July 2023,

XX Ed. ,

472 pages

Price (single user license):

EUR 2900 / USD 3132

For multiple/corporate license prices please contact us

Language: English

Report code: W17

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

CSIL’s Market Research Report The world mattress industry gives a comprehensive overview of the global mattress sector with the latest trends and data: mattress market indicators from 2013 to 2022, covering production, consumption, and international trade flows, mattress market forecasts for 2023 and 2024, competitive landscape analysis with detailed profiles of the leading world mattress manufacturers and their strategies.

The purpose of this study is to provide an in-depth analysis of the mattress market across regions, countries, and key players, with outlook and market potential approached through a thorough analysis of the main sector’s statistics.

PART I. THE WORLD MATTRESS INDUSTRY

This part reviews the main drivers and challenges of the global mattress industry, such as supply chain issues, trade tensions, nearshoring, globalization and uncertainties, e-commerce channels, bed-in-a-box, sustainability, and circularity. It also presents updated figures for the world mattress market and its competitive landscape.

This part also presents insights from the CSIL’s survey addressed to a sample of global manufacturers involved in the mattress industry (May – July 2023) on Mattress manufacturers’ strategies.

PART II. KEY MARKETS AND THE MOST IMPORTANT COUNTRIES IN THE GLOBAL MATTRESS SECTOR. 50 COUNTRIES ANALYSIS

The first part of this chapter provides a detailed analysis of the Top 20 world mattress markets (Australia, Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, South Korea, Spain, Sweden, Türkiye, United Kingdom, United States, Vietnam), that includes for each country:

- Mattress production, apparent consumption, exports, imports for the years 2013-2022, and forecasts of yearly changes in mattress consumption in 2023 and 2024.

- Mattress production in quantity (available for is available for Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, Spain, Sweden, Türkiye, United Kingdom, United States, Vietnam)

- Information on breakdown of production by material (innerspring, latex, foam, other) available for Australia, Belgium, Brazil, China, France, Germany, India, Italy, Mexico, Poland, Portugal, Spain, United Kingdom, Vietnam.

- Major trading partners (countries of origin of imports and destination of exports of mattresses)

- Socio-economic indicators, including population forecasts and resident population in main cities and projected growth

- Major mattress manufacturers by turnover, and short profiles of selected leading mattress manufacturers (Company name, Headquarters/Main Location, Email, Website, Activity, Product Portfolio, Brands, Online Sales, Total Turnover range, Employees range, Manufacturing plants)

Moreover, for further 30 countries (Argentina, Austria, Bulgaria, Chile, Croatia, Czech Republic, Denmark, Estonia, Finland, Greece, Hungary, Indonesia, Ireland, Kuwait, Latvia, Lithuania, Malaysia, Netherlands, Norway, Philippines, Romania, Russia, Saudi Arabia, Serbia, Slovakia, South Africa, Switzerland, Taiwan (China), Thailand, United Arab Emirates), the study provides Mattress production, apparent consumption, exports, imports for the years 2013-2022 and forecasts of yearly changes in mattress consumption in 2023 and 2024; Major trading partners (countries of origin of imports and destination of exports of mattresses).

Data on the international trade of mattresses (in addition to the 50 countries) are provided for further 10 other countries, for a total of 60 countries covered by the report.

PART III. LEADING MANUFACTURERS IN THE WORLD MATTRESS INDUSTRY

Detailed profiles of the 35 world leading mattress manufacturers: company information (company name, headquarter, general contact info), financial highlights and sales performance, manufacturing activity (plants and production strategies).

PART VI LISTING OF THE MAJOR MATTRESS MANUFACTURERS for the other 30 countries not covered by Part III.

The report covers overall around 500 companies

Selected companies

Adova, Aquinos, Ashley Furniture, Auping, BRN Sleep Products, Correct, Eurocomfort, Flex, Healthcare (Mlily), Herval Móveis e Colchões, Hilding Anders, Ikano Industry, Jason Furniture – Kuka, Kurlon, Magniflex, Perdormire, Pikolin, Recticel, Serta Simmons, Sheela Foam (Sleepwell), Silentnight, Sinomax, Sleep Number Co., Tempur Sealy, Xilinmen, Yatas Yatak, Zinus.

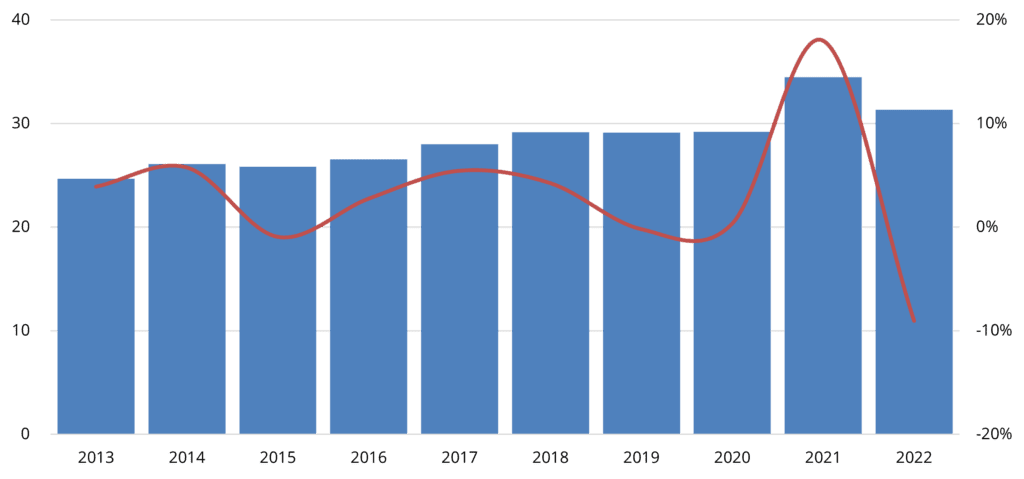

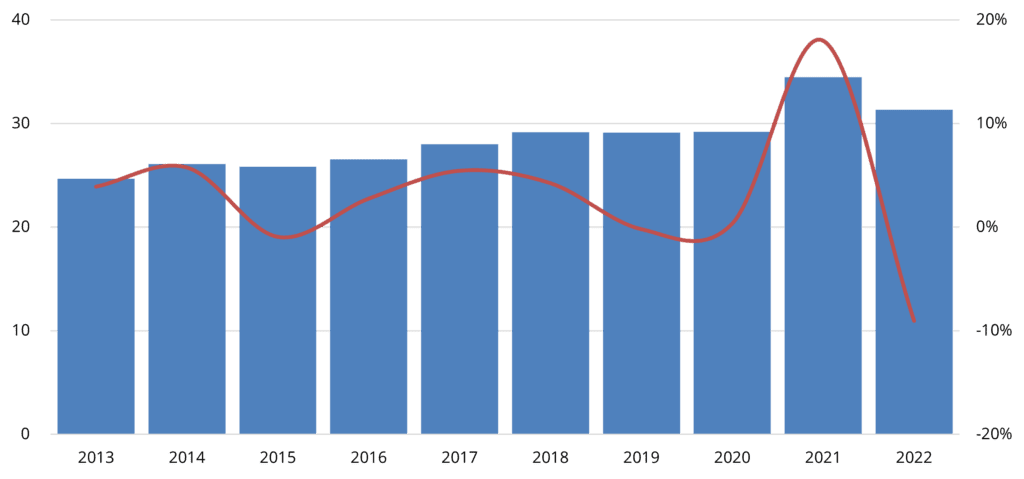

World Mattress consumption, 2013-2022. US$ billion

The world mattress market, valued at approximately US$30 billion, has witnessed steady growth over the past decade, except for a remarkable surge in 2021. However, in 2022, the market experienced a decline in demand, particularly in the latter half of the year, primarily due to inflationary pressures affecting consumer spending. This resulted in a contraction of the global market. Overall, despite the temporary contraction witnessed in the mattress market, there are positive trends and drivers indicating potential growth in the coming years.

Regional and country analysis: Asia and Pacific, and North America are the leading markets for mattresses, accounting for over 70% the global market.

Market outlook: The world mattress market is projected to undergo a real-term contraction in 2023, with consumption decreasing across all regions except Asia and the Middle East. Nevertheless, a resumption of growth is anticipated in 2024.

Demand drivers: A key trend driving the mattress industry is the increased awareness among consumers about the health benefits of better sleep both in traditional and emerging markets. Room for growth derives from the high-end market, less affected by the high inflationary pressure. Another important driver is the increased demand for roll-packed/compressed mattresses in online and traditional sales channels. Lastly, the resumption of the contract segment, which experienced a halt during the pandemic but has rebounded in the past two years, represents growth opportunities for companies operating in this sector

Abstract of Table of Contents

METHODOLOGY, INTRODUCTION AND EXECUTIVE SUMMARY

Structure of the report, Basic data, Competitive system and Product trends

E-commerce and sustainability: major topics of the world mattress market

Mattress manufactures’ strategies. Insights from the CSIL’s survey

PART I. CONSUMPTION, PRODUCTION AND INTERNATIONAL TRADE OF MATTRESSES

Consumption and imports of mattresses 2013-2022

- Mattress consumption in the 50 major markets

- Import penetration and opening of major markets

Production and exports of mattresses 2013-2022

- Mattress production in the 50 major producing countries

- Number of units

- Major exporting countries. Origin and destination of mattresses

International trade of mattresses

International trade of mattresses, 60 countries

Mattress consumption. Scenario

Evolution of world GDP

Mattress market forecasts 2023 and 2024

PART II. MATTRESS MARKET INDICATORS

Overview of the world mattress industry (50 major countries)

Mattress exports and imports, 60 countries, 2013-2022

World mattress trade. Destination of exports and origin of imports

Mattress consumption 2023-2024. Change forecasts in real terms

PART III. TOP 20 COUNTRIES FOR MATTRESS INDUSTRY (Australia, Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, South Korea, Spain, Sweden, Türkiye, United Kingdom, United States, Vietnam)

FOR EACH COUNTRY:

- Mattress production, apparent consumption, exports, imports for the years 2013-2022 and forecasts of yearly changes in mattress consumption in 2023 and 2024.

- Mattress production in quantity 2017-2022 (available for Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Russia, Spain, Sweden, Türkiye, United Kingdom, United States)

- Information on breakdown of production by material (innerspring, latex, foam, other) (available for Australia, Belgium, Brazil, China, France, Germany, India, Italy, Mexico, Poland, Russia, Spain, United Kingdom, Vietnam)

- Major trading partners (countries of origin of imports and destination of exports of mattresses)

- Socio-economic indicators, including population forecasts and resident population in main cities and projected growth

- Major mattress manufacturers by turnover with short profiles

PART IV. SELECTED PROFILES OF MAJOR MATTRESS MANUFACTURERS

PART V. 50 COUNTRY TABLES: MATTRESS MARKET INDICATORS BY COUNTRY

FOR EACH COUNTRY:

- Mattress production, apparent consumption, exports, imports for the years 2013-2022 and forecasts of yearly changes in mattress consumption in 2023 and 2024.

- Major trading partners (countries of origin of imports and destination of exports of mattresses).

PART VI. SELECTED MATTRESS MANUFACTURERS

APPENDIX

CSIL’s Market Research Report The world mattress industry gives a comprehensive overview of the global mattress sector with the latest trends and data: mattress market indicators from 2013 to 2022, covering production, consumption, and international trade flows, mattress market forecasts for 2023 and 2024, competitive landscape analysis with detailed profiles of the leading world mattress manufacturers and their strategies.

The purpose of this study is to provide an in-depth analysis of the mattress market across regions, countries, and key players, with outlook and market potential approached through a thorough analysis of the main sector’s statistics.

PART I. THE WORLD MATTRESS INDUSTRY

This part reviews the main drivers and challenges of the global mattress industry, such as supply chain issues, trade tensions, nearshoring, globalization and uncertainties, e-commerce channels, bed-in-a-box, sustainability, and circularity. It also presents updated figures for the world mattress market and its competitive landscape.

This part also presents insights from the CSIL’s survey addressed to a sample of global manufacturers involved in the mattress industry (May – July 2023) on Mattress manufacturers’ strategies.

PART II. KEY MARKETS AND THE MOST IMPORTANT COUNTRIES IN THE GLOBAL MATTRESS SECTOR. 50 COUNTRIES ANALYSIS

The first part of this chapter provides a detailed analysis of the Top 20 world mattress markets (Australia, Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, South Korea, Spain, Sweden, Türkiye, United Kingdom, United States, Vietnam), that includes for each country:

- Mattress production, apparent consumption, exports, imports for the years 2013-2022, and forecasts of yearly changes in mattress consumption in 2023 and 2024.

- Mattress production in quantity (available for is available for Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, Spain, Sweden, Türkiye, United Kingdom, United States, Vietnam)

- Information on breakdown of production by material (innerspring, latex, foam, other) available for Australia, Belgium, Brazil, China, France, Germany, India, Italy, Mexico, Poland, Portugal, Spain, United Kingdom, Vietnam.

- Major trading partners (countries of origin of imports and destination of exports of mattresses)

- Socio-economic indicators, including population forecasts and resident population in main cities and projected growth

- Major mattress manufacturers by turnover, and short profiles of selected leading mattress manufacturers (Company name, Headquarters/Main Location, Email, Website, Activity, Product Portfolio, Brands, Online Sales, Total Turnover range, Employees range, Manufacturing plants)

Moreover, for further 30 countries (Argentina, Austria, Bulgaria, Chile, Croatia, Czech Republic, Denmark, Estonia, Finland, Greece, Hungary, Indonesia, Ireland, Kuwait, Latvia, Lithuania, Malaysia, Netherlands, Norway, Philippines, Romania, Russia, Saudi Arabia, Serbia, Slovakia, South Africa, Switzerland, Taiwan (China), Thailand, United Arab Emirates), the study provides Mattress production, apparent consumption, exports, imports for the years 2013-2022 and forecasts of yearly changes in mattress consumption in 2023 and 2024; Major trading partners (countries of origin of imports and destination of exports of mattresses).

Data on the international trade of mattresses (in addition to the 50 countries) are provided for further 10 other countries, for a total of 60 countries covered by the report.

PART III. LEADING MANUFACTURERS IN THE WORLD MATTRESS INDUSTRY

Detailed profiles of the 35 world leading mattress manufacturers: company information (company name, headquarter, general contact info), financial highlights and sales performance, manufacturing activity (plants and production strategies).

PART VI LISTING OF THE MAJOR MATTRESS MANUFACTURERS for the other 30 countries not covered by Part III.

The report covers overall around 500 companies

World Mattress consumption, 2013-2022. US$ billion

The world mattress market, valued at approximately US$30 billion, has witnessed steady growth over the past decade, except for a remarkable surge in 2021. However, in 2022, the market experienced a decline in demand, particularly in the latter half of the year, primarily due to inflationary pressures affecting consumer spending. This resulted in a contraction of the global market. Overall, despite the temporary contraction witnessed in the mattress market, there are positive trends and drivers indicating potential growth in the coming years.

Regional and country analysis: Asia and Pacific, and North America are the leading markets for mattresses, accounting for over 70% the global market.

Market outlook: The world mattress market is projected to undergo a real-term contraction in 2023, with consumption decreasing across all regions except Asia and the Middle East. Nevertheless, a resumption of growth is anticipated in 2024.

Demand drivers: A key trend driving the mattress industry is the increased awareness among consumers about the health benefits of better sleep both in traditional and emerging markets. Room for growth derives from the high-end market, less affected by the high inflationary pressure. Another important driver is the increased demand for roll-packed/compressed mattresses in online and traditional sales channels. Lastly, the resumption of the contract segment, which experienced a halt during the pandemic but has rebounded in the past two years, represents growth opportunities for companies operating in this sector

Abstract of Table of Contents

METHODOLOGY, INTRODUCTION AND EXECUTIVE SUMMARY

Structure of the report, Basic data, Competitive system and Product trends

E-commerce and sustainability: major topics of the world mattress market

Mattress manufactures’ strategies. Insights from the CSIL’s survey

PART I. CONSUMPTION, PRODUCTION AND INTERNATIONAL TRADE OF MATTRESSES

Consumption and imports of mattresses 2013-2022

- Mattress consumption in the 50 major markets

- Import penetration and opening of major markets

Production and exports of mattresses 2013-2022

- Mattress production in the 50 major producing countries

- Number of units

- Major exporting countries. Origin and destination of mattresses

International trade of mattresses

International trade of mattresses, 60 countries

Mattress consumption. Scenario

Evolution of world GDP

Mattress market forecasts 2023 and 2024

PART II. MATTRESS MARKET INDICATORS

Overview of the world mattress industry (50 major countries)

Mattress exports and imports, 60 countries, 2013-2022

World mattress trade. Destination of exports and origin of imports

Mattress consumption 2023-2024. Change forecasts in real terms

PART III. TOP 20 COUNTRIES FOR MATTRESS INDUSTRY (Australia, Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, South Korea, Spain, Sweden, Türkiye, United Kingdom, United States, Vietnam)

FOR EACH COUNTRY:

- Mattress production, apparent consumption, exports, imports for the years 2013-2022 and forecasts of yearly changes in mattress consumption in 2023 and 2024.

- Mattress production in quantity 2017-2022 (available for Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Russia, Spain, Sweden, Türkiye, United Kingdom, United States)

- Information on breakdown of production by material (innerspring, latex, foam, other) (available for Australia, Belgium, Brazil, China, France, Germany, India, Italy, Mexico, Poland, Russia, Spain, United Kingdom, Vietnam)

- Major trading partners (countries of origin of imports and destination of exports of mattresses)

- Socio-economic indicators, including population forecasts and resident population in main cities and projected growth

- Major mattress manufacturers by turnover with short profiles

PART IV. SELECTED PROFILES OF MAJOR MATTRESS MANUFACTURERS

PART V. 50 COUNTRY TABLES: MATTRESS MARKET INDICATORS BY COUNTRY

FOR EACH COUNTRY:

- Mattress production, apparent consumption, exports, imports for the years 2013-2022 and forecasts of yearly changes in mattress consumption in 2023 and 2024.

- Major trading partners (countries of origin of imports and destination of exports of mattresses).

PART VI. SELECTED MATTRESS MANUFACTURERS

APPENDIX

SEE ALSO

Top 100 mattress specialist retailers in Europe

November 2023, I Ed. , 14 pages

A bird’s eye view of players in the European mattress market with a ranking of the 100 leading mattress specialist retailers in Europe.

Top 100 mattress manufacturers in China

October 2023, I Ed. , 15 pages

A bird’s eye view of the Chinese Mattress industry competitive landscape with ranking of the 100 leading manufacturers of this segment.

E-commerce in the mattress industry

September 2023, V Ed. , 102 pages

Detailed analysis of the global e-commerce mattress markets with a focus on North America, Europe, and the Asia Pacific. Features of the online mattress business, the current incidence of online mattress sales by geographical areas and in key countries, the major markets, e-commerce mattress sales of the leading retailers by area, and company profiles of top players operating in the online mattress sector.

Top 100 mattress manufacturers in the World

September 2023, II Ed. , 15 pages

Who are the top mattress manufacturers in the world? This study gives a picture of the global mattress competitive system through the analysis of the leading 100 producers benchmarking their performance and the whole sector concentration.

Il mercato dei materassi e delle reti in Italia (Italian)

February 2021, I Ed. , 47 pages

A detailed analysis of the mattress and the bed base market in Italy: basic data to 2020, consumption forecasts up to 2022, competitive system of the respective sectors, with company profiles, production of mattresses by material, production of bed bases by material and type. The analysis of e-commerce for mattresses in Italy is also included.