June 2023,

XXXV Ed. ,

281 pages

Price (single user license):

EUR 3500 / USD 3815

For multiple/corporate license prices please contact us

Language: English

Report code: EU02

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The CSIL Report The European Market for Office Furniture offers an extensive analysis of the office furniture sector in Europe across 30 countries, through the historical series of key indicators, the market prospects, and delves into the performance of major manufacturers, the product categories and the distribution channels. With this in-depth research, CSIL also highlights and assesses the primary macro trends which are impacting the sector, such as features of the supply system, hybrid work solutions, and sustainability.

MARKET EVOLUTION AND FIGURES BY COUNTRY

The report provides a comprehensive analysis of the European office furniture sector, including demand drivers, production and price trends, macroeconomic indicators, workforce statistics, and 2017-2022 values of office furniture production, consumption, imports, and exports and 2023 and 2024 office furniture consumption forecasts for Europe as a whole and by country.

The international trade of office furniture is thoroughly examined, providing a breakdown of European office furniture imports and exports by country and product type (office furniture and office seating), alongside key trading partners.

COMPETITION: KEY PLAYERS IN THE EUROPEAN OFFICE FURNITURE SECTOR

The study presents sales data and market shares (including trends), significant events in the competitive landscape, and mergers and acquisitions involving the leading European office furniture manufacturers.

Sales of the largest European office furniture manufacturers and their market share are provided on both a country level and for specific sub-segments, accompanied by brief profiles of selected firms.

Extra-European business: Office furniture sales Extra-European Union and Russia, Middle East, Asia Pacific, North America, Central-South America, and Africa are provided for a sample of European companies.

Additionally, the report includes the addresses of over 300 office furniture companies

SUPPLY STRUCTURE, TYPES OF PRODUCTS AND TRENDS

In this new edition, the analysis of the office furniture supply structure has been further deepened.

European office furniture production is broken down by types of products (Seating, Operative Desking, Partitions / Acoustic Filing / Storage, Communal Areas, and Executive Furniture). For each one the report includes production values for the time series 2017-2022. The values of Office furniture by segment are also provided for selected countries (Germany, Italy, France, United Kingdom, Sweden, Spain, Poland, and the Czech Republic)

- Office Seating: production values, breakdown by type and by covering and supply by type in a sample of companies.

FOCUS ON: Swivel Chairs. A detailed analysis of office seating volumes and brand positioning. Brand positioning by average net price and total units sold are given on a European level. The number and the performance of swivel chairs sold in the time series 2019-2022 are also provided for the major countries (Germany, France, United Kingdom, Italy, Spain, Poland, and Sweden). Values include both products manufactured in Europe and products imported from extra-European countries. - Operative Desking: production values, the breakdown between freestanding and panel-based desking, and supply by freestanding and panel-based desking in a sample of companies.

FOCUS ON: Height Adjustable Tables (HAT) , production of sit-standing desks by the main country/region (Scandinavia, DACH, Benelux, Italy, France, United Kingdom, Spain & Portugal, Poland, Other) and breakdown of desking supply between fixed and height adjustable, in a sample of companies. - Executive Furniture: production values.

- Filing Systems: production values, breakdown by type and supply by type in a sample of companies

- Walls, Partitions and Acoustic Products: production values, partition walls by type, supply by type in a sample of companies.

FOCUS ON: Phone Booths and Acoustic Pods, values of production of phone booths and acoustic pods, phone booths and acoustic pods by kind, average list prices, a sample of brand and products by year of launch, and price segment. - Furniture for Meeting Rooms and Communal Areas: production values and breakdown by type.

HYBRID WORK AND HOME OFFICE: In the light of the latest insights (see ‘Home office furniture market in Europe‘) and the most recent CSIL analysis, this report outlines trends in the Home-Office furniture market, through demand drivers and incidence on total European office furniture consumption.

MARKET AND DISTRIBUTION

The analysis of office furniture distribution channels covers Direct sales, Specialist dealers, Non-specialists, and E-commerce, with the incidence in the major European markets. A breakdown of office furniture sales by distribution channel is available for the top companies.

GEOGRAPHICAL COVERAGE:

- Northern Europe: Denmark (DK), Finland (FI), Norway (NO), and Sweden (SE);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL), and the United Kingdom (UK). Unless otherwise specified, figures for Belgium include those for Luxembourg;

- Central Europe (DACH): Germany (DE), Austria (AT), and Switzerland (CH);

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT), and Spain (ES);

- Central-Eastern Europe: Poland (PL), Czech Republic (CZ), Slovakia (SK), Hungary (HU) and Romania (RO), Slovenia (SL), Croatia (HR), Bulgaria (BG), Cyprus (CY), Malta (MT), Estonia (EE), Latvia (LV), Lithuania (LT)

Selected companies

Ahrend, Assmann, Buzzi Space, Estel, Flokk, Framery, Haworth, MillerKnoll, Interstuhl, Isku, Kinnarps, König + Neurath, Las Mobili, Martela, Narbutas, Nowy Styl, Quadrifoglio, Sedus Stoll, Senator, Sokoa, Steelcase, Topstar-Wagner, Unifor, USM, Vitra, Wilkhahn

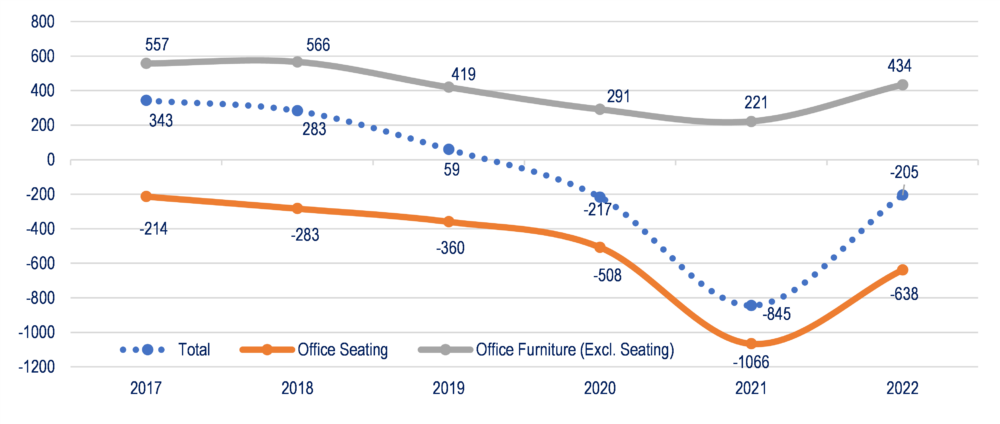

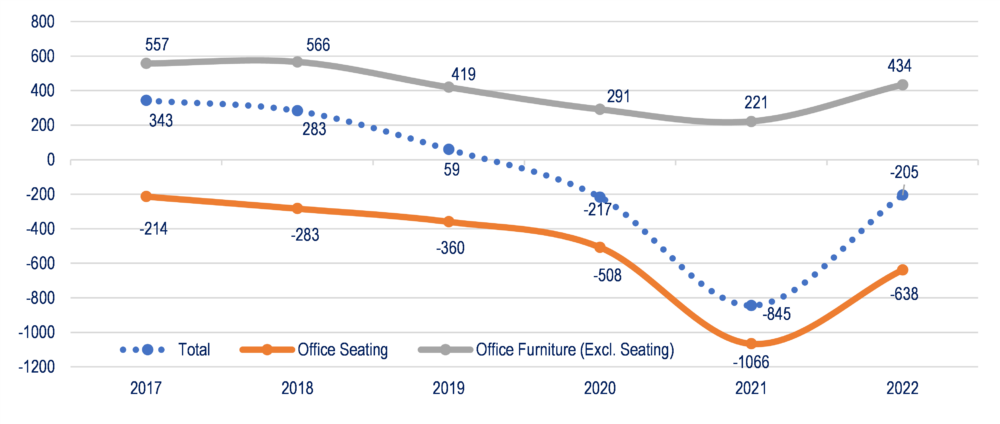

Europe. Trade balance by segment, 2017-2022. EUR Million and percentages

The European office furniture sector is showing signs of recovery, exceeding the pre-pandemic levels. Growth is however strongly influenced by rising inflation. Production values increased by a remarkable +13% in 2022, driven by double-digit price increases. Consequently, the actual volume of production in Europe grew moderately.

Over the past years, we have witnessed the acceleration of various structural processes that have resulted in the demand for more flexible office spaces, multi-format environments, and remote working locations including private homes. These changes have had a noticeable impact, leading to significant shifts in the market share of different product segments.

Abstract of Table of Contents

METHODOLOGY, DEFINITIONS AND NOTES

EXECUTIVE SUMMARY: KEY FACTORS DRIVING THE OFFICE FURNITURE INDUSTRY IN EUROPE

1. MARKET SCENARIO: Trends, product types and figures by country

1.1 Market evolution and figures by country 2017-2022: Office furniture production values and prices, consumption and international trade

1.2 Demand drivers

1.3 Leading groups in Europe and their market shares

1.4 Current trends and market forecasts for 2023 and 2024

2. BUSINESS PERFORMANCE: Basic data e and macroeconomic indicators by region and by country

2.1 Northern Europe (Denmark, Finland, Norway and Sweden)

2.2 Western Europe (Belgium, France, Ireland, Netherlands, the UK)

2.3 Central Europe (DACH: Austria, Germany, Switzerland)

2.4 Southern Europe (Greece, Italy, Portugal, Spain)

2.5 Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovenia, Slovakia)

3. THE INTERNATIONAL TRADE OF OFFICE FURNITURE

3.1 Trade balance by segment

3.2 Exports: by country and segments

3.3 Extra-European destinations

3.4 Imports: by country and segments

3.5 Leading supplying countries

4. SUPPLY STRUCTURE AND PRODUCT SEGMENTS

4.1 Product segments: Office furniture by segment in Europe and in selected countries

- – Office seating: production values, breakdown by type and covering and supply by type in a sample of companies

- – Operative desking: production values, freestanding and panel-based desking, supply by freestanding and panel-based desking in a sample of companies

- – Executive furniture: production values

- – Filing systems: production values, breakdown by type, supply by type in a sample of companies

- – Walls, partitions and acoustic products: production values, partition walls by type, supply by type in a sample of companies

- – Furniture for meeting rooms and communal areas: production values and breakdown by type

FOCUS ON

4.2 Phone booths and acoustic pods in Europe: values of production of phone booths and acoustic pods, phone booths and acoustic pods by kind, average list prices, a sample of brand and products by year of launch, and price segment.

4.3 Height Adjustable Tables (HAT) in Europe:production of sit-standing desks by the main country/region and breakdown of desking supply between fixed and height adjustable, in a sample of companies

4.4 Employment and investment activity

4.5 Sustainability and reuse

5. MARKET AND DISTRIBUTION: Office furniture Sales by distribution channel

5.1 Hybrid work and home office: incidence on office furniture consumption

5.2 Swivel chairs in Europe: volumes and brand positioning

THE COMPETITIVE LANDSCAPE

- – Sales and market shares of the leading manufacturers by product category

- – Sales and market shares of the leading manufacturers by major markets

APPENDIX 1: International Trade Tables

APPENDIX 2: List of Mentioned Companies

The CSIL Report The European Market for Office Furniture offers an extensive analysis of the office furniture sector in Europe across 30 countries, through the historical series of key indicators, the market prospects, and delves into the performance of major manufacturers, the product categories and the distribution channels. With this in-depth research, CSIL also highlights and assesses the primary macro trends which are impacting the sector, such as features of the supply system, hybrid work solutions, and sustainability.

MARKET EVOLUTION AND FIGURES BY COUNTRY

The report provides a comprehensive analysis of the European office furniture sector, including demand drivers, production and price trends, macroeconomic indicators, workforce statistics, and 2017-2022 values of office furniture production, consumption, imports, and exports and 2023 and 2024 office furniture consumption forecasts for Europe as a whole and by country.

The international trade of office furniture is thoroughly examined, providing a breakdown of European office furniture imports and exports by country and product type (office furniture and office seating), alongside key trading partners.

COMPETITION: KEY PLAYERS IN THE EUROPEAN OFFICE FURNITURE SECTOR

The study presents sales data and market shares (including trends), significant events in the competitive landscape, and mergers and acquisitions involving the leading European office furniture manufacturers.

Sales of the largest European office furniture manufacturers and their market share are provided on both a country level and for specific sub-segments, accompanied by brief profiles of selected firms.

Extra-European business: Office furniture sales Extra-European Union and Russia, Middle East, Asia Pacific, North America, Central-South America, and Africa are provided for a sample of European companies.

Additionally, the report includes the addresses of over 300 office furniture companies

SUPPLY STRUCTURE, TYPES OF PRODUCTS AND TRENDS

In this new edition, the analysis of the office furniture supply structure has been further deepened.

European office furniture production is broken down by types of products (Seating, Operative Desking, Partitions / Acoustic Filing / Storage, Communal Areas, and Executive Furniture). For each one the report includes production values for the time series 2017-2022. The values of Office furniture by segment are also provided for selected countries (Germany, Italy, France, United Kingdom, Sweden, Spain, Poland, and the Czech Republic)

- Office Seating: production values, breakdown by type and by covering and supply by type in a sample of companies.

FOCUS ON: Swivel Chairs. A detailed analysis of office seating volumes and brand positioning. Brand positioning by average net price and total units sold are given on a European level. The number and the performance of swivel chairs sold in the time series 2019-2022 are also provided for the major countries (Germany, France, United Kingdom, Italy, Spain, Poland, and Sweden). Values include both products manufactured in Europe and products imported from extra-European countries. - Operative Desking: production values, the breakdown between freestanding and panel-based desking, and supply by freestanding and panel-based desking in a sample of companies.

FOCUS ON: Height Adjustable Tables (HAT) , production of sit-standing desks by the main country/region (Scandinavia, DACH, Benelux, Italy, France, United Kingdom, Spain & Portugal, Poland, Other) and breakdown of desking supply between fixed and height adjustable, in a sample of companies. - Executive Furniture: production values.

- Filing Systems: production values, breakdown by type and supply by type in a sample of companies

- Walls, Partitions and Acoustic Products: production values, partition walls by type, supply by type in a sample of companies.

FOCUS ON: Phone Booths and Acoustic Pods, values of production of phone booths and acoustic pods, phone booths and acoustic pods by kind, average list prices, a sample of brand and products by year of launch, and price segment. - Furniture for Meeting Rooms and Communal Areas: production values and breakdown by type.

HYBRID WORK AND HOME OFFICE: In the light of the latest insights (see ‘Home office furniture market in Europe‘) and the most recent CSIL analysis, this report outlines trends in the Home-Office furniture market, through demand drivers and incidence on total European office furniture consumption.

MARKET AND DISTRIBUTION

The analysis of office furniture distribution channels covers Direct sales, Specialist dealers, Non-specialists, and E-commerce, with the incidence in the major European markets. A breakdown of office furniture sales by distribution channel is available for the top companies.

GEOGRAPHICAL COVERAGE:

- Northern Europe: Denmark (DK), Finland (FI), Norway (NO), and Sweden (SE);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL), and the United Kingdom (UK). Unless otherwise specified, figures for Belgium include those for Luxembourg;

- Central Europe (DACH): Germany (DE), Austria (AT), and Switzerland (CH);

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT), and Spain (ES);

- Central-Eastern Europe: Poland (PL), Czech Republic (CZ), Slovakia (SK), Hungary (HU) and Romania (RO), Slovenia (SL), Croatia (HR), Bulgaria (BG), Cyprus (CY), Malta (MT), Estonia (EE), Latvia (LV), Lithuania (LT)

Europe. Trade balance by segment, 2017-2022. EUR Million and percentages

The European office furniture sector is showing signs of recovery, exceeding the pre-pandemic levels. Growth is however strongly influenced by rising inflation. Production values increased by a remarkable +13% in 2022, driven by double-digit price increases. Consequently, the actual volume of production in Europe grew moderately.

Over the past years, we have witnessed the acceleration of various structural processes that have resulted in the demand for more flexible office spaces, multi-format environments, and remote working locations including private homes. These changes have had a noticeable impact, leading to significant shifts in the market share of different product segments.

Abstract of Table of Contents

METHODOLOGY, DEFINITIONS AND NOTES

EXECUTIVE SUMMARY: KEY FACTORS DRIVING THE OFFICE FURNITURE INDUSTRY IN EUROPE

1. MARKET SCENARIO: Trends, product types and figures by country

1.1 Market evolution and figures by country 2017-2022: Office furniture production values and prices, consumption and international trade

1.2 Demand drivers

1.3 Leading groups in Europe and their market shares

1.4 Current trends and market forecasts for 2023 and 2024

2. BUSINESS PERFORMANCE: Basic data e and macroeconomic indicators by region and by country

2.1 Northern Europe (Denmark, Finland, Norway and Sweden)

2.2 Western Europe (Belgium, France, Ireland, Netherlands, the UK)

2.3 Central Europe (DACH: Austria, Germany, Switzerland)

2.4 Southern Europe (Greece, Italy, Portugal, Spain)

2.5 Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovenia, Slovakia)

3. THE INTERNATIONAL TRADE OF OFFICE FURNITURE

3.1 Trade balance by segment

3.2 Exports: by country and segments

3.3 Extra-European destinations

3.4 Imports: by country and segments

3.5 Leading supplying countries

4. SUPPLY STRUCTURE AND PRODUCT SEGMENTS

4.1 Product segments: Office furniture by segment in Europe and in selected countries

- – Office seating: production values, breakdown by type and covering and supply by type in a sample of companies

- – Operative desking: production values, freestanding and panel-based desking, supply by freestanding and panel-based desking in a sample of companies

- – Executive furniture: production values

- – Filing systems: production values, breakdown by type, supply by type in a sample of companies

- – Walls, partitions and acoustic products: production values, partition walls by type, supply by type in a sample of companies

- – Furniture for meeting rooms and communal areas: production values and breakdown by type

FOCUS ON

4.2 Phone booths and acoustic pods in Europe: values of production of phone booths and acoustic pods, phone booths and acoustic pods by kind, average list prices, a sample of brand and products by year of launch, and price segment.

4.3 Height Adjustable Tables (HAT) in Europe:production of sit-standing desks by the main country/region and breakdown of desking supply between fixed and height adjustable, in a sample of companies

4.4 Employment and investment activity

4.5 Sustainability and reuse

5. MARKET AND DISTRIBUTION: Office furniture Sales by distribution channel

5.1 Hybrid work and home office: incidence on office furniture consumption

5.2 Swivel chairs in Europe: volumes and brand positioning

THE COMPETITIVE LANDSCAPE

- – Sales and market shares of the leading manufacturers by product category

- – Sales and market shares of the leading manufacturers by major markets

APPENDIX 1: International Trade Tables

APPENDIX 2: List of Mentioned Companies

SEE ALSO

The world office furniture industry

December 2023, XII Ed. , 442 pages

A comprehensive picture of the global office furniture sector with production, consumption imports, and export data for the time series 2014-2023, international trade, market forecasts for the years 2024 and 2025, profiles of the leading office furniture manufacturers, and summary tables for 60 countries. Focus on the Top 20 office furniture countries.

The world market for Height Adjustable Tables

November 2023, I Ed. , 80 pages

A comprehensive analysis of the Height Adjustable Tables (HAT) market, delving into key players (manufacturers and suppliers), trends, and market forecasts by major world areas and relevant regions, focusing on product destinations.

The world market for office seating

November 2023, II Ed. , 162 pages

A comprehensive report analysing key statistics of the global office seating industry, including production, consumption, and international trade for the 2018-2023 time series, office seating market forecasts for 2024 and 2025, the leading companies, a range of products and their features, with a focus on three world regions (North America, Europe, and Asia-Pacific) and key countries.

The office furniture market in North America. The United States, Canada, and Mexico

July 2023, VII Ed. , 129 pages

Analysis of the office furniture industry in North America with a focus on the USA, Canada and Mexico. Value of office furniture market, market forecasts, figures by country, market share of leading companies, distribution channels

Home office furniture market in Europe

September 2022, III Ed. , 115 pages

Trends in the home office furniture segment and hybrid working in Europe, demand drivers, market size and evolution, sales of home office furniture, distribution, manufacturers, retailers, and main results of the CSIL survey on a sample of end-users, aiming at analysing the home office environment, the furniture products, the purchasing process, the expected budgets and channels.