoor furniture, Kitchen furniture, Office furniture, Other furniture)

- -e-commerce furniture sales by channel (E-tailers, Furniture specialists, Non-specialists/Lifestyle/DIY and Furniture manufacturers through webstores)

1.3. E-commerce sales performance in a sample of companies

1.4. Models of e-commerce business: Furniture manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains, Open Platforms

2. ACTIVITY TRENDS

2.1. Furniture sales and e-commerce furniture sales growth

- -E-commerce furniture sales by geographical region and E-commerce furniture consumption in the top 10 countries

- -E-commerce furniture sales by product segment

- -Online furniture distributors by category: dimension, market share and average growth

2.2. The business evolution and organisation: the Omnichannel approach, Dynamic shopping and Sustainability

ANALYSIS BY GEOGRAPHICAL AREA: Europe, North America, Asia Pacific

3. FURNITURE E-COMMERCE IN EUROPE

3.1. Retail and e-commerce sales in Europe: overview and demand drivers

3.2. The furniture market in Europe: Sector overview

- -Furniture consumption at end-user prices in Europe and e-commerce furniture sales by country (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, United Kingdom)

3.3. The leading e-commerce websites selling furniture in Europe: Estimated e-commerce furniture sales and Total e-commerce revenues

4. FURNITURE E-COMMERCE IN NORTH AMERICA

4.1. Retail and e-commerce sales in North America: overview and demand drivers

4.2. The furniture market in North America: Sector overview

- -Furniture consumption at end-user prices in North America and e-commerce furniture sales by country (United States, Canada and Mexico)

4.3. Furniture manufacturers selling online

4.4. The leading e-commerce websites selling furniture in North America: Estimated e-commerce furniture sales and Total e-commerce revenues

5. FURNITURE E-COMMERCE IN ASIA PACIFIC

5.1. Retail and e-commerce sales in Asia Pacific: overview and demand drivers

5.2. The furniture market in Asia Pacific: Sector overview

- -Furniture consumption at end-user prices in Asia Pacific and e-commerce furniture sales by country (Australia, China, India, Japan, South Korea)

5.3. The leading e-commerce websites selling furniture in Asia Pacific: Total e-commerce revenues

6. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS

6.1. The sample of companies

6.2. Revenue performance

6.3. The use of e-commerce

6.4. E-commerce channels

6.5. Products and promotion tools

This report analyses e-commerce for the furniture industry on a global level and it is mainly divided into two parts:

PART I. E-COMMERCE FOR THE FURNITURE INDUSTRY deals with the features and the incidence of the online channel in the furniture market with a focus on key geographical areas (Europe, North America, Asia Pacific) and key countries, and analyses the different e-commerce business models and the performance of the leading players.

An overview of the world furniture industry, with current furniture consumption in large markets, introduces this part.

Trends in furniture e-commerce sales, 2022 (preliminary estimates) compared to 2019, are provided by segment (upholstered furniture, outdoor furniture, office furniture, kitchen furniture, other furniture), by geographical area and by kind of distributor (E-tailers, Furniture specialists, Non-specialists/Lifestyle/DIY and Furniture manufacturers selling online)

The different E-commerce business models (Furniture manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains, Open Platforms) and their evolution and organization (the omnichannel approach, the ‘dynamic shopping’ through a mixture of live-streaming and online shopping, and strategies and investments toward sustainable and responsible growth) are discussed in light of companies’ experience.

ANALYSIS BY GEOGRAPHICAL AREAS: The furniture e-commerce business in Europe, North America, and Asia Pacific:for each considered region, the report analyses demand drivers, the online furniture market performance and sales of the leading furniture e-commerce players. E-commerce furniture sales are also provided for the most relevant markets (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, United Kingdom – the United States, Canada, Mexico – Australia, China, India, Japan, South Korea).

Online sales are presented for around 190 leading players based in North America, Europe, and Asia Pacific, with profiles highlighting their e-commerce policies. Profiles of the major companies are also provided. E-commerce furniture sales are provided both for European and North American companies.

PART II. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS provides results of a CSIL survey conducted in the period October-November 2022 to a sample of around 150 furniture manufacturers from all over the world, aiming at understanding their approach to the web channel, their strategies, their future expectations, and the most-demanded products in the web channel.

This survey mainly focused on:

- Companies revenues and performance

- The use of e-commerce/ Intentions to invest in e-commerce

- Features of the companies’ e-commerce channels

- Products sold online, strategies and promotion tools

Use of e-commerce and incidence of total furniture sales, 2022. Percentage shares on the total sample of respondents to the CSIL survey

With a yearly growth of 18% during the period 2019-2022, the e-commerce furniture market has evolved rapidly in recent years, growing faster than the whole furniture market. The United States is the largest e-commerce marketplace globally, with the highest penetration rate, followed by China.

The swiftly changing worldwide scenario strongly continues to influence the evolution of the e-commerce channel. Following the booming performance during the pandemic, the market has been impacted by the consequences of the war in Ukraine, energy and food shortages, and strong inflationary pressures.

Also, the e-commerce competitive arena is showing some turbulence. Online sales of furniture are falling giving an advantage to the omnichannel retailers (brick & click) which are showing resilience to the weak market conditions, maximising physical stores’ potential in combination with the virtual experience.

INTRODUCTION: Research Tools, Sample of companies, Terminology and methodological notes

EXECUTIVE SUMMARY: E-commerce for the furniture sector at a glance

1. E-COMMERCE FOR THE FURNITURE INDUSTRY

1.1. An overview of the furniture market: Consumption and Imports

1.2. E-commerce for the furniture industry: basic data

- -incidence of e-commerce on total furniture consumption

- -furniture consumption and e-commerce sales by geographical region

- -furniture consumption and e-commerce sales by product segment (Upholstered furniture, Outdoor furniture, Kitchen furniture, Office furniture, Other furniture)

- -e-commerce furniture sales by channel (E-tailers, Furniture specialists, Non-specialists/Lifestyle/DIY and Furniture manufacturers through webstores)

1.3. E-commerce sales performance in a sample of companies

1.4. Models of e-commerce business: Furniture manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains, Open Platforms

2. ACTIVITY TRENDS

2.1. Furniture sales and e-commerce furniture sales growth

- -E-commerce furniture sales by geographical region and E-commerce furniture consumption in the top 10 countries

- -E-commerce furniture sales by product segment

- -Online furniture distributors by category: dimension, market share and average growth

2.2. The business evolution and organisation: the Omnichannel approach, Dynamic shopping and Sustainability

ANALYSIS BY GEOGRAPHICAL AREA: Europe, North America, Asia Pacific

3. FURNITURE E-COMMERCE IN EUROPE

3.1. Retail and e-commerce sales in Europe: overview and demand drivers

3.2. The furniture market in Europe: Sector overview

- -Furniture consumption at end-user prices in Europe and e-commerce furniture sales by country (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, United Kingdom)

3.3. The leading e-commerce websites selling furniture in Europe: Estimated e-commerce furniture sales and Total e-commerce revenues

4. FURNITURE E-COMMERCE IN NORTH AMERICA

4.1. Retail and e-commerce sales in North America: overview and demand drivers

4.2. The furniture market in North America: Sector overview

- -Furniture consumption at end-user prices in North America and e-commerce furniture sales by country (United States, Canada and Mexico)

4.3. Furniture manufacturers selling online

4.4. The leading e-commerce websites selling furniture in North America: Estimated e-commerce furniture sales and Total e-commerce revenues

5. FURNITURE E-COMMERCE IN ASIA PACIFIC

5.1. Retail and e-commerce sales in Asia Pacific: overview and demand drivers

5.2. The furniture market in Asia Pacific: Sector overview

- -Furniture consumption at end-user prices in Asia Pacific and e-commerce furniture sales by country (Australia, China, India, Japan, South Korea)

5.3. The leading e-commerce websites selling furniture in Asia Pacific: Total e-commerce revenues

6. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS

6.1. The sample of companies

6.2. Revenue performance

6.3. The use of e-commerce

6.4. E-commerce channels

6.5. Products and promotion tools

SEE ALSO

Furniture retailing in Europe

February 2024, XVII Ed. , 296 pages

Comparative analysis of the home furniture retailing industry in 15 European countries, with trends in home furniture consumption, market forecasts, data by country, analysis by distribution channel, retail formats and sales performances of leading home furniture retailers in Europe

Top 100 mattress specialist retailers in Europe

November 2023, I Ed. , 14 pages

A bird’s eye view of players in the European mattress market with a ranking of the 100 leading mattress specialist retailers in Europe.

E-commerce in the mattress industry

September 2023, V Ed. , 102 pages

Detailed analysis of the global e-commerce mattress markets with a focus on North America, Europe, and the Asia Pacific. Features of the online mattress business, the current incidence of online mattress sales by geographical areas and in key countries, the major markets, e-commerce mattress sales of the leading retailers by area, and company profiles of top players operating in the online mattress sector.

La distribuzione del mobile in Italia. Analisi per provincia (Italian)

July 2023, XX Ed. , 174 pages

This report provides a detailed picture of the Italian furniture market and retailing, for the whole national market and by province, providing the size and development of the home furniture market and its segments, market shares and development of distribution channels, estimated home furniture sales for key retailers, in-depth analysis of both large retail chains and independent retailers, companies’ strategies and trends

Top 100 furniture retailers in Europe

November 2022, I Ed. , 15 pages

Analysis of the European Furniture retail competitive landscape: ranking of the 100 leading retailers, with company name, group, headquarter location, website, brands, estimated home furniture turnover, and number of stores.