February 2024,

XVII Ed. ,

296 pages

Price (single user license):

EUR 3500 / USD 3745

For multiple/corporate license prices please contact us

Language: English

Report code: EU09

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

Download

Abstract

CSIL Market Research Report Furniture retailing in Europe offers an in-depth analysis of the home furniture distribution in 15 European countries (Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Poland, Spain, Sweden, Switzerland and the United Kingdom) with trends in home furniture consumption, market forecasts, data by country, analysis by distribution channel, retail formats and sales performances of leading home furniture retailers.

This report aims to provide information on the following topics:

- Value of the home furniture market and its historical and forecasted trends in Europe and for each considered market

- The main structural changes affecting the sector (e.g. concentration process, the impact of large-scale organized specialist distribution, the online channel)

- Market share of each distribution channel

- Country peculiarities in furniture retailing

- Listing the leading home furniture retailers by home furniture sales, in Europe and for each considered country

- Identifying the most important and recent retailers’ M&A operations affecting the furniture market

STRUCTURE OF THE REPORT

SECTION I.: Basic data and overview of the European home furniture market trends, its main demand determinants and the distribution channel’s structure.

The section also presents the ranking of the 30 leading retailers by home furniture sales in Europe, the full sample of leading furniture retailers active in Europe with summary tables and characteristics of the selection of companies for which is available a detailed profile in the report and a financial performance analysis of the sample considered. Significant mergers, acquisitions, and agreements that occurred in the last 5 years among leading furniture retailers are also provided.

SECTION II.: Each country chapter provides basic data on consumption trends, furniture segments, imports, the structure of the distribution channels and detailed company profiles of the leading furniture retailers operating on the reference markets.

Profiles include basic data (total revenues, estimated home furniture revenues, employees, number of stores), type of retailing format, product specialization, brands, online sales, and other information, such as website and product portfolio.

CSIL worked on extensive data gathering, including market data and detailed financial figures for around 350 retailers (the main actors operating in Europe).

Over 760 furniture retailers and buying groups, of which 175 with detailed profiles are mentioned in the study.

Home furniture market is broken down by distribution channel: Organized specialist distributors (furniture chains, franchises, buying groups); Independent furniture retailers; Non specialist distributors (department stores, multi-stores, DIY); e-commerce; Other (direct sales and handicraft).

The estimate of online share is available for markets included in the report.

Furniture segments included: Kitchen furniture; Upholstered furniture; Furniture for bedroom, dining and living rooms; Mattresses; Non-Upholstered seats

Timeframe considered: 2014-2023 and furniture market forecasts in real terms for 2024 and 2025.

Selected companies

Amazon, De Mandemakers, DFS, Fournier, Howden Joinery, IKEA, John Lewis, La Redoute, Lars Larsen, Maisons du Monde, Migros, Mondo Convenienza, Otto Group, Poltronesofà, Sainsbury’s / Home Retail, Schmidt Grupe, Segmüller Gruppe, Wayfair, XXXLutz, El Corte Inglés, Furniture Village, Wayfair, Krieger-Gruppe, Nobia, Mobilux (BUT International), West Retail Group, Tessner Holding

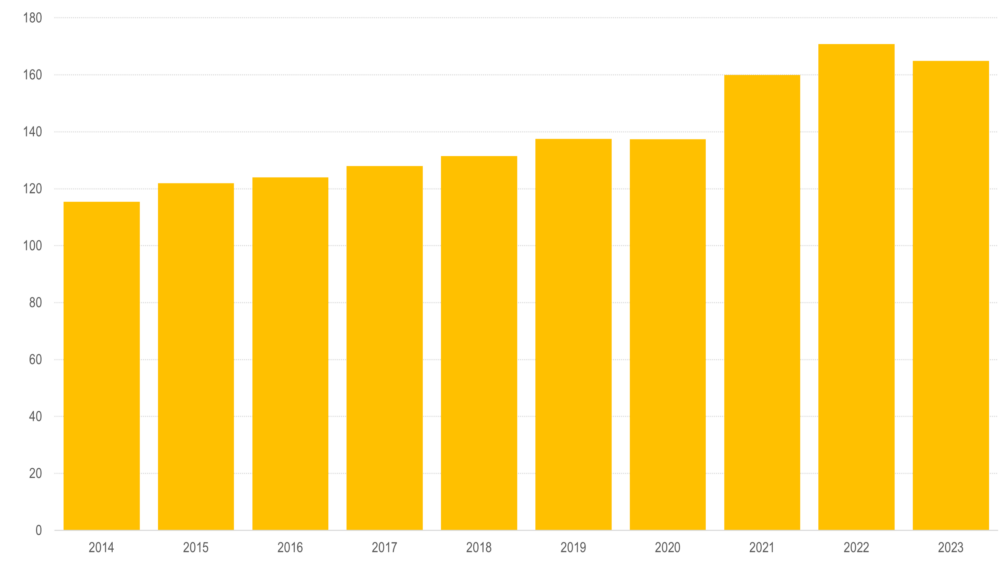

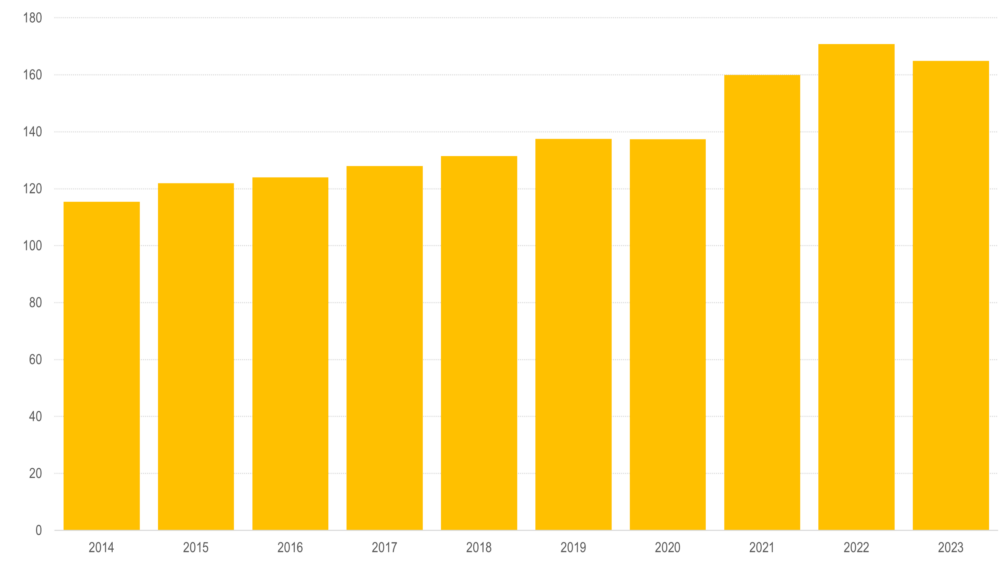

Europe. Total home furniture consumption, 2014-2023*. Euro billion.

Source: CSIL. (*): 2023 preliminary estimates

According to CSIL, the European furniture retailing market is a EUR 165 billion market. The market exhibited robust growth in 2021, followed by a deceleration in 2022, and a contraction in 2023. During the last decade, the furniture retailing sector has experienced structural changes. Even though the market is dominated by large-scale furniture retailers (further bolstered by significant merger and acquisition activities in the past two years), small-scale independent stores showed resilience and adaptability facing competition from larger retailers and online platforms. Moreover, the online channel has been an undeniable game changer in the furniture market during the pandemic outbreak, and it has continued to maintain a strong position well above pre-pandemic levels.

Abstract of Table of Contents

METHODOLOGY AND SCOPES OF THE REPORT

– Structure of the report, Data gathering and processing methodology, Geographical coverage, Product covered and definitions, Exchange rates

EUROPEAN HOME FURNITURE MARKET PERFORMANCE

Home furniture market performance

Market dynamic

– Europe. Home furniture retail sales; Per household home furniture consumption

Prices

Macroeconomic context and indicators

Home furniture consumption by country

Furniture market forecasts

Imports penetration

– Home furniture market. Breakdown by national production and imports from extra-Europe areas

– Home furniture imports from Asia and Pacific by country

Home furniture segments: Kitchen furniture; Upholstered furniture; Furniture for bedroom, dining and living rooms; Mattresses; Non-Upholstered seats

– Development of home furniture consumption by segment

– Home furniture imports/home furniture consumption ratio by segment

Market trends

Products: Home office, Outdoor furniture, RTA furniture,

Home Furniture Distribution Channels

Business demography: Europe. Retail sale of furniture, lighting equipment and other household articles in specialized stores. Enterprises and persons employed

Retailer definition. Pure and mixed businesses

Distribution channels: trends

Home furniture consumption by distribution channel: Specialised, Non-specialised distribution, E-commerce, Others

Leading Home Furniture Retailers

Home Furniture Sales for a selection of leading furniture retailers in Europe

Financial performance

– Sales development, KPIs

Market concentration

Market shares of the top 5, top 10, top 15 and top 30 retailers.

– Leading furniture retailers by home furniture sales

– M&A deals of the leading furniture retailers

Summary tables

– The sample of leading furniture retailers in Europe

– The sample of leading furniture buying groups in Europe

PART II. ANALYSIS BY COUNTRY

For each considered country: Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Spain, Sweden, Switzerland, United Kingdom

Home furniture market and performance

– Home furniture consumption, Home furniture imports, Trend in home furniture prices

– Home furniture consumption by segment

Home furniture distribution channels

– Home furniture sales by distribution channel

Leading furniture retailers

– Profiles of leading furniture retailers

– Other furniture retailers operating in the country

Forecasts and demand determinants

Home furniture imports

CSIL Market Research Report Furniture retailing in Europe offers an in-depth analysis of the home furniture distribution in 15 European countries (Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Poland, Spain, Sweden, Switzerland and the United Kingdom) with trends in home furniture consumption, market forecasts, data by country, analysis by distribution channel, retail formats and sales performances of leading home furniture retailers.

This report aims to provide information on the following topics:

- Value of the home furniture market and its historical and forecasted trends in Europe and for each considered market

- The main structural changes affecting the sector (e.g. concentration process, the impact of large-scale organized specialist distribution, the online channel)

- Market share of each distribution channel

- Country peculiarities in furniture retailing

- Listing the leading home furniture retailers by home furniture sales, in Europe and for each considered country

- Identifying the most important and recent retailers’ M&A operations affecting the furniture market

STRUCTURE OF THE REPORT

SECTION I.: Basic data and overview of the European home furniture market trends, its main demand determinants and the distribution channel’s structure.

The section also presents the ranking of the 30 leading retailers by home furniture sales in Europe, the full sample of leading furniture retailers active in Europe with summary tables and characteristics of the selection of companies for which is available a detailed profile in the report and a financial performance analysis of the sample considered. Significant mergers, acquisitions, and agreements that occurred in the last 5 years among leading furniture retailers are also provided.

SECTION II.: Each country chapter provides basic data on consumption trends, furniture segments, imports, the structure of the distribution channels and detailed company profiles of the leading furniture retailers operating on the reference markets.

Profiles include basic data (total revenues, estimated home furniture revenues, employees, number of stores), type of retailing format, product specialization, brands, online sales, and other information, such as website and product portfolio.

CSIL worked on extensive data gathering, including market data and detailed financial figures for around 350 retailers (the main actors operating in Europe).

Over 760 furniture retailers and buying groups, of which 175 with detailed profiles are mentioned in the study.

Home furniture market is broken down by distribution channel: Organized specialist distributors (furniture chains, franchises, buying groups); Independent furniture retailers; Non specialist distributors (department stores, multi-stores, DIY); e-commerce; Other (direct sales and handicraft).

The estimate of online share is available for markets included in the report.

Furniture segments included: Kitchen furniture; Upholstered furniture; Furniture for bedroom, dining and living rooms; Mattresses; Non-Upholstered seats

Timeframe considered: 2014-2023 and furniture market forecasts in real terms for 2024 and 2025.

Europe. Total home furniture consumption, 2014-2023*. Euro billion.

Source: CSIL. (*): 2023 preliminary estimates

According to CSIL, the European furniture retailing market is a EUR 165 billion market. The market exhibited robust growth in 2021, followed by a deceleration in 2022, and a contraction in 2023. During the last decade, the furniture retailing sector has experienced structural changes. Even though the market is dominated by large-scale furniture retailers (further bolstered by significant merger and acquisition activities in the past two years), small-scale independent stores showed resilience and adaptability facing competition from larger retailers and online platforms. Moreover, the online channel has been an undeniable game changer in the furniture market during the pandemic outbreak, and it has continued to maintain a strong position well above pre-pandemic levels.

Abstract of Table of Contents

METHODOLOGY AND SCOPES OF THE REPORT

– Structure of the report, Data gathering and processing methodology, Geographical coverage, Product covered and definitions, Exchange rates

EUROPEAN HOME FURNITURE MARKET PERFORMANCE

Home furniture market performance

Market dynamic

– Europe. Home furniture retail sales; Per household home furniture consumption

Prices

Macroeconomic context and indicators

Home furniture consumption by country

Furniture market forecasts

Imports penetration

– Home furniture market. Breakdown by national production and imports from extra-Europe areas

– Home furniture imports from Asia and Pacific by country

Home furniture segments: Kitchen furniture; Upholstered furniture; Furniture for bedroom, dining and living rooms; Mattresses; Non-Upholstered seats

– Development of home furniture consumption by segment

– Home furniture imports/home furniture consumption ratio by segment

Market trends

Products: Home office, Outdoor furniture, RTA furniture,

Home Furniture Distribution Channels

Business demography: Europe. Retail sale of furniture, lighting equipment and other household articles in specialized stores. Enterprises and persons employed

Retailer definition. Pure and mixed businesses

Distribution channels: trends

Home furniture consumption by distribution channel: Specialised, Non-specialised distribution, E-commerce, Others

Leading Home Furniture Retailers

Home Furniture Sales for a selection of leading furniture retailers in Europe

Financial performance

– Sales development, KPIs

Market concentration

Market shares of the top 5, top 10, top 15 and top 30 retailers.

– Leading furniture retailers by home furniture sales

– M&A deals of the leading furniture retailers

Summary tables

– The sample of leading furniture retailers in Europe

– The sample of leading furniture buying groups in Europe

PART II. ANALYSIS BY COUNTRY

For each considered country: Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Spain, Sweden, Switzerland, United Kingdom

Home furniture market and performance

– Home furniture consumption, Home furniture imports, Trend in home furniture prices

– Home furniture consumption by segment

Home furniture distribution channels

– Home furniture sales by distribution channel

Leading furniture retailers

– Profiles of leading furniture retailers

– Other furniture retailers operating in the country

Forecasts and demand determinants

Home furniture imports

SEE ALSO

Top 100 mattress specialist retailers in Europe

November 2023, I Ed. , 14 pages

A bird’s eye view of players in the European mattress market with a ranking of the 100 leading mattress specialist retailers in Europe.

E-commerce in the mattress industry

September 2023, V Ed. , 102 pages

Detailed analysis of the global e-commerce mattress markets with a focus on North America, Europe, and the Asia Pacific. Features of the online mattress business, the current incidence of online mattress sales by geographical areas and in key countries, the major markets, e-commerce mattress sales of the leading retailers by area, and company profiles of top players operating in the online mattress sector.

La distribuzione del mobile in Italia. Analisi per provincia (Italian)

July 2023, XX Ed. , 174 pages

This report provides a detailed picture of the Italian furniture market and retailing, for the whole national market and by province, providing the size and development of the home furniture market and its segments, market shares and development of distribution channels, estimated home furniture sales for key retailers, in-depth analysis of both large retail chains and independent retailers, companies’ strategies and trends

Top 100 furniture retailers in Europe

November 2022, I Ed. , 15 pages

Analysis of the European Furniture retail competitive landscape: ranking of the 100 leading retailers, with company name, group, headquarter location, website, brands, estimated home furniture turnover, and number of stores.

E-commerce for the furniture industry

November 2022, IX Ed. , 118 pages

This report analyses e-commerce in the furniture market, with a focus on key geographical areas (Europe, North America, and Asia Pacific) and key countries, providing current market size, e-commerce business models, the performance of the leading players, and the results of a CSIL survey to furniture manufacturers that highlights their approach to the web channel, their strategies, future expectations, and the most-demanded furniture products online.