Trends in the European Office Market: the Dealer’s Point of View

Retail & Ecommerce | Office | December 2017

€1600

December 2017,

I Ed. ,

40 pages

Price (single user license):

EUR 1600 / USD 1728

For multiple/corporate license prices please contact us

Language: English

Report code: EU33a

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The European market for office furniture is currently showing signs of a general recovery. Following two years of consecutive growth the market is expected to further improve its performance in both 2018 and 2019.

In such a context, CSIL decided to launch a survey with the aim of understanding and describing the expectations of European office furniture distributors and the main sector trends over the next two years.

The study was launched to get a better understanding of the prospects for the office furniture sector in Europe by gathering the expectations of the distribution companies for the period 2018-2019. The analysis involved around 100 office furniture distributors (dealers, distributors, interior designers, specifiers) located in Western Europe and surveyed by CSIL in September-November 2017.

In particular the analysis concentrates on:

- The office furniture market and forecasts

- Quantification and performance of the main customer segments

- Factors influencing the purchasing decision

- Average customer budgets by product category, for both corporate tenders and individuals

- Trends for single office seating categories, use of sit-stand desks and evolution of office furniture areas

- Use of e-commerce and prospects

- Expansion of product portfolio and new product categories to be introduced

- Location of suppliers and delivery terms

The countries were divided into four areas according to their geographical proximity and similarity in market characteristics. These areas are:

- Scandinavia: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE);

- Central Europe (DACH): Germany (DE), Austria (AT) and Switzerland (CH);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL) and the United Kingdom (UK).

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

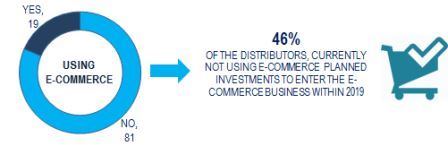

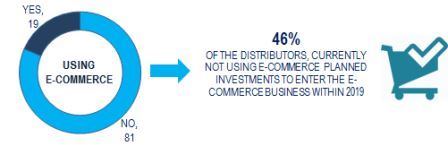

Sample. The use of e-commerce channel and perspectives. Percentages

The European market for office furniture is witnessing a general recovery. Following two years of consecutive growth, the market is expected to further improve its performance in both 2018 and 2019. In such a context this survey aimed at understanding and describing the expectations of European distributors regarding the main sector trends over the next two years.

As office distribution is progressively transforming from the simple supply of furniture items to a more global offer of service, consultancy and projects, the vast majority of survey respondents declared intentions to expand their offer and product portfolios.

Distributors are also paying attention to new instruments for approaching customers. The fact that customers (individuals and professionals in particular) look to Social Media for ideas, information and product reviews cannot be disregarded when developing a marketing and advertising campaign. In fact, a sizeable share of interviewees is considering investing in e-commerce by 2019.

The research findings are also shown by single geographic region and, when relevant, according to the size of the distributors (small or medium-large companies).

Abstract of Table of Contents

EXECUTIVE SUMMARY

1. INTRODUCTION

Contents

Methodology

Other CSIL reports on the office furniture industry and e-commerce

The sample

2. THE EUROPEAN OFFICE FURNITURE MARKET

Macroeconomics

The office furniture market

Forecasts

3. DISTRIBUTORS PRODUCT PORTFOLIO

Brand policy

Strategies

4. CUSTOMER ANALYSIS

Segments

The purchasing decision

Average customer budgets

5. PRODUCT TRENDS

Seating

Office spaces

Sit-stand desks

6. SUPPLIERS

Location of suppliers

Terms of delivery

7. E-COMMERCE EVOLUTION

E-commerce

ANNEX 1. THE QUESTIONNAIRE

The European market for office furniture is currently showing signs of a general recovery. Following two years of consecutive growth the market is expected to further improve its performance in both 2018 and 2019.

In such a context, CSIL decided to launch a survey with the aim of understanding and describing the expectations of European office furniture distributors and the main sector trends over the next two years.

The study was launched to get a better understanding of the prospects for the office furniture sector in Europe by gathering the expectations of the distribution companies for the period 2018-2019. The analysis involved around 100 office furniture distributors (dealers, distributors, interior designers, specifiers) located in Western Europe and surveyed by CSIL in September-November 2017.

In particular the analysis concentrates on:

- The office furniture market and forecasts

- Quantification and performance of the main customer segments

- Factors influencing the purchasing decision

- Average customer budgets by product category, for both corporate tenders and individuals

- Trends for single office seating categories, use of sit-stand desks and evolution of office furniture areas

- Use of e-commerce and prospects

- Expansion of product portfolio and new product categories to be introduced

- Location of suppliers and delivery terms

The countries were divided into four areas according to their geographical proximity and similarity in market characteristics. These areas are:

- Scandinavia: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE);

- Central Europe (DACH): Germany (DE), Austria (AT) and Switzerland (CH);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL) and the United Kingdom (UK).

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

Sample. The use of e-commerce channel and perspectives. Percentages

The European market for office furniture is witnessing a general recovery. Following two years of consecutive growth, the market is expected to further improve its performance in both 2018 and 2019. In such a context this survey aimed at understanding and describing the expectations of European distributors regarding the main sector trends over the next two years.

As office distribution is progressively transforming from the simple supply of furniture items to a more global offer of service, consultancy and projects, the vast majority of survey respondents declared intentions to expand their offer and product portfolios.

Distributors are also paying attention to new instruments for approaching customers. The fact that customers (individuals and professionals in particular) look to Social Media for ideas, information and product reviews cannot be disregarded when developing a marketing and advertising campaign. In fact, a sizeable share of interviewees is considering investing in e-commerce by 2019.

The research findings are also shown by single geographic region and, when relevant, according to the size of the distributors (small or medium-large companies).

Abstract of Table of Contents

EXECUTIVE SUMMARY

1. INTRODUCTION

Contents

Methodology

Other CSIL reports on the office furniture industry and e-commerce

The sample

2. THE EUROPEAN OFFICE FURNITURE MARKET

Macroeconomics

The office furniture market

Forecasts

3. DISTRIBUTORS PRODUCT PORTFOLIO

Brand policy

Strategies

4. CUSTOMER ANALYSIS

Segments

The purchasing decision

Average customer budgets

5. PRODUCT TRENDS

Seating

Office spaces

Sit-stand desks

6. SUPPLIERS

Location of suppliers

Terms of delivery

7. E-COMMERCE EVOLUTION

E-commerce

ANNEX 1. THE QUESTIONNAIRE

SEE ALSO

The world office furniture industry

December 2023, XII Ed. , 442 pages

A comprehensive picture of the global office furniture sector with production, consumption imports, and export data for the time series 2014-2023, international trade, market forecasts for the years 2024 and 2025, profiles of the leading office furniture manufacturers, and summary tables for 60 countries. Focus on the Top 20 office furniture countries.

The world market for Height Adjustable Tables

November 2023, I Ed. , 80 pages

A comprehensive analysis of the Height Adjustable Tables (HAT) market, delving into key players (manufacturers and suppliers), trends, and market forecasts by major world areas and relevant regions, focusing on product destinations.

The world market for office seating

November 2023, II Ed. , 162 pages

A comprehensive report analysing key statistics of the global office seating industry, including production, consumption, and international trade for the 2018-2023 time series, office seating market forecasts for 2024 and 2025, the leading companies, a range of products and their features, with a focus on three world regions (North America, Europe, and Asia-Pacific) and key countries.

The office furniture market in North America. The United States, Canada, and Mexico

July 2023, VII Ed. , 129 pages

Analysis of the office furniture industry in North America with a focus on the USA, Canada and Mexico. Value of office furniture market, market forecasts, figures by country, market share of leading companies, distribution channels

The European market for office furniture

June 2023, XXXV Ed. , 281 pages

An extensive analysis of the office furniture sector in Europe, with historical data on key indicators, and demand prospects, delving into the performance of the leading manufacturers, the product categories, and the distribution.