September 2021,

I Ed. ,

80 pages

Price (single user license):

EUR 1600 / USD 1744

For multiple/corporate license prices please contact us

Language: English

Report code: S85

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The aim of the Report “ The world market for Horticultural Lighting” is to better understand the global market for horticultural lighting, its competitive landscape, and the new opportunities arising from the growth of the agritech business.

Horticulture lighting is a technology that stimulates photosynthesis in plants by emitting suitable wavelength. The scope of the analysis includes different types of horticulture lighting installations: Top lighting, Vertical farming, Interlighting (intracanopy lighting). These lighting systems playing several roles in plant growth: supplemental lighting, photoperiodic lighting, and sole-source lighting.

The analysis has been based on a mixed methodology, combining primary and secondary research:

- Desk research. The desk research will include available data from CSIL database; web surfing; balance-sheets and related international databases; collected statistics (Eurostat, IMF, World Bank, etc).

- Field analysis. Direct interviews with industry testimonials.

The geographical classification is as follows:

- North America: United States and Canada.

- Latin America: Argentina, Brazil, Chile, Colombia, Mexico, Venezuela.

- Europe: Austria, Belgium (including Luxembourg), Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, and United Kingdom.

- CSI countries: Belarus, Kazakhstan, Russia, Serbia, Turkey, and Ukraine.

- Asia-Pacific: Australia, China, India, Indonesia, Malaysia, Japan, New Zealand, Philippines, Singapore, South Korea, Taiwan, Thailand, Vietnam.

- Middle East: Algeria, Bahrain, Egypt, Israel, Jordan, Kuwait, Lebanon, Morocco, Oman, Qatar, Saudi Arabia, South Africa, Tunisia, United Arab Emirates.

- Rest of the world: remaining countries.

The Report provides estimates 2018-2020 and forecasts 2021-2023 of Total and LED-based consumption of horticultural lighting fixtures at global level and broken down by geographical area.

The horticultural lighting fixtures demand is broken down by Light Source (Conventional and LED) and by Application (Greenhouses, Indoor and Vertical Farming, and Others, which include R&D, animal barns, and aquaculture). The Cannabis business encompasses both the Greenhouse segment and the Indoor and vertical farming segment, therefore is treated as a separate section. The Distribution Channels and Reference Prices are examined. The Technological Evolution of the horticultural lighting industry is provided by analysing Intellectual Property (IP) applications

The competitive system analyses the main companies active in the horticultural lighting fixtures market are reported with data on sales, market shares, and short company profiles.

The main Market Drivers (food demand and population dynamics, climate change and weather uncertainty, and cannabis legislation evolution) together with the Other Players operating in the agritech industry complete the study.

Selected companies

ABC Lights, Aessense grows, Ardatovskiy Lighting Plant (ASTZ), Aurea Lighting, Barron Lighting Group , Bios – Biological Innovation and Optimization Systems, LLC, BL Trade (Boos Lighting Group) , California LightWorks, Candidus, Cree Inc, Current powered by GE, DN Lighting Co Ltd – DNL, EVE Lighting Co Ltd, Everlight Electronics Co Ltd, Fagerhult Belysning AB, Faros Group, Fiberli, Fohse Inc., Fluence by Osram, Signify

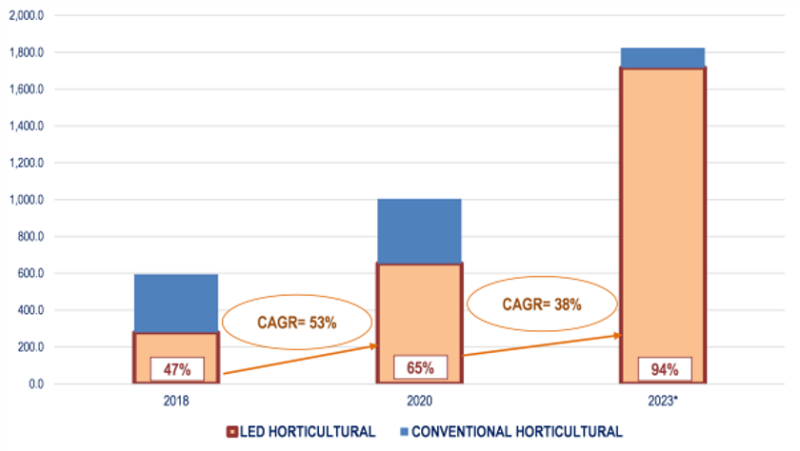

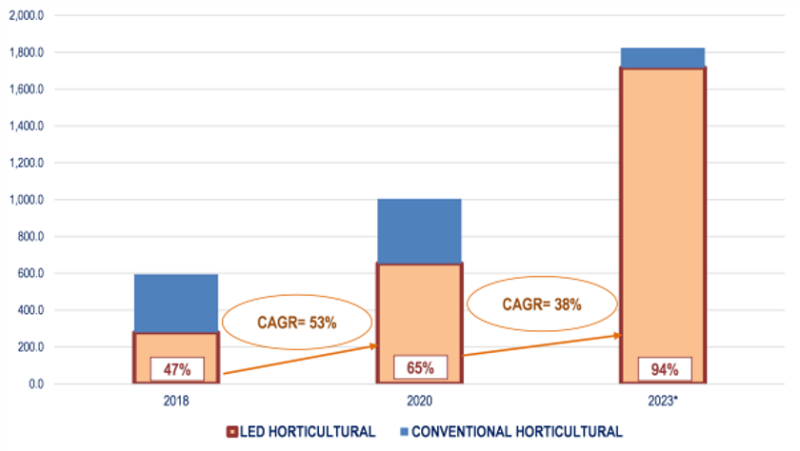

- Horticultural lighting is one of the fastest growing markets in the lighting industry today. Between 2018 and 2020, while the total lighting fixtures market dropped at an average rate of 3% per year, the horticultural business kept increasing at a CAGR of 30%. CSIL estimates that the sector will reach US$ 1.8 billion by 2023.

- The advent of LED technology has emerged to have a leg of a few years compared to the general market, but it has been catching up fast. Its share has passed from less than 47% (2018) to 94% (2023).

- The largest regional market is Asia Pacific, followed by North America and Europe. Asia Pacific and CSI countries are the ones expecting to report the fastest growth between 2020 and 2023.

- In term of applications, in 2020 the global market for horticultural market can be broken down in descendent order in: greenhouse, cannabis, indoor and vertical farming and research.

- The market is quite concentrated among the largest players. The top 10 largest players in CSIL sample hold a cumulative market share of over 50%. Signify is by far the leading player with a market share of 14%, followed Fluence by Osram and Gavita.

INTRODUCTION

Contents of the Report; Definitions; Methodological notes

BASIC DATA AND ACTIVITY TREND

World. Total and horticultural lighting market by geographic area, 2018-2020 estimates and 2021-2023 forecasts

MARKET STRUCTURE

World. LED Horticultural lighting. Market estimates 2018-2020 and forecast 2021-2023 (in value and as a share of the total)

World. Total horticultural lighting market broken down by application, 2020-2023 (in value and as a share of the total)

World. A list of greenhouses, indoor and vertical farmers, research institutions and their lighting partners.

World. A list of Cannabis cultivators and their lighting partners

World. Horticultural lighting. Reference prices, 2021.

World. IP family applications, 2000-2020

COMPETITIVE SYSTEM

World. Horticultural lighting fixtures sales and market shares of 40 among the leading companies

Short profiles of additional players grouped in North America, EMEA, and Asia Pacific

AGRITECH INDUSTRY OVERVIEW

Market drivers (Food demand: population dynamics, Climate change and weather uncertainty, Cannabis legislation evolution)

World Population, total (2000-2100) and broken down by geographic area (2000-2050) and by urban vs rural (2000-2050)

World. Annual global surface temperature, 1850-2100.

World and USA. Map of cannabis legality

Main players of the agritech business (Component Technology, Production Growing Systems, Growers)

The aim of the Report “ The world market for Horticultural Lighting” is to better understand the global market for horticultural lighting, its competitive landscape, and the new opportunities arising from the growth of the agritech business.

Horticulture lighting is a technology that stimulates photosynthesis in plants by emitting suitable wavelength. The scope of the analysis includes different types of horticulture lighting installations: Top lighting, Vertical farming, Interlighting (intracanopy lighting). These lighting systems playing several roles in plant growth: supplemental lighting, photoperiodic lighting, and sole-source lighting.

The analysis has been based on a mixed methodology, combining primary and secondary research:

- Desk research. The desk research will include available data from CSIL database; web surfing; balance-sheets and related international databases; collected statistics (Eurostat, IMF, World Bank, etc).

- Field analysis. Direct interviews with industry testimonials.

The geographical classification is as follows:

- North America: United States and Canada.

- Latin America: Argentina, Brazil, Chile, Colombia, Mexico, Venezuela.

- Europe: Austria, Belgium (including Luxembourg), Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, and United Kingdom.

- CSI countries: Belarus, Kazakhstan, Russia, Serbia, Turkey, and Ukraine.

- Asia-Pacific: Australia, China, India, Indonesia, Malaysia, Japan, New Zealand, Philippines, Singapore, South Korea, Taiwan, Thailand, Vietnam.

- Middle East: Algeria, Bahrain, Egypt, Israel, Jordan, Kuwait, Lebanon, Morocco, Oman, Qatar, Saudi Arabia, South Africa, Tunisia, United Arab Emirates.

- Rest of the world: remaining countries.

The Report provides estimates 2018-2020 and forecasts 2021-2023 of Total and LED-based consumption of horticultural lighting fixtures at global level and broken down by geographical area.

The horticultural lighting fixtures demand is broken down by Light Source (Conventional and LED) and by Application (Greenhouses, Indoor and Vertical Farming, and Others, which include R&D, animal barns, and aquaculture). The Cannabis business encompasses both the Greenhouse segment and the Indoor and vertical farming segment, therefore is treated as a separate section. The Distribution Channels and Reference Prices are examined. The Technological Evolution of the horticultural lighting industry is provided by analysing Intellectual Property (IP) applications

The competitive system analyses the main companies active in the horticultural lighting fixtures market are reported with data on sales, market shares, and short company profiles.

The main Market Drivers (food demand and population dynamics, climate change and weather uncertainty, and cannabis legislation evolution) together with the Other Players operating in the agritech industry complete the study.

- Horticultural lighting is one of the fastest growing markets in the lighting industry today. Between 2018 and 2020, while the total lighting fixtures market dropped at an average rate of 3% per year, the horticultural business kept increasing at a CAGR of 30%. CSIL estimates that the sector will reach US$ 1.8 billion by 2023.

- The advent of LED technology has emerged to have a leg of a few years compared to the general market, but it has been catching up fast. Its share has passed from less than 47% (2018) to 94% (2023).

- The largest regional market is Asia Pacific, followed by North America and Europe. Asia Pacific and CSI countries are the ones expecting to report the fastest growth between 2020 and 2023.

- In term of applications, in 2020 the global market for horticultural market can be broken down in descendent order in: greenhouse, cannabis, indoor and vertical farming and research.

- The market is quite concentrated among the largest players. The top 10 largest players in CSIL sample hold a cumulative market share of over 50%. Signify is by far the leading player with a market share of 14%, followed Fluence by Osram and Gavita.

INTRODUCTION

Contents of the Report; Definitions; Methodological notes

BASIC DATA AND ACTIVITY TREND

World. Total and horticultural lighting market by geographic area, 2018-2020 estimates and 2021-2023 forecasts

MARKET STRUCTURE

World. LED Horticultural lighting. Market estimates 2018-2020 and forecast 2021-2023 (in value and as a share of the total)

World. Total horticultural lighting market broken down by application, 2020-2023 (in value and as a share of the total)

World. A list of greenhouses, indoor and vertical farmers, research institutions and their lighting partners.

World. A list of Cannabis cultivators and their lighting partners

World. Horticultural lighting. Reference prices, 2021.

World. IP family applications, 2000-2020

COMPETITIVE SYSTEM

World. Horticultural lighting fixtures sales and market shares of 40 among the leading companies

Short profiles of additional players grouped in North America, EMEA, and Asia Pacific

AGRITECH INDUSTRY OVERVIEW

Market drivers (Food demand: population dynamics, Climate change and weather uncertainty, Cannabis legislation evolution)

World Population, total (2000-2100) and broken down by geographic area (2000-2050) and by urban vs rural (2000-2050)

World. Annual global surface temperature, 1850-2100.

World and USA. Map of cannabis legality

Main players of the agritech business (Component Technology, Production Growing Systems, Growers)

SEE ALSO

The worldwide market for connected lighting

February 2024, I Ed. , 88 pages

This report analyses the global lighting market focusing on LED and connected lighting trends. It provides market forecasts emphasizing the impact of green transition and digital transformation. The study also includes a section on industry competition, estimating sales, and market shares for leading manufacturers.

Lighting: World Market Outlook

November 2023, XXVI Ed. , 123 pages

The world market for lighting fixtures reached a value of USD 97 billion in 2023. After some fluctuating performance in the post-pandemic period, it is expected to remain stable in 2024, followed by moderate growth in 2025 and 2026. The major consuming countries are the US, China, Japan, India and Germany. The twenty-six edition of CSIL research “Lighting: World market outlook” analyzes, through tables and graphs, data on lighting fixtures production, consumption and international trade at worldwide level as a whole and for 70 considered countries, for the years 2013-2022 and 2023 preliminary. lighting fixtures market forecasts for the next three years (2024-2026) are also provided

The lighting fixtures market in China

September 2023, XVI Ed. , 205 pages

The 16th edition of The Lighting Fixtures market in China offers an accurate and in-deep analysis of the lighting fixtures industry in China, providing data and trends for the period 2017-2022 and forecasts up to 2025. From one hand, the report analyses the main trends affecting the market over the last five years, considering the production, consumption, imports and exports of lighting fixtures in the country. On the other hand, it offers an analysis of the supply structure and the competitive system, an overview on smart connected lighting trend, the distribution system and the main players operating in the market

The lighting fixtures market in the United States

June 2023, XVII Ed. , 256 pages

The total US lighting market is estimated to be worth around USD 26 billion in 2022. This value includes lighting fixtures and lamps. The US lighting market during 2022 registers a 6.5% growth in nominal terms as for lighting fixtures (consumer, professional, outdoor), up to 23.2 billion USD. The lamps market registers a decrease (about -2.9%). The residential segment has grown well above the market average (+5.9% on average over the last five years). In 2022, the weight of Office and Entertainment on the overall commercial lighting market has declined, while Hospitality and Public premises grew. In 2022, the value of completed construction grew by more than 10 percent to nearly USD 1.8 billion

The European market for lighting fixtures

May 2023, XXXII Ed. , 392 pages

In 2022, consumption of lighting fixtures in the EU30 countries registered a 8.3% increase, reaching a value of EUR 19.9 billion. Better results for commercial lighting (versus residential, industrial and outdoor), big players (with a 12% Ebitda), design oriented, area lighting, hospitality, contract (versus retail), linear lighting, emergency. More IP patents and acquisitions. Top 10 players hold a 30% market share.